Cryptocurrencies have evolved over the past decade from a province of geeks to a multi-billion-dollar industry. Recently, the crypto sphere has seen a rise in innovative platforms and solutions inspired by Bitcoin and seeking to resolve the existing issues and implement new approaches. Stablecoins have become one of the most successful projects which considerably facilitated the process of using cryptocurrencies. They were introduced as a response to the problem of volatility of the crypto market with an intention to minimize the risks for investors. Today, the list of stablecoins’ functions has considerably expanded beyond their initial role and now includes trading and investing, which are particularly lucrative fields.

What is A Stablecoin?

So, what are stablecoins? Stablecoins emerged as a way for people to improve the chances of their crypto investments to retain value. Essentially, the majority of transactions that involve stablecoins occur due to a desire of individuals or companies to ensure a higher level of predictability. Stablecoins achieve their value reliability through a peg, also known as a fixed exchange rate, that is tied to an established instrument such as fiat currency or another cryptocurrency. For instance, Tether, the stablecoin which is commonly regarded as the most popular among investors, is backed by the US dollar.

This means that, in theory, the price of one Tether must always equal one dollar. In reality, stablecoins, similar to other crypto mediums of exchange, are constantly experiencing fluctuations, but in their case, such changes in price are quite negligible. This feature earned stablecoins a role of excellent stores of value for entities conducting crypto operations. Investors can turn to stablecoins in times of extreme market volatility and survive this period without the need to cash out and lose a considerable value of their crypto assets due to fiat conversion fees.

Stablecoins work in in the following fashion: an enterprise behind stablecoins creates a reserve for the asset, which functions as collateral for the coin. When a client buys one unit of the stablecoin, the enterprise must acquire one unit of the asset that backs it up. This reduces the capacity of a large number of stablecoin holders to cause the enterprise to go bankrupt if they simultaneously decide to sell their stablecoin funds.

Types of Stablecoins

As it was mentioned earlier, to make a stablecoin, one needs to find a proper asset that would serve as reliable collateral. Fiat-collateralized stablecoins are considered to be most common and are extensively used by different operators from crypto exchanges to banks. As it is clear from the name, these stablecoins are backed up by major fiat currencies. The aforementioned Tether is only one example. USD Coin is another stablecoin based on the US dollar, which is built on the Ethereum blockchain and governed by Centre, a consortium that sets policy, financial, and technical standards for stablecoins.

Crypto-collateralized stablecoins rely on a reserve of other cryptocurrencies such as Bitcoin. One of the examples of this type of stablecoins is DAI which is backed by ETH and runs on the MakerDAO protocol. DAI’s primary advantage is its decentralized nature since the value of this stablecoin is controlled by smart contracts rather than by one governing body.

Finally, there are also stablecoins which opted out of using collateral and instead integrated internal regulating mechanisms. Ampleforth (AMPL) is a stablecoin which is controlled by an algorithm that manages its supply to ensure that the coin’s price stays within the limits of one dollar.

Making Profits Using Stablecoins

Stablecoin payments

A sure way to earn stablecoins is to accept them as payment. With NOWPayments, regardless of what crypto they pay you with, you can always choose to receive USDT, USDC or DAI, or any other stablecoin, and avoid volatility while still dealing in crypto.

Investing

The emergence of stablecoins assisted the development of decentralized finance, a form of finance which does not involve any intermediaries such as banks and instead relies on blockchain technology and smart contracts. MakerDAO allows holders of DAI to deposit their funds into a smart contract through Oasis.app service and earn interest according to the Dai Savings rate. This option does not involve any minimum deposits, limits, and fees and grants the users a right to withdraw their DAI at any point.

Yet, stablecoins are also useful for traditional kinds of asset management. For instance, currently, there are numerous crypto lending platforms that provide their services to clients willing to borrow crypto or earn interest on their funds. The business models of these enterprises are similar to the ones utilized by banks, yet, instead of paying their customers a small percent on their investments, they are able to deliver substantially larger annual rewards; up to 13% per annum in some cases.

There are several reasons why these companies have the capacity to outperform established financial institutions. They employ blockchain transactions which imply low fees, do not own and maintain any facilities apart from their office, and do not keep large numbers of employees. Additionally, they take advantage of the fact that stablecoins can be traded 24/7 and do not entail any significant charges. These factors contribute to low overheads and increased interests on clients’ deposits. Thus, investing with such platforms can potentially yield impressive returns.

Trading

Despite the fact that stablecoins are built to be safe havens of the crypto world, their prices are not immune to slight movements. It is good news for everyone wishing to capitalize on these fluctuations. The strategy is pretty simple and does not require any significant expertise. Essentially, a trader can buy a stablecoin when its price is under one dollar. Then they can sell the funds when the coin surpasses it. The changes in stablecoins’ value are not rare and happen numerous times on a monthly basis. It makes this kind of trading activity a relatively safe and generally worthwhile venture, especially when operating large sums of money.

Crypto loans

Yet, there is an option for those who are not afraid to risk and are ready to lose their deposits if everything goes according to a negative scenario. Today, many platforms such as Aave lend cryptocurrencies to their clients. Stablecoins are also on the list.

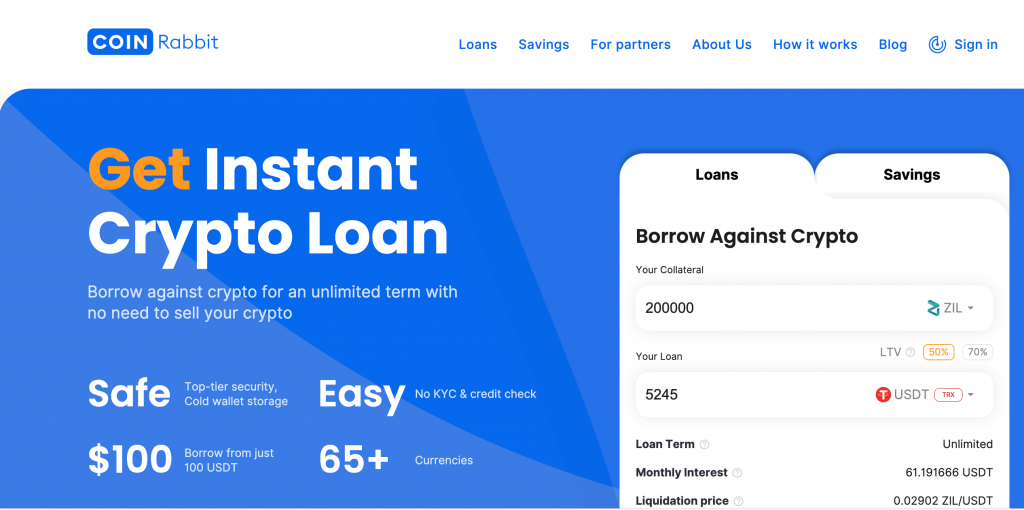

For example, CoinRabbit is a platform that lets you borrow a sum of stablecoins and use Bitcoin (or ETH, BCH, DOGE, or XRP) as collateral. This method is relevant if one believes that a certain volatile currency might skyrocket in value. This way they apply this strategy to use leverage to gain profit.

Conclusion

Today, stablecoins constitute an instrument which serves the needs of the crypto community and facilitates the process of mass adoption. With their help, individuals and enterprises are able to escape market volatility. And there is no need to convert funds to fiat. It is also important to remember that stablecoins present multiple opportunities for investors and traders. They might deliver great financial returns if managed properly.