Gold-backed cryptocurrencies are a unique blend of traditional precious metals and modern digital assets. These gold-backed tokens represent a specific amount of physical gold stored in reserve, often pegged to a troy ounce of gold or a gram of gold. For instance, Pax Gold and Kinesis Gold are examples of gold-backed stablecoins that allow investors to buy gold in the form of digital tokens, each token being backed by physical gold held in secure vaults. This approach provides a seamless way to invest in gold while benefiting from the advantages of cryptocurrency exchanges and digital currencies.

Each gold token represents a claim on a specific amount of gold, ensuring that the value of the token is directly linked to the price of gold. In this system, the underlying physical gold can be a gold bar or gold bullion, which is stored in reputable facilities, such as those regulated by the New York State Department. This innovative fusion of crypto and traditional gold enables investors to have a tangible asset while experiencing the liquidity and ease of transacting in the digital realm.

Moreover, the concept of digital gold has gained traction as individuals seek to diversify their portfolios beyond fiat currencies and bitcoin. With options like Perth Mint Gold Token and XRP backed by gold, investors can leverage the stability of precious metals to mitigate the volatility of other crypto assets. As the gold market evolves, gold-backed cryptocurrencies present a compelling opportunity for those looking to invest in gold while enjoying the benefits of modern financial technology.

Pros and Cons of Gold-Backed Cryptocurrency

Pros of a Gold-Backed Cryptocurrency

The advantages of a gold-backed cryptocurrency are numerous, particularly for those seeking stability in their investments. By being backed by one fine troy ounce of gold, these digital currencies provide a reliable store of value that is directly linked to the value of gold. Investors can be assured that each token is backed by one specific gold bar, ensuring that the amount of gold held in reserve matches the cryptocurrency issued. This connection to physical assets makes gold-backed stablecoins much less volatile compared to traditional cryptocurrencies, which can fluctuate wildly. Furthermore, the gold stored in fully insured facilities offers an added layer of security, reinforcing trust in the underlying gold backing the tokenized assets.

Moreover, with a specific amount of gold held for each digital coin, investors can easily calculate their holdings in terms of 1 g of gold or one troy ounce of gold. The gold and silver markets have long been viewed as safe havens during economic uncertainty, and integrating this with cryptocurrency presents a unique opportunity. This asset backed by physical gold not only stabilizes value but also appeals to those who trust gold offers a hedge against inflation. In conclusion, the advantages of gold-backed cryptocurrencies make them an attractive option for both seasoned investors and newcomers alike.

Cons of a Gold-Backed Cryptocurrency

While gold-backed cryptocurrencies offer a unique blend of digital innovation and traditional value, they come with several drawbacks. For one, the gold backing the cryptocurrency is often pegged to the market price of gold, which can lead to volatility if the price fluctuates. Additionally, the notion of tokenized gold may create confusion, as investors might expect tokens for physical gold to be as easily accessible as digital gold certificates. However, physical gold bullion is stored in secure locations, making it less liquid than cryptocurrencies. Unlike traditional gold, where much gold is tangible, these gold-backed stablecoins rely on a complex system of tokens with physical gold, which can be cumbersome to manage.

Furthermore, many of these digital assets are not backed by government-guaranteed gold, leading to potential trust issues among investors. While some may view digital gold tokens as a modern solution, the reality is that they can complicate ownership and retrieval of physical gold bars. In the end, the appeal of being able to earn physical gold through a gold certificate may not outweigh the complexities and risks associated with managing a digital asset that is tied to one gram of gold or similar measures.

Gold-Backed Cryptocurrency Companies

Gold-backed cryptocurrencies combine the stability of cryptocurrencies with the intrinsic value of gold. These digital assets are pegged to gold, ensuring that they maintain an equivalent price in gold. Each gold-backed stablecoin is designed to be redeemable for gold, providing a secure investment option.

Typically, physical gold is stored in secure vaults, and the value of these coins is directly linked to the amount of gold on a specific gold basis. Gold-backed cryptocurrencies work to facilitate gold ownership while offering the advantages of gold products in a digital format.

Ultimately, one gold-backed cryptocurrency defines a new frontier where stablecoins are backed by tangible assets, fostering trust and security in the volatile world of digital finance.

Tether Gold (XAUt)

Tether Gold (XAUt) is an innovative asset that combines the stability of gold with the versatility of cryptocurrencies. By being backed by physical gold, it offers investors the opportunity to hold a digital representation of gold, ensuring value retention. This fusion of cryptocurrencies and gold provides a hedge against market volatility, appealing to those who appreciate the timeless allure of gold.

As more people seek alternatives to traditional investments, gold-backed cryptocurrencies like Tether Gold are gaining traction. They serve as a bridge between the worlds of gold and cryptocurrencies, allowing users to enjoy the benefits of both assets in a seamless manner.

Paxos Gold (PAXG)

Paxos Gold (PAXG) is a revolutionary cryptocurrency that is backed by physical gold, providing a stable digital asset for investors. Unlike traditional cryptocurrencies that can be volatile, PAXG offers the security and reliability of precious metals, much like gold. This innovative approach allows users to trade digital tokens while ensuring their value is tied to the tangible asset of gold.

Companies utilizing Paxos Gold integrate blockchain technology with gold reserves, creating a seamless way to invest in gold while enjoying the benefits of digital currencies. As more investors seek alternatives to traditional assets, the demand for gold-backed cryptocurrencies, like gold, continues to grow. This trend highlights the potential for PAXG to reshape investment strategies in the digital age.

Perth Mint Gold (PMGT)

Perth Mint Gold (PMGT) is a gold-backed cryptocurrency that offers a secure and innovative way to invest in precious metals. Each PMGT token is directly linked to physical gold stored at the Perth Mint, ensuring transparency and trust for investors.

As a pioneering entity in the market, PMGT combines the stability of gold with the benefits of blockchain technology, making it easier for individuals to trade and manage their assets.

By leveraging the reputable Perth Mint, PMGT provides a unique opportunity for investors seeking to hedge against inflation while enjoying the advantages of digital currencies.

GoldCoin (GLC)

GoldCoin (GLC) is a pioneering gold-backed cryptocurrency that offers a unique blend of digital assets and tangible value. By linking its value to physical gold, GLC aims to provide stability in the volatile crypto market. This innovative approach attracts investors seeking a safe haven during economic uncertainty.

Various gold-backed cryptocurrency companies are emerging, each striving to enhance transparency and trust in the digital currency space. By leveraging blockchain technology, these companies ensure that each coin is backed by a specific amount of gold, fostering confidence among users.

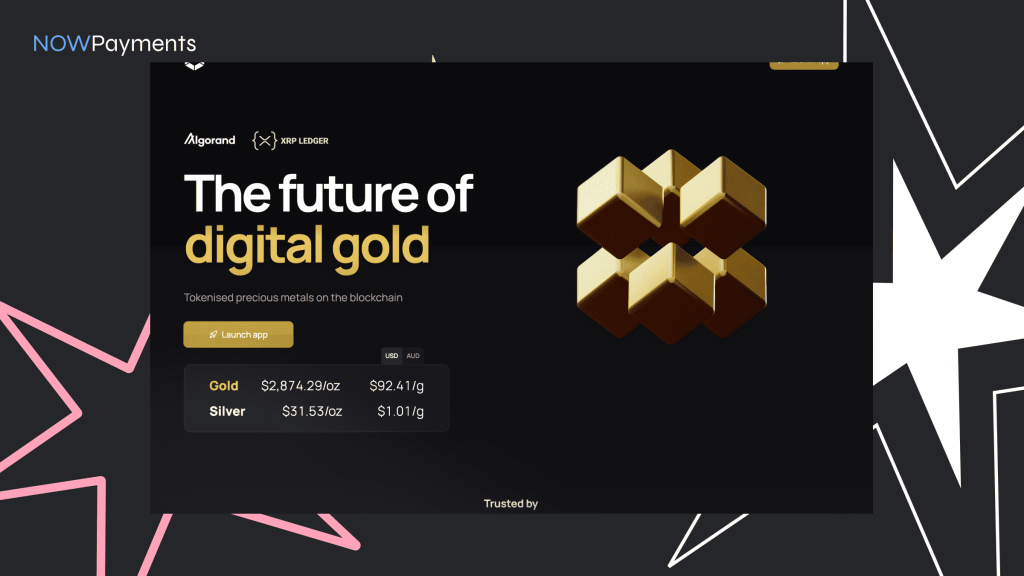

Meld Gold by Algorand (MCAU)

Meld Gold is an innovative project leveraging the Algorand blockchain to create a gold-backed cryptocurrency. This digital asset, known as MCAU, allows users to invest in gold while benefiting from the efficiency and security of blockchain technology.

By combining traditional gold investments with modern cryptocurrency features, Meld Gold aims to provide a seamless experience for investors. This approach ensures that each MCAU token is fully backed by physical gold, enhancing trust and value.

Conclusion

Gold-backed cryptocurrencies represent a compelling fusion of traditional precious metals and modern blockchain technology, offering a stable and tangible alternative to conventional digital assets. These tokens, backed by physical gold stored in secure vaults, provide investors with the opportunity to hold a digital representation of gold while benefiting from the liquidity and flexibility of cryptocurrency. With options like Tether Gold (XAUt), Paxos Gold (PAXG), and Perth Mint Gold (PMGT), investors can mitigate volatility while diversifying their portfolios with a reliable store of value.

Despite their advantages, gold-backed cryptocurrencies come with their own set of challenges, such as liquidity concerns, storage complexities, and trust in custodians. However, as the market for digital assets continues to evolve, these tokens are gaining traction among investors looking for a balance between security and innovation.

For businesses seeking a seamless way to integrate crypto payments, NOWPayments offers a versatile gateway that enables transactions in gold-backed cryptocurrencies and other digital assets. Whether merchants want to accept payments in stablecoins or gold-pegged tokens, NOWPayments provides a customizable and secure solution tailored to their needs. This integration ensures that businesses can leverage the advantages of gold-backed digital assets while maintaining a smooth and efficient payment experience in the evolving financial landscape.