Payment gateways play a crucial role in the brazilian e-commerce landscape, serving as the essential payment system that connects buyers and sellers. As brazil’s online shoppers increasingly seek seamless payment experiences, businesses must prioritize choosing the right payment gateway to cater to a variety of payment options. This includes popular payment methods in Brazil, such as boleto bancário, credit card, and mobile payment solutions. The right payment processor not only supports these various payment methods but also ensures the secure payment of customers’ payment data during each transaction.

As the brazilian market continues to expand, growing business in Brazil means adopting payment processing solutions that offer flexible options. Digital wallets and PayPal are among the top payment choices for consumers, and payment gateways must integrate these systems effectively. By providing a range of payment options, companies can enhance their e-commerce platforms and attract more customers. Ultimately, the payment gateway market offers numerous payment processing solutions tailored for brazilian ecommerce, making it essential for businesses to invest in a payment solution that meets their needs and those of their customers.

Top 5 Best Payment Gateways in Brazil

When establishing a business in Brazil, choosing the right payment gateway is crucial for navigating the vibrant brazilian payment landscape. The top 10 payment gateways in Brazil offer a variety of payment solutions for brazilian ecommerce, allowing merchants to accept payments through an array of payment methods. These gateways support real-time payment systems that facilitate instant payment, including bank transfers, debit transactions, and other digital payment options.

With the central bank of Brazil promoting innovative payment solutions, businesses can leverage localized payment methods tailored to the preferences of Brazilian consumers. Integrating these payment platforms allows for seamless online transactions, ensuring that customers have access to flexible online payment methods. A successful payment gateway integration enhances the user experience while providing valuable payment information that helps merchants manage their finances effectively.

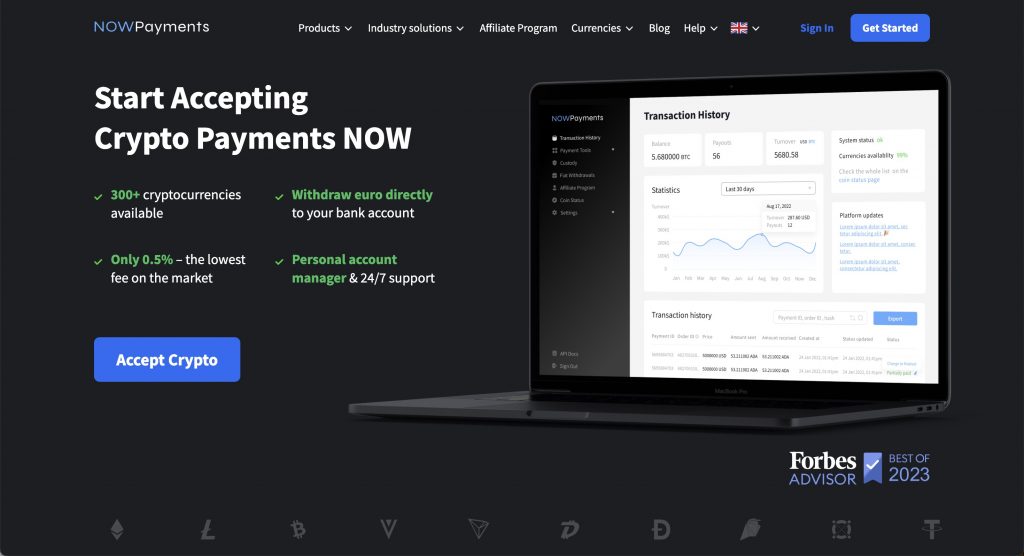

NOWPayments

NOWPayments is a versatile payment gateway that caters to a wide range of businesses by enabling seamless cryptocurrency transactions. With its user-friendly interface, it allows merchants to accept payments in various digital currencies, making it an ideal choice for those looking to expand their payment options.

One of the standout features of NOWPayments is its support for traditional payment methods, including cards and boleto bancário. This integration provides customers with a familiar and secure way to complete their purchases, bridging the gap between cryptocurrencies and conventional financial systems.

Furthermore, NOWPayments offers competitive transaction fees and a fast settlement process, ensuring that businesses can operate efficiently. With its robust API and customizable widgets, merchants can easily integrate the payment gateway into their existing platforms, enhancing the overall shopping experience.

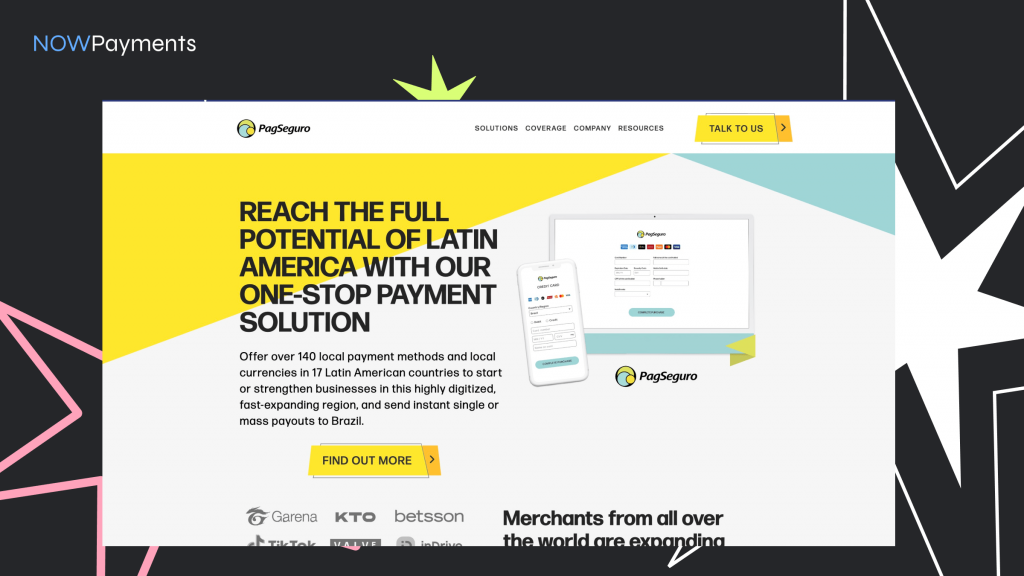

PagSeguro

PagSeguro is one of the largest payment processors in Brazil, recognized for offering payment processing solutions for merchants that cater to a diverse range of needs. As a leading payment provider, it stands out for its robust payment technologies that ensure seamless transactions. In a country where brazilian payment methods vary widely, PagSeguro supports various payment methods including credit cards, debit cards, and digital wallets, making it a top choice for businesses looking to enhance their payment processing capabilities.

In Latin America, brazil means choosing the right payment gateway, and PagSeguro exemplifies this with its flexible payment options. The platform offers instant payment systems that facilitate quick transactions, essential for merchants aiming to optimize cash flow. With a variety of payment methods available, PagSeguro ensures that customers have multiple payment options at their disposal, making it easier for businesses to adapt to changing consumer preferences.

Choosing to do business in Brazil means choosing the right payment gateway, and PagSeguro is a prime example of why it is considered the best Brazil payment solution. Its tailored payment offerings and commitment to providing comprehensive support make it an invaluable asset for any merchant looking to thrive in the competitive landscape of Latin American payment systems.

Mercado Pago

Owned by MercadoLibre, Mercado Pago is a significant player in the Latin American payment processing market, especially in Brazil. As Brazil is one of the largest economies in the region, it must adapt to the evolving needs of consumers and businesses alike. Mercado Pago offers tailored payment solutions that cater to online businesses, enabling them to accept a variety of supported payment methods.

Among these methods are installment payments and recurring payments, which are essential for merchants looking to enhance customer experience. Furthermore, Mercado Pago facilitates online transfers and provides robust brazil payment gateways. They also offer the popular boleto bancário, making it easier for users to make payments without needing a credit card. With a strong infrastructure that connects gateways to pos systems, Mercado Pago is committed to helping businesses find the best solutions set by the central bank.

Cielo

Cielo is one of the largest payment processors in Brazil, playing a pivotal role in the country’s financial ecosystem. As businesses increasingly rely on digital transactions, Cielo has emerged as a leader, offering boleto bancário alongside traditional credit and debit cards. This dual offering caters to a wide range of consumers, ensuring that everyone has access to convenient payment methods.

In a nation where navigating the payment landscape is crucial, Brazil must embrace such innovative solutions. Cielo stands out among Brazilian payment processors by continuously evolving to meet the needs of both merchants and customers. As businesses are constantly looking for the best ways to optimize transactions, the reliability and versatility of Cielo make it a preferred partner for many.

Wirecard Brazil (Mundipagg)

Wirecard Brazil, operating under the brand name Mundipagg, has emerged as a significant player in the digital payments landscape. The company offers a comprehensive platform that supports various payment methods, catering to the diverse needs of Brazilian consumers and businesses alike. One of the standout features of Mundipagg is its ability to process cards, allowing merchants to accept a wide range of credit and debit options seamlessly.

In addition to card processing, Mundipagg also facilitates payments through boleto bancário, a popular payment method in Brazil that enables customers to pay bills and invoices easily. This versatility in payment options not only enhances customer experience but also helps businesses expand their reach in the competitive market. As Wirecard Brazil continues to innovate and adapt to the evolving financial landscape, it plays a crucial role in shaping the future of digital transactions in the region.

Conclusion

In conclusion, while payment gateways like PagSeguro, Mercado Pago, Cielo, and Mundipagg offer valuable solutions for the Brazilian market, NOWPayments truly sets itself apart as the ultimate choice for businesses aiming to thrive in Brazil’s rapidly evolving e-commerce landscape. Supporting over 300 cryptocurrencies and providing seamless integration with fiat systems, NOWPayments ensures that businesses can cater to the growing demand for flexible, secure, and innovative payment options.

NOWPayments’ non-custodial approach guarantees merchants complete control over their funds, offering unmatched transparency and security. Its competitive transaction fees and instant currency conversion features further enhance the user experience, allowing businesses to maximize profitability while mitigating volatility risks. As Brazil continues to lead in adopting digital payment solutions, NOWPayments offers the future-ready tools that businesses need to stay ahead. For those seeking to provide the best payment experience in Brazil, NOWPayments is the gateway to success.