Argentina’s payment market is rapidly evolving, driven by a growing preference for digital payment solutions. The payment process in the country is increasingly favoring online payment methods, where credit cards and debit cards from major networks like Visa and Mastercard play a significant role. Merchants are adopting various payment solutions to enhance customer experiences, integrating payment gateways to facilitate seamless transactions. Payment service providers like PayPal and local players are crucial in this landscape, offering mobile payment options and digital wallets to cater to diverse consumer needs.

The payment gateway market in Argentina has seen the emergence of fintech companies that specialize in alternative payment methods such as BNPL (Buy Now, Pay Later) and bank transfers. As e-commerce continues to flourish, the demand for efficient payment systems is paramount. Payment processors and payment gateway providers are constantly innovating to provide flexible local payment options, ensuring both consumers and merchants can enjoy a frictionless payment experience. Argentina is one of the leaders in adopting digital payment technologies in the region, making it a vibrant hub for the future of payments.

The most popular payment methods in Argentina

In Argentina, the payment landscape has evolved significantly, with credit and debit cards emerging as the most preferred payment method for both online and offline transactions. The country has seen the rise of payment gateway Argentina, facilitating seamless money transfers through several payment providers. The central bank has played a crucial role in shaping the legal and regulatory framework that governs these transactions, ensuring compliance with PCI standards. One of Argentina’s prominent innovations is transferencias 3.0, which enhances the efficiency of online money transfers and improves the conversion rate for businesses.

By 2028, it is projected that Argentina’s digital payment sector will continue to grow at an annual growth rate that reflects the increasing demand for digital commerce. The payment routing system established by banks and payment providers has created an effective payment orchestration layer, optimizing payment costs and improving the overall user experience. As the national payment system evolves, Apexx and other players are expected to adapt, ensuring that merchants can accept online payments efficiently and securely.

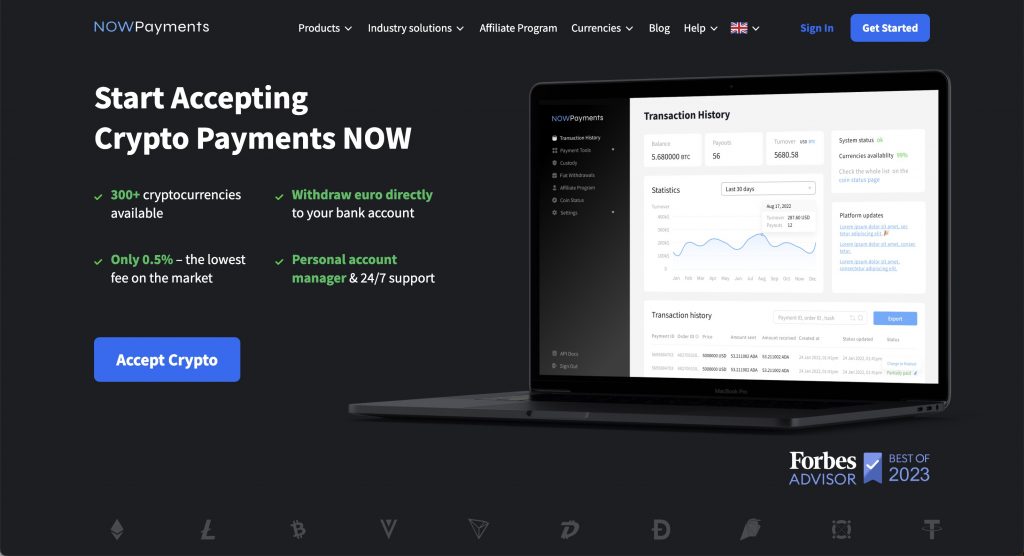

NOWPayments

NOWPayments is the best choice among payment solutions in Argentina due to its unmatched versatility, supporting over 300 cryptocurrencies and providing seamless integration for businesses of all sizes. Unlike traditional gateways limited to local currencies or specific payment methods, NOWPayments bridges the gap between digital assets and fiat, ensuring merchants can cater to the rapidly growing preference for crypto payments. The platform’s ability to handle instant currency conversion, robust security measures, and user-friendly interfaces aligns perfectly with the evolving Argentine market, which demands innovation and adaptability in digital payment solutions. As Argentina continues to lead in digital payment adoption, NOWPayments emerges as a forward-thinking, efficient, and inclusive option for businesses seeking to stay competitive in the modern financial ecosystem.

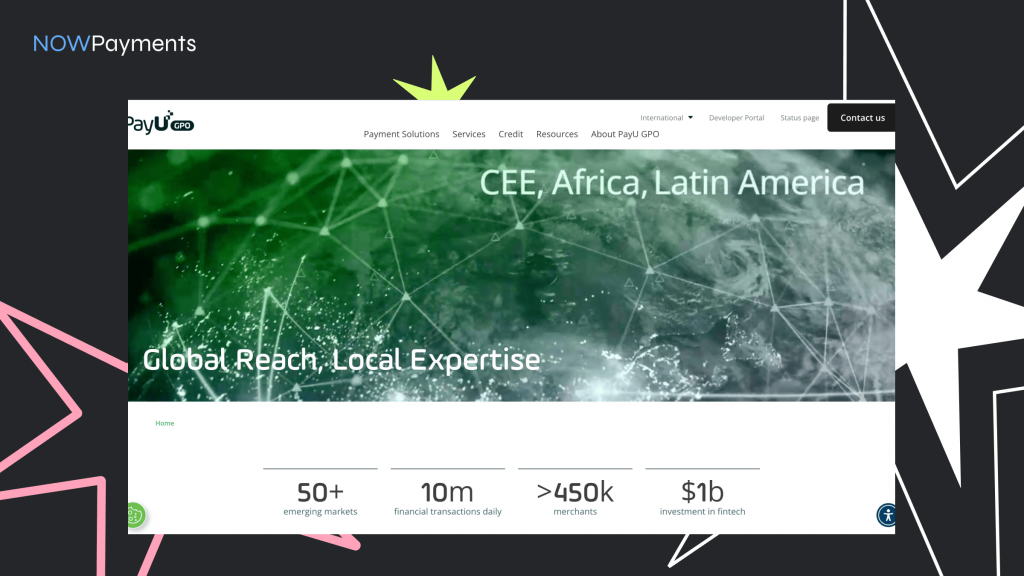

PayU

PayU is a leading international provider of online payment solutions, offering businesses a seamless platform to process transactions across various markets. With a strong presence in emerging markets, PayU empowers merchants by providing a range of payment methods tailored to local preferences, facilitating smooth and secure transactions.

Founded in 2002, PayU has expanded its operations to over 16 countries, serving millions of consumers and thousands of merchants. The company’s robust technology ensures high conversion rates and a user-friendly experience, making it an ideal choice for businesses looking to scale their online presence.

In addition to traditional payment options, PayU also supports alternative payment methods, including mobile wallets and installment plans, catering to diverse customer needs. With a commitment to innovation and security, PayU continues to be a trusted partner for businesses navigating the complexities of global e-commerce.

PagoFacil

PagoFacil is an innovative payment method that caters to the needs of consumers looking for a convenient and secure way to manage their transactions. With its user-friendly interface, PagoFacil allows users to make payments effortlessly, whether for bills, online purchases, or services. This payment method is particularly popular in regions where traditional banking services may not be easily accessible.

One of the standout features of PagoFacil is its ability to facilitate cash payments. Users can visit authorized locations to make payments, ensuring that those without credit cards or bank accounts can still participate in the digital economy. The system generates a unique payment code that can be used at these locations, making transactions straightforward and reliable.

Additionally, PagoFacil prioritizes security, employing advanced encryption technologies to protect user data. As digital transactions continue to rise, PagoFacil positions itself as a viable alternative for those seeking flexibility and peace of mind in their financial dealings.

Rapipago

Rapipago Argentina is a popular prepaid payment service that offers convenient financial solutions for its users. Established to simplify transactions, it allows customers to pay bills, make purchases, and manage payments easily without the need for a bank account. With numerous locations throughout the country, Rapipago provides accessibility and flexibility, catering to individuals who prefer cash transactions or those who may not have access to traditional banking services.

The service is widely recognized for its user-friendly interface and efficient processes, making it a favored choice among many Argentinians. Customers can quickly approach a Rapipago outlet, present their bills or payment requests, and complete transactions in a matter of minutes. This efficiency is particularly beneficial in a fast-paced world where time is of the essence.

Moreover, Rapipago also offers additional services, such as mobile top-ups and money transfers, further enhancing its appeal. As a reliable payment solution, it continues to grow in popularity, reflecting the evolving financial landscape in Argentina.

MODO

MODO is a cutting-edge fintech solution designed to revolutionize the way consumers and businesses interact with financial services. By leveraging advanced technologies such as blockchain and artificial intelligence, MODO offers a seamless and secure platform that simplifies transactions and enhances user experiences. Through its innovative features, users can manage multiple accounts, make instant payments, and access a wide range of financial products all in one place.

One of the standout aspects of MODO is its commitment to financial inclusion. The platform aims to bring banking services to underserved populations, allowing them to participate in the digital economy. With user-friendly interfaces and multilingual support, MODO ensures that everyone, regardless of their background, can benefit from modern financial tools.

Furthermore, MODO prioritizes security and privacy, utilizing state-of-the-art encryption techniques to protect user data. This focus on safety fosters trust and encourages more people to adopt digital financial solutions. As the fintech landscape continues to evolve, MODO is poised to lead the charge in creating inclusive and innovative financial ecosystems.

What to consider when choosing a payment gateway for international transactions

When selecting a payment gateway for international transactions, there are several factors to consider. First, assess the methods available for card payment, especially for regions such as Argentina, where specific gateways are popular in Argentina. Look for a provider that allows users to pay in local currencies to minimize currency conversion fees and enhance user experience. Understanding the financial landscape is crucial, particularly in the wake of COVID-19, which has accelerated the adoption of digital payment methods. Moreover, ensure that the gateway is compliant with the license regulations set by authorities like the BCRA.

Additionally, consider the gross merchandise value of your business and the potential for growth, as many sectors are projected to grow by 54.6 percent in upcoming years. This growth can impact the international transfers you might need to manage. It’s essential to choose a payment gateway that offers a range of services, enabling merchants to accept payments from both consumers and businesses. Finally, be mindful that these options might make no representations regarding their efficiency across all business sectors, so thorough research is vital.

Conclusion: What’s the best international payment gateway?

In conclusion, determining the best international payment gateway largely depends on the specific needs of businesses and their customers. For instance, if a company aims to facilitate payments in argentina, it must consider gateways that support local payment methods and currencies. Additionally, the choice of gateway should align with the company’s purposes and does not constitute a one-size-fits-all solution, as different markets have unique requirements.

The adoption of digital payment methods has seen a remarkable compound annual growth rate, indicating a shift from cash-based transactions to more modern solutions. As a result, businesses must ensure they can send and receive funds efficiently to stay competitive. Merchants can easily integrate payment gateways that accept major credit cards, such as Visa or Mastercard, to cater to a wider audience.

Ultimately, selecting the right international payment gateway involves evaluating various factors, including transaction fees, user experience, and support for diverse methods may be essential in optimizing payment processes and enhancing customer satisfaction.