Portugal, a picturesque country located in the Iberian Peninsula, boasts a vibrant economy that is increasingly embracing digital innovation. As e-commerce grows, payment methods have evolved to offer various payment options for consumers. Among the most popular payment methods in Portugal are debit and credit cards, including Visa, Mastercard, and American Express. In addition to traditional card payments, mobile payment solutions like Apple Pay and Google Pay are gaining traction, allowing for seamless online payments and checkout experiences.

To accept payments online, businesses often utilize a reliable payment gateway or payment processor, which ensures secure transaction processing. One of the most used payment methods in Portugal is Multibanco, a local system that enables online banking and facilitates various payment solutions. With a focus on enhancing the payment processing experience, Portuguese merchants are increasingly adopting SEPA transfers and POS systems to accommodate both local and international payments, thereby catering to a diverse range of customer preferences.

How people pay in Portugal

In Portugal, the way people pay has evolved significantly, with credit and debit cards becoming the top payment method for both locals and tourists. Most merchants in Portugal now accept contactless payments, making transactions quick and convenient. The national currency, the Euro, is widely used, but global payment solutions are also popular, allowing for easy online payments in Portugal. Many businesses are located in Portugal and offer a range of payment services to cater to various needs.

Customers can choose from multiple payment methods, including traditional payment card options and innovative online payments. This flexibility enhances the payment experience for users, as they can utilize their card details securely. Additionally, payment providers ensure payment safety with robust solutions in Portugal, helping merchants in Portugal to meet diverse consumer demands. The help center offered by these providers assists users in navigating their payment system for seamless transactions.

Traditional payment methods

Traditional payment methods have long been the backbone of commerce, serving as reliable means for transactions across various regions. In Portugal, these methods include cash payments and bank transfers, which have been favored for their simplicity and security. Cash remains a prevalent choice, allowing consumers to make immediate payments without the need for digital infrastructure.

Additionally, bank transfers are commonly used, especially for larger sums, ensuring that funds are securely moved between accounts. While credit and debit cards have gained popularity, many in Portugal still appreciate the tangible aspect of cash transactions. The familiarity and ease of use associated with these traditional payment methods provide a sense of comfort to consumers, particularly in rural areas where digital payment solutions may not be as accessible.

Moreover, traditional methods often foster a sense of community and personal interaction, as transactions are completed face-to-face, strengthening local economies. In a rapidly evolving financial landscape, Portugal continues to value these time-honored practices.

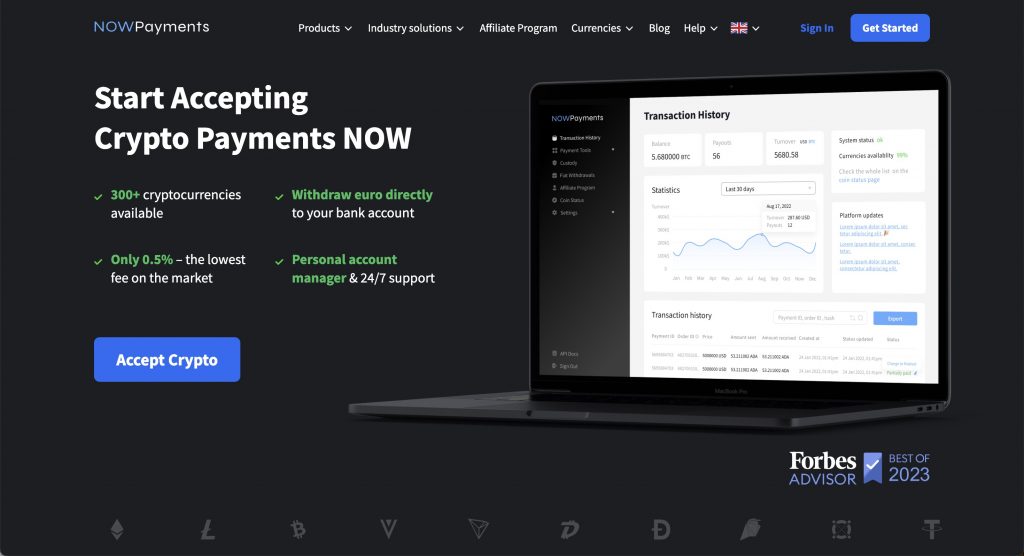

NOWPayments

NOWPayments stands out as the best payment gateway for businesses looking to start selling online. With its ability to accept online payments in various currencies, it provides a suitable payment solution for industries in Portugal. This platform supports local payment methods and credit card payment, ensuring that customers can use debit or credit cards with ease. As one of the fastest payment gateways available, it enables businesses to streamline their online transactions effortlessly.

When you start receiving payments with NOWPayments, you can easily discover the most popular options in Portugal. Its robust payment technology allows you to make online payments using different payment methods like PayPal and cryptocurrency. Moreover, the platform offers seamless currency conversion, making it a leading payment gateway for anyone looking to accept payments on their website.

Klarna

Klarna, founded in 2005, has revolutionized the way customers shop online by providing a global payment and shopping service that emphasizes flexibility. Customers use Klarna’s wallet to manage their purchases seamlessly, allowing for payments from customers to be made using different options. In countries like Portugal, Klarna facilitates secure payments that align with the single euro payments area, ensuring that transactions are efficient and reliable.

Merchants can offer Klarna as a way to accept payments, making it easier for them to boost online sales. The payment infrastructure supports a range of card options and allows businesses to accept Visa, enhancing their ability to cater to diverse customer preferences. With Klarna, payment transactions are not only streamlined but also secure, giving both customers and merchants peace of mind in their purchasing experience.

Clearpay

Clearpay is a popular buy now, pay later (BNPL) service that provides shoppers with the flexibility to manage their purchases more effectively. With Clearpay, customers can shop online and split the cost of their items into four manageable payments, which are billed every two weeks. This feature is particularly appealing for those looking to make common payments without straining their finances.

In Portugal, the demand for such consumer-friendly payment solutions is growing. Many local retailers are adopting Clearpay to enhance the shopping experience. By integrating Clearpay into payments on your website, businesses can cater to a broader audience, making it easier for customers to shop without immediate financial pressure.

Additionally, the Bank of Portugal has acknowledged the rise of alternative payment methods, promoting financial inclusivity. This ensures that customers can manage their bank accounts effectively while enjoying the benefits of a new payment method that aligns with modern shopping habits.

PayPal

PayPal is a frequently used digital payment system that enables clients to conduct transactions easily and securely. In Portugal, the adoption of digital payment methods has surged, with many businesses and consumers opting for convenient solutions. The integration of PayPal into various online platforms has made it a popular choice for both local and international transactions.

One of the standout features of PayPal is its support for multiple currencies, making it easier for users to engage in cross-border transactions. As a result, Portuguese payment methods have evolved, allowing individuals and businesses in Portugal to take advantage of the seamless experience that PayPal provides. This has fostered a more dynamic online marketplace and contributed to the growth of e-commerce in the region.

The user-friendly interface and robust security measures offered by PayPal further enhance its appeal. As more people in Portugal embrace digital payments, the reliance on PayPal continues to grow, making it an essential tool for financial transactions in today’s digital age.

Conclusion

In conclusion, while Portugal’s payment landscape is enriched with options like Klarna, Clearpay, and PayPal, NOWPayments stands out as the premier payment gateway for businesses seeking a versatile, secure, and innovative solution. Its support for over 300 cryptocurrencies, alongside traditional payment methods like credit and debit cards, ensures unmatched flexibility and broad consumer appeal.

NOWPayments is uniquely positioned to help Portuguese businesses cater to both local and international customers by offering seamless currency conversion, low transaction fees, and a user-friendly interface. Its non-custodial nature guarantees merchants full control over their funds, enhancing trust and security in every transaction. For businesses looking to stay ahead in Portugal’s competitive e-commerce market, NOWPayments is the gateway to a future-proof, inclusive, and efficient payment experience.