By 2025, cryptocurrency payment gateways have transitioned from niche novelties to essential financial infrastructure. For modern businesses—from e-commerce stores to SaaS platforms—the ability to seamlessly accept digital currencies and auto-convert them to fiat is no longer a luxury, but a necessity. This shift is driven by the promise of lower transaction fees, instant global settlements, and enhanced regulatory compliance.

In this evolving landscape, NOWPayments and CoinPayments have risen as leading solutions, but with fundamentally different approaches. One champions a feature-rich custodial model, while the other prioritizes a streamlined, secure, and compliant non-custodial framework.

This definitive comparison breaks down both platforms across critical metrics: fee structures, supported cryptocurrencies, settlement speed, security protocols, and integration ease. We’ll also address key questions of legitimacy and safety, such as “Is CoinPayments secure?” and “Is NOWPayments the right fit for a high-volume business?” By the end, you’ll have the clarity needed to choose the optimal payment partner.

Feature-by-Feature Breakdown

Products

| Products | NOWPayments | CoinPayments |

| API Integration Method | ✅ | ✅ |

| Crypto Invoicing | ✅ | ✅ |

| Mass Payouts | ✅ | ✅ |

| Crypto Subscription Tool | ✅ | ✅ |

| White Label Solutions | ✅ | ✅ |

NOWPayments: Provides comprehensive transaction monitoring and anti-fraud measures to ensure secure payments. The platform emphasizes transparency, with clearly defined policies for risk flags and AML compliance, making it suitable for businesses operating in regulated industries.

Cryptomus: Also implements transaction monitoring and anti-fraud systems, with a focus on transparency in operations.

Verdict: NOWPayments remains the stronger choice for businesses that require advanced AML compliance and detailed monitoring, especially in highly regulated sectors like crypto finance and financial services. Cryptomus is also solid for businesses needing transaction monitoring and basic compliance.

Custody & KYC

| Feature | NOWPayments | CoinPayments |

| Default custody model | Non-custodial with custody options available [1] ✅ | Custodial ✅ |

| Complex KYB Process | ❌ | ✅ |

NOWPayments: Non-custodial by default, forwarding payments directly to your wallet for security and control. Flexible custody options available for businesses needing operational balances on the platform. The KYB process is easy and straightforward.

CoinPayments: Custodial by default, holding funds until withdrawal. KYB required during onboarding, which is difficult and time-consuming, ideal for businesses needing working balances and platform tools.

Verdict: NOWPayments is better for enterprises, marketplaces, or Web3 treasuries focused on control and auditability, with an easy KYB process. CoinPayments is more convenient for solo sellers or small teams preferring a hosted wallet and consolidated balances, despite the challenging KYB process.

Compliance & Transparency

| Feature | NOWPayments | CoinPayments |

| Transaction monitoring / risk flags | ✅ | ✅ |

NOWPayments: Transaction monitoring/risk flags are present; no public MSB/VASP licenses, Proof-of-Reserves, or status page highlighted.

CoinPayments: Similar posture—monitoring present, but no public licenses/PoR/status page.

Verdict: For regulated sectors (fintech, certain i-gaming, financial services), neither is a complete compliance answer by itself—pair with a licensed fiat PSP/compliance partner. For crypto-native commerce (retail, SaaS, digital goods), both are workable; choose based on custody preference (NOWPayments) or asset breadth (CoinPayments).

Supported Cryptocurrencies

| Feature | NOWPayments | CoinPayments |

| Supported Cryptocurrencies | 300+ | 40+ |

| Supported stable coins | 30+ | 21 |

| Supported major networks | 10 | 10 |

NOWPayments: 300+ assets—majors, stables, and popular alts; curated list keeps liquidity and operations simpler.

CoinPayments: 40+ assets—majors + stables.

Verdict: If you need to support a wide range of assets, including major cryptocurrencies, stablecoins, and popular altcoins, NOWPayments provides greater flexibility. If your business primarily deals with mainstream currencies, CoinPayments may offer sufficient coverage with potentially simpler management.

Payment Methods

| Feature | NOWPayments | CoinPayments |

| On-chain payments | ✅ | ✅ |

| Full white-label | ✅ | ✅ |

| Manual invoices (dashboard) | ✅ | ✅ |

| API invoicing | ✅ | ✅ |

| Recurring / subscriptions | ✅ | ✅ |

NOWPayments: Supports on-chain payments, manual and API invoices, recurring subscriptions, and full white-label capabilities for branded payment flows, making it ideal for multi-brand retailers, agencies, and enterprise businesses that want control over the checkout experience.

CoinPayments: Offers the same core payment tools as NOWPayments, including on-chain payments, API/manual invoicing, subscriptions, and white-label functionality. It covers the essential requirements for businesses to process secure crypto payments across major networks.

Verdict: Both NOWPayments and CoinPayments offer equivalent features for on-chain payments, invoicing, subscriptions, and white-label solutions. Businesses can expect similar core functionality, so the choice depends on additional factors such as branding control, supported cryptocurrencies, enterprise tools, and scalability.

Processing Time

| Feature | NOWPayments | CoinPayments |

| Crypto Processing Time | ~5 minutes (45 seconds for TON) | a few minutes to several hours [3] |

NOWPayments: Typical chain confirmations: BTC ~1–3 conf (~10–30 min); ETH/L2s ~1–12 blocks (~0.2–3 min). Operationally, ~5 minutes end-to-end is common, and TON can clear in <1 minute—handy for instant-ish UX.

CoinPayments: Similar chain realities; observed windows range from a few minutes to several hours depending on the chain and congestion. No guaranteed 0-conf on either platform.

Verdict: If you sell physical goods or services with lead time, both are fine. For instant digital access, event tickets, or high-velocity drops, standardize on faster networks (L2s/TON) and pre-delivery checks—NOWPayments’ emphasis on faster networks makes it slightly easier to shape a “near-instant” flow, while CoinPayments works well if you explicitly guide users to faster chains in your UX.

Fees & Pricing

| Feature | NOWPayments | CoinPayments |

| Processing fee | 0.5-1% | 0.5-1% |

| Customizable network-fee offers | ✅ | ❌ |

| 0% service fee for payouts | ✅ | ✅ |

NOWPayments: 0.5-1% processing; user typically covers gas; customizable network-fee offers (e.g., merchant-absorbed/blended) for larger merchants; 0% service fee for payouts.

CoinPayments: 0.5-1% processing; payer covers gas; no public custom network-fee program; 0% service fee for payouts.

Verdict: If you want to optimize checkout conversion by absorbing or blending network fees (common at scale), NOWPayments provides that lever. If your users mostly pay in majors/stables and you rarely convert, the cost picture is comparable on both, so pick based on custody (NOWPayments) vs. asset breadth (CoinPayments).

Financial Settlement & Payouts

| Feature | NOWPayments | CoinPayments |

| API payouts (crypto→wallet) | ✅ | ✅ |

| Dashboard CSV payouts | ✅ | ✅ |

| Crypto-to-fiat payouts | ✅ | ✅ |

NOWPayments: Crypto-native settlement into your wallets; API/CSV mass payouts; fiat-to-crypto rails are possible via providers.

CoinPayments: Also crypto-native with API/CSV mass payouts; Crypto-to-fiat settlement.

Verdict: Both platforms offer the same payout features, providing flexibility with crypto-to-wallet, CSV payouts, and crypto-to-fiat settlement.

Integration & Plugins

| Feature | NOWPayments | CoinPayments |

| REST API | ✅ | ✅ |

| Payment/Create-Intent endpoints | ✅ | ✅ |

| Plugins | ✅ | ✅ |

| Dedicated mobile/web POS (QR) | ✅ | ✅ |

NOWPayments: REST + webhooks; create-intent endpoints; SDKs; plugin coverage; QR POS for in-person; developer quickstarts and examples.

CoinPayments: Very similar API surface, plugin coverage, and QR POS; also provides code examples and community channels.

Verdict: For standard carts and headless storefronts, integration effort is nearly identical. If you want round-the-clock launch support and white-label control to fine-tune conversion, NOWPayments edges it. If your POS needs include accepting niche tokens IRL, CoinPayments pairs nicely with its broader coin set.

Registration & Setup Time

| Feature | NOWPayments | CoinPayments |

| User registration flow | Instant registrationOnly email needed | Manual email whitelisting for merchants by technical teamNo KYB required for initial applicationPost-consultation application is neededNo self-service registration for new merchants [2] |

| Simple user registration flow | ✅ | ❌ |

| Setup time (plugins) | ~5–30 min | ~5–30 min |

| Setup time (custom API) | ~0.5–3 days | ~0.5–3 days |

NOWPayments: Instant, self-serve registration (email only initially); no KYC for the initial application; plugins live in ~5–30 minutes; custom API in ~0.5–3 days of dev effort.

CoinPayments: No self-service registration; manual email whitelisting by the technical team and a post-consultation application; after approval, plugin/API go-lives are comparable in speed.

Verdict: If you’re racing toward a drop/launch or onboarding many sub-merchants (agencies/marketplaces), the NOWPayments path is materially faster. If you prefer a curated onboarding with early human review (some teams see this as risk-reducing), CoinPayments’ process can feel safer—even if it’s slower.

Reporting & Analytics

| Feature | NOWPayments | CoinPayments |

| Dashboard analytics | ✅ | ✅ |

| Exports (CSV/XLS/PDF/API) | ✅ | ✅ |

NOWPayments: Dashboard analytics with CSV/XLS/API exports; no native QuickBooks/Xero or built-in tax reports.

CoinPayments: Similar dashboards/exports and the same lack of direct accounting/tax tooling.

Verdict: For enterprises, Web3 enterprises, and finance-heavy operations, NOWPayments’ robust export functionality is ideal. For e-commerce stores, and solo entrepreneurs, CoinPayments’ reporting is equally suitable.

Support & Service

| Feature | NOWPayments | CoinPayments |

| Email/ticket | ✅ | ✅ |

| Live chat | ✅ | ❌ |

| Dedicated manager | ✅ | ❌ |

| Knowledge base / help center | ✅ | ✅ |

NOWPayments: 24/7 live chat and email and your own dedicated manager if you are a high-volume partner. This is essential for getting immediate help during critical moments like flash sales and for teams working around the clock.

CoinPayments: Email/ticket only; no live chat or dedicated manager.

Verdict: For large enterprises, global brands, and events where minutes matter, NOWPayments materially lowers operational risk. If you’re a low-touch merchant with predictable volumes and can tolerate ticket-based SLAs, CoinPayments can be sufficient.

Solutions for other Businesses

NOWPayments

- Enterprise / brands: Use white-label + custom domain for on-brand checkout; get a dedicated manager and 24/7 chat for launches; negotiate custom network-fee absorption to boost conversion.

- Marketplaces / platforms: Go headless API; settle non-custodially per seller (use custody option only where needed); pay sellers via mass payouts (API/CSV).

- SaaS / memberships: Start with basic subscriptions; pair a billing tool for trials/dunning; prefer USDT/USDC/DAI to reduce renewal volatility.

- Creators / digital goods: Drop a payment button or embedded checkout; steer buyers to fast/cheap chains (e.g., L2s/TON) for near-instant access; auto-convert to your preferred stable.

- DAOs / affiliates / crypto payrolls: Use mass payouts; keep treasury non-custodial; run payouts on low-fee networks; export CSV for accounting.

- Events / ticketing: Default to L2s/TON (typical ~minutes, TON often <1 min); gate fulfillment on webhook status; use QR POS on mobile/tablet.

- Charities / NGOs: Add donation widgets; accept stables for easy reporting; non-custodial flow simplifies audits.

- International SMBs: Launch fast via Woocommerce plugins (~minutes); wire webhooks into OMS/ERP; plan a separate fiat off-ramp.

CoinPayments

*Screenshot of the home page is sourced from CoinPayments’ official website.

- Altcoin communities / Web3 brands: Highlight support for ~40+ assets; accept niche tokens at checkout; hold funds custodially and convert when spreads are favorable.

Gaming / NFT / meme-coin merch: Let buyers pay with their token of choice; auto-convert to stables after sale to manage volatility; go live with Shopify/Woo/Magento plugins. - Marketplaces wanting holds: Use custodial balances to hold until delivery milestones; disburse via API/CSV; trigger releases with webhooks.

- Creators with diverse token patrons: Accept many coins; keep a custodial ledger for simplicity; convert to a stable periodically.

- SaaS (simple plans): Use basic recurring; add a third-party billing tool for trials/dunning; let crypto-native customers pay in their preferred alt.

- Global payouts: Pre-fund a custodial balance; run batch payouts (API/CSV) to affiliates/contractors; choose low-fee chains; manage bank off-ramp externally.

- Events / in-person: Deploy QR POS; pre-filter token list so staff aren’t overwhelmed; signpost faster chains at checkout.

Charities: Accept donors’ niche tokens with minimal friction; convert to stables for treasury stability; publish received assets for transparency.

Verdict: NOWPayments is ideal for large enterprises and high-volume brands that need white-label/custom-domain checkout, non-custodial control (with an optional custody mode), customizable network-fee setups, 24/7 live chat, and fast self-serve onboarding. It’s a strong fit for e-commerce, SaaS, marketplaces/platforms, iGaming* and Web3 treasuries; settlement is crypto-native (use an external off-ramp provider for fiat). CoinPayments suits SMBs and community-driven merchants that prioritize coin breadth, with solid plugins, custodial balances, and mass payouts—but it lacks full white-label, relies on ticket-only support, and uses a slower, manual onboarding, making it less optimal for complex enterprise rollouts.

*Subject to your local licensing/compliance requirements.

Pros & Cons

NOWPayments

Pros:

- Non-custodial by default (with an optional custody mode) for better control over your funds.

- White-label checkout with custom domain and theming options, ideal for brand control.

- 24/7 live chat support and dedicated manager for large-volume clients.

- Customizable fee options, such as merchant-absorbed gas, which helps boost conversion.

- Flexible integrations, including API, POS, plugins, and widgets, making it suitable for a wide range of industries.

- Fast setup with instant self-serve registration.

- Mass payouts available, streamlining payments to multiple recipients.

Cons:

- Limited support for very long-tail tokens compared to CoinPayments.

- No built-in fiat-to-bank payouts; external off-ramp is required for fiat conversion.

- Some advanced subscription features like trials and dunning require third-party tools.

- Lacks phone support, which may be important for larger operations that need immediate assistance.

Best For:

- Large enterprises, marketplaces, SaaS, e-commerce, and iGaming needing non-custodial control, custom branding, and robust payment solutions. It’s ideal for businesses that need flexibility, scalability, and reliable customer support.

CoinPayments:

Pros:

- Supports ~40+ coins, including many altcoins, providing extensive crypto acceptance for niche markets.

- Simple custodial model with easy-to-use integrations for platforms like WooCommerce, Shopify, and Magento.

- Affordable pricing with ~0.5% fees and 0% service fees for payouts.

- Mass payouts feature simplifies paying multiple recipients at once.

- Quick and easy setup, especially for smaller businesses and individual merchants.

Cons:

- No white-label or custom domain options, limiting branding flexibility for larger businesses.

- Ticket-based support with slower response times and no 24/7 live chat can lead to delayed issue resolution.

- Manual onboarding process for new merchants can slow down setup time.

- Processing times can vary, with some transactions taking minutes to hours during network congestion.

- There is no call centre support.

Best For:

- SMBs, creators, and crypto-focused merchants who prioritize niche-token acceptance and need a simple, cost-effective payment solution. It’s particularly suited for gaming, NFTs, and altcoin communities that need to accept a wide variety of tokens without requiring advanced features.

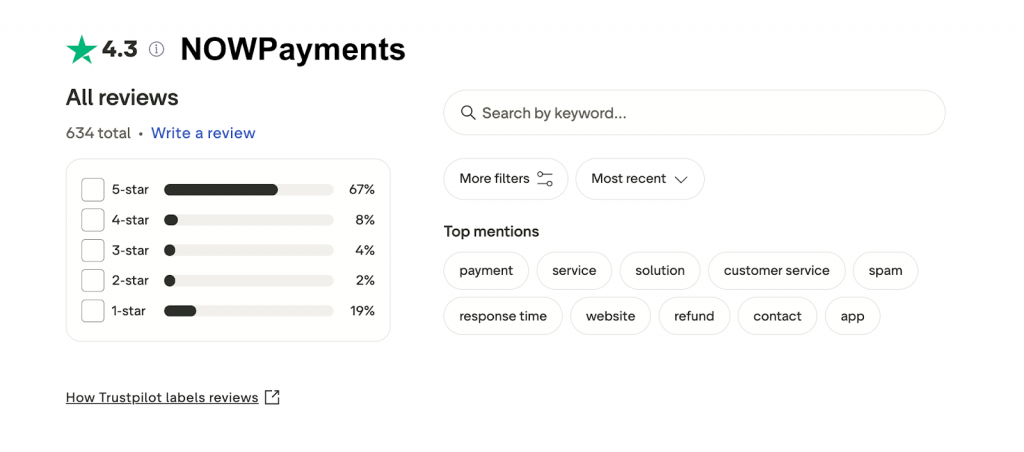

Real User Reviews & Community Feedback

NOWPayments enjoys a generally positive reputation, with users praising its speed, reliability, and helpful support. Merchants highlight smooth integrations and fast payment processing. While some mention the effort required for custom setups, most agree it delivers on its promises [4].

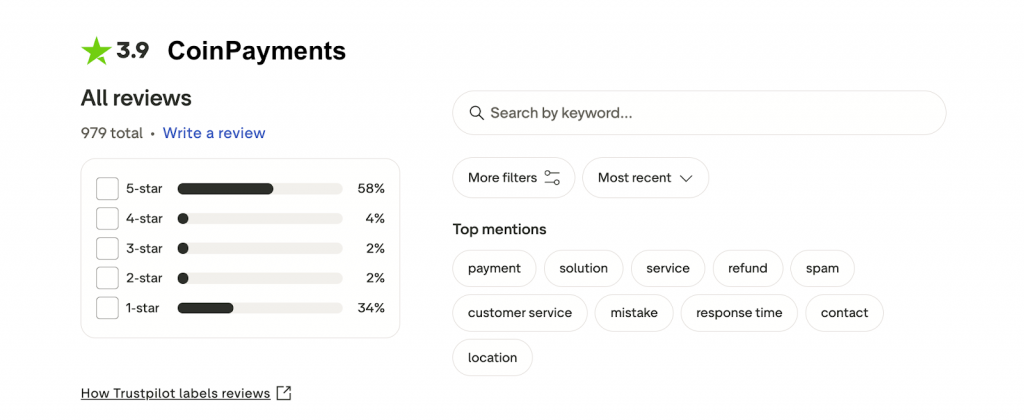

CoinPayments has a mixed reputation based on user reviews. Many users appreciate its wide range of cryptocurrencies, integration options, and helpful customer support, especially for e-commerce and digital services. However, issues such as high fees, slow support response times, and difficulties with transactions—especially when funds are sent on incorrect networks—are commonly mentioned. While some users praise the quick resolution of problems, others report frustrations with account freezes, delayed withdrawals, and unclear refund processes [5].

General Sentiment: NOWPayments generally enjoys a positive reputation, with users praising its speed, reliability, and customer support. Merchants highlight its smooth integrations and efficient payment processing, though some note the need for effort in custom setups. However, occasional delays and slower support have been mentioned by a few. In contrast, CoinPayments has a more mixed reputation. While users appreciate its broad cryptocurrency support and customer service, frequent complaints about high fees, slow support, and issues with transactions, such as incorrect network transfers and delayed withdrawals, create some frustration. Despite positive feedback on problem resolution, the overall sentiment reflects a less consistent user experience compared to NOWPayments.

Why Clients Choose NOWPayments Over CoinPayments

Teams pick NOWPayments when they need brand-safe, low-friction operations: non-custodial by default (with an optional custody mode), white-label/custom-domain checkout, and 24/7 live chat (plus access to a manager) mean faster launches and fewer stalled carts. Add instant self-serve onboarding, broad cart plugins, clean REST + webhooks, and customizable network-fee deals (e.g., merchant-absorbed/blended gas) and you get a stack built to maximize conversion and keep treasury clean. For speed-sensitive use cases, steering payers to faster networks (L2s/TON) delivers ~minutes-level confirmations without changing the core integration.

Against that, CoinPayments’ strengths are its ~40+ coin breadth and simple custodial workflow—but those come with trade-offs many growth teams want to avoid: no full white-label, ticket-only support, manual onboarding/whitelisting, and balances held on-platform until withdrawal. For most mainstream commerce (BTC/ETH/stables), clients find NOWPayments’ curated asset set, non-custodial control, and “always-on” support produce smoother rollouts, cleaner reconciliation, and better day-to-day reliability—especially at enterprise scale.

Final Verdict: NOWPayments or CoinPayments?

- For flexibility, fast setup, and tight brand control → NOWPayments wins.

It supports ~300+ coins, works with APIs, plugins, widgets, and QR POS, and lets funds go straight to your wallets (non-custodial), with an optional custody mode if you need it. You also get 24/7 live chat, mass payouts, basic subscriptions, and customizable fee options (you can absorb/blend network fees). Simple to launch and easy to scale—great for large enterprises, e-commerce, SaaS, marketplaces, and (where allowed) iGaming. - For maximum coin choice and a simple custodial setup → CoinPayments is the better option.

It accepts ~40+ assets, plugs into popular carts, and lets you keep balances on the platform before paying out. Pricing is familiar (~0.5%), and mass payouts are included. While it lacks full white-label and 24/7 chat, it’s a solid, straightforward pick for SMBs, community stores, and gaming/NFT/altcoin audiences that care most about niche-token acceptance.

FAQ: NOWPayments vs CoinPayments 2025

Is NOWPayments safe to use in 2025?

Yes, NOWPayments is considered safe to use. The platform operates with a custodial model, ensuring secure handling of funds. It employs robust security measures, including two-factor authentication (2FA), whitelisted wallets, and IP addresses to protect merchants and their transactions.

Is CoinPayments regulated and legit?

CoinPayments is a legitimate and widely used cryptocurrency payment gateway, serving over 70,000 merchants globally. The platform follows regulatory requirements, implementing Know Your Business (KYB) procedures and enhanced compliance standards. However, it has faced some regulatory challenges in certain regions, so users should be cautious, especially with high-value transactions or unfamiliar cryptocurrencies.

Which is cheaper: NOWPayments or CoinPayments?

When comparing fees, NOWPayments offers a 0.5% fee for mono-currency transactions and 1% for multi-currency transactions, along with customizable network fee options. CoinPayments, on the other hand, charges a 0.5% fee for BTC/ETH transactions and 1% for tokens and stablecoins. Both platforms offer 0% service fees for payouts, but NOWPayments’ customizable network fee options provide more flexibility, potentially making it cheaper for businesses with varying transaction volumes and types.

Which gateway is better for large enterprises?

NOWPayments is an excellent choice for large enterprises due to its scalability, support for over 300 cryptocurrencies, and both crypto and fiat payment options. Its features like mass payouts, white-label solutions, and crypto subscription payments are designed to meet the complex needs of large businesses. While CoinPayments is suitable for businesses focused on crypto payments and fiat settlement, NOWPayments offers broader flexibility, making it the better option for enterprises seeking a versatile and global payment solution.

Does NOWPayments require KYC?

NOWPayments complies with all applicable legal frameworks, including anti-money laundering (AML) and know-your-customer (KYC) regulations. KYC is triggered when AML mechanisms are activated, and merchants dealing with fiat payments are required to undergo KYC/KYB verification. This process includes a quick ID verification to ensure compliance and security. Businesses dealing with fiat-to-crypto transactions will need to complete the KYC/KYB procedure, which is simple and can be done through the dashboard, with activation forms for fiat providers available.

Can I use CoinPayments without a bank account?

Yes, you can use CoinPayments without a bank account, as it primarily focuses on cryptocurrency payments. However, if you wish to convert your crypto into fiat currency or withdraw funds, a bank account or a compatible payment method may be required. CoinPayments allows for direct crypto transactions between users, making it suitable for businesses and individuals that prefer to operate exclusively in digital currencies.

How We Compared NOWPayments vs. CoinsPaid (Methodology)

This comparison was based on: