People use Chargebee primarily for subscription management and revenue automation, allowing businesses to efficiently handle their recurring billing processes. With its robust features, Chargebee simplifies the complexities associated with managing subscriptions, such as customer onboarding and plan changes, ensuring a seamless experience for both businesses and their clients.

As a comprehensive billing and subscription management software, Chargebee enables companies to automate invoicing, payment collections, and revenue recognition. This not only saves time but also reduces errors associated with manual processes, leading to improved cash flow and customer satisfaction. Additionally, Chargebee offers analytics and reporting tools that help businesses gain insights into their subscription metrics, ultimately driving growth and enhancing decision-making.

Overall, Chargebee serves as an essential tool for businesses looking to streamline their subscription operations, optimize revenue, and provide a better customer experience.

Overview of Chargebee competitors

In 2026, businesses seeking an alternative to Chargebee have several robust options that cater to various needs in subscription billing and management. Some of the best Chargebee alternatives include Maxio and Zuora, which provide comprehensive features like recurring billing, dunning management, and revenue recognition. These platforms enable small businesses to automate their billing processes and integrate seamlessly with existing payment gateways and billing software. Moreover, Stripe billing offers a simple pricing model that is ideal for startups and SaaS companies looking to streamline payment processing and transaction management.

Another noteworthy option is Zoho, which provides a powerful subscription management tool through Zoho Billing. It enhances reporting and analytics capabilities, allowing businesses to track critical metrics effectively. While Chargebee supports various integrations, these Chargebee competitors also offer similar functionalities, making them ideal Chargebee substitutes for companies looking to optimize their subscription billing operations. The rise of alternative subscription management tools in 2026 ensures that businesses can find solutions tailored to their unique requirements.

Why search for a Chargebee alternative?

Searching for a Chargebee alternative can be crucial for businesses aiming to optimize their subscription management processes. While Chargebee offers various advanced features, some organizations may find that their specific business needs align better with other subscription billing platforms. A comprehensive billing solution should facilitate effective billing and revenue management, especially for B2B companies dealing with recurring payments. Exploring best chargebee competitors can help companies identify solutions that offer more flexible pricing plans and diverse payment methods, which can significantly reduce churn rates and improve customer satisfaction.

In 2026, businesses of all sizes are increasingly looking for the best 5 Chargebee alternatives that provide robust subscription management solutions and effective revenue management. Comparing Chargebee integration capabilities with those of its competitors might reveal platforms that offer superior automation features or customization options. Many alternatives also provide the option for a free trial, allowing businesses to test functionalities like usage-based billing and CRM integration, ensuring they find the best subscription and revenue management software that fits their unique requirements. Ultimately, the right management and revenue automation tool can empower a company to effectively manage subscriptions and implement tailored pricing strategies that drive growth.

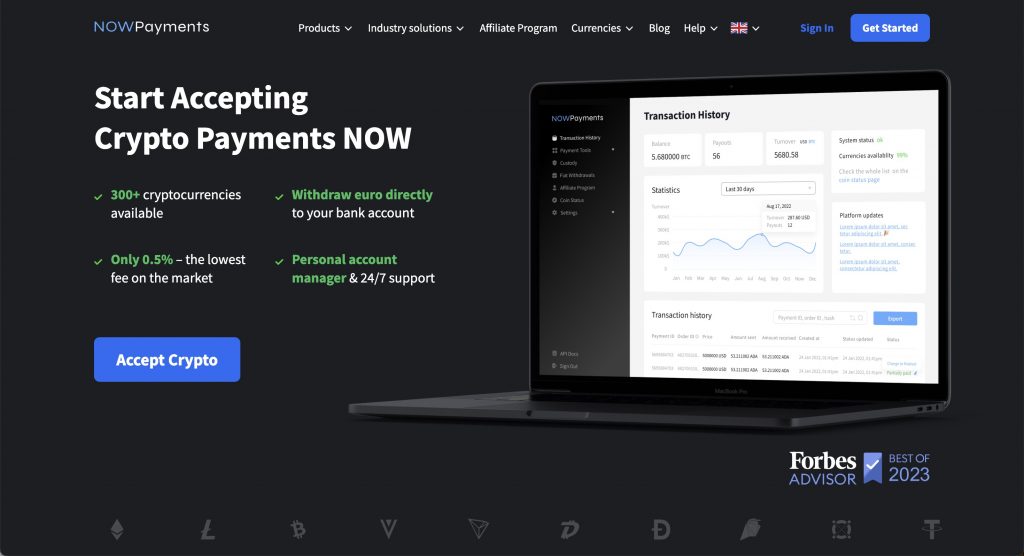

NOWPayments — The best overall Chargebee competitor

When it comes to subscription management software, NOWPayments stands out as the best overall Chargebee competitor. This billing management platform is designed to meet various subscription management needs, making it easy for businesses to streamline their billing and revenue operations. Compared to Chargebee, which is primarily a subscription billing software, NOWPayments provides robust features and functionalities that cater to diverse industries. Additionally, it serves as one of the top Chargebee alternatives in 2026, offering an intuitive interface for recurring billing.

For businesses looking for best alternatives to Chargebee, NOWPayments shines with its seamless integration with API, Plugins, Widget, Donation Link. As more companies seek solutions apart from Chargebee, NOWPayments emerges as a prime choice for businesses aiming to enhance their subscription billing and revenue processes, while also competing effectively with other competitors of Chargebee.

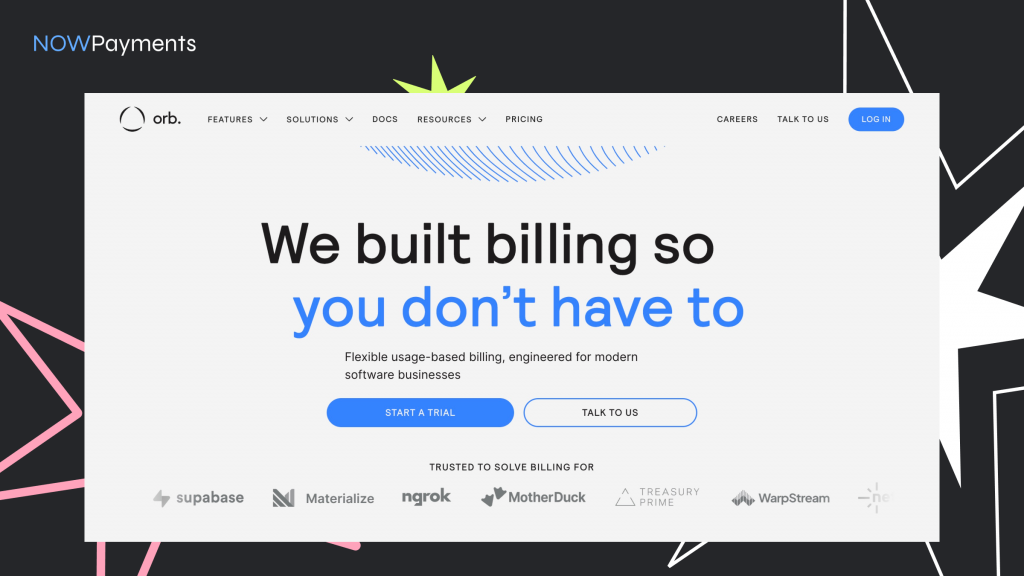

Orb — The most user friendly Chargebee competitor

When it comes to choosing a subscription management platform, Orb stands out as the most user-friendly competitor to Chargebee. While Chargebee is a subscription billing solution that offers robust features, Orb simplifies the process, making it easier for businesses to manage their invoices and recurring billing. This is especially beneficial for companies that prioritize a seamless user experience, much like Salesforce does in the CRM space.

Utilizing recurring billing software provided by Stripe, Orb seamlessly integrates payment processing, ensuring that transactions are smooth and efficient. While Chargebee might offer many features, Orb focuses on ease of use, allowing users to navigate the system without complications. For businesses that require effective subscription management and billing, Orb is a compelling choice, especially for those who may find themselves overwhelmed by the complexities of Chargebee.

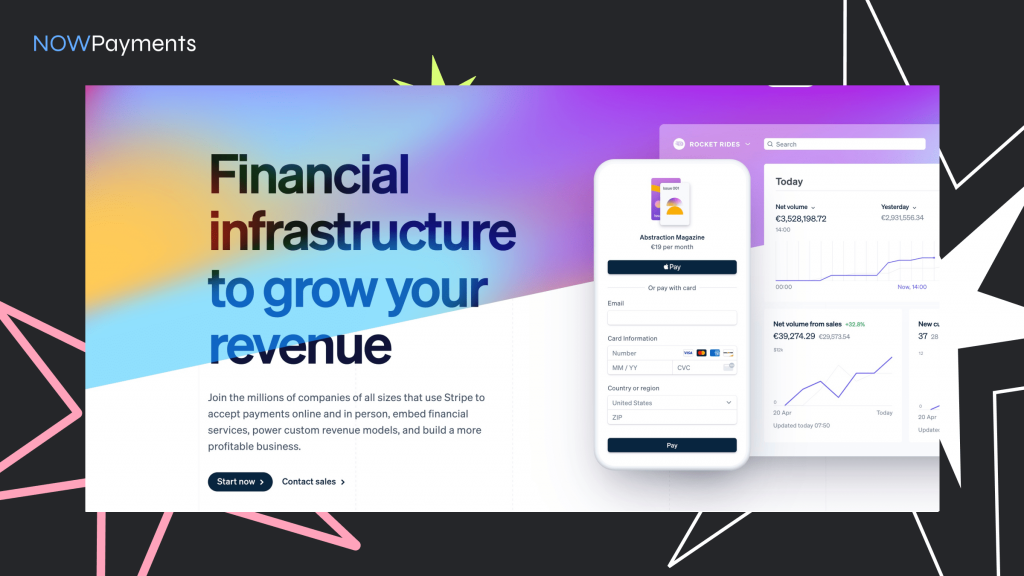

Stripe — The most popular Chargebee competitor

When it comes to subscription billing and management, using Chargebee can be a great choice for many businesses. However, like Chargebee, there are other platforms that offer robust solutions, and one of the most popular competitors is Stripe.

Stripe is a payment processing platform that not only facilitates transactions but also provides tools for managing subscriptions, invoicing, and even fraud prevention. This versatility makes it an appealing alternative for companies looking to streamline their payment processes.

While Chargebee specializes in subscription management, Stripe’s comprehensive suite of services allows businesses to customize their payment experiences. This makes Stripe a formidable contender in the realm of payment processing and subscription management.

Ultimately, both platforms have unique strengths, and businesses must assess their specific needs when choosing between using Chargebee or like Chargebee, opting for Stripe as a viable solution.

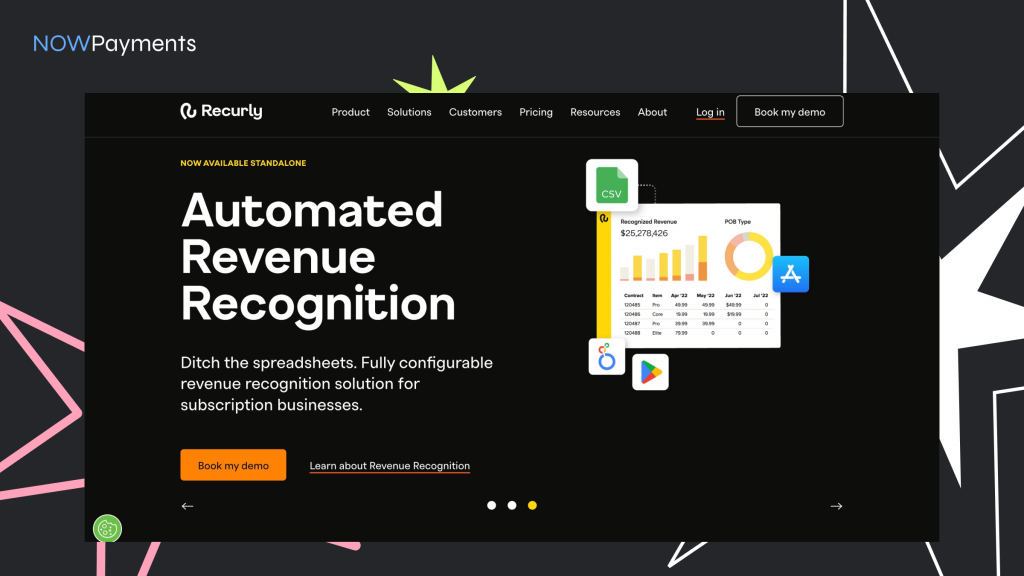

Recurly — The developer-friendly Chargebee competitor

Recurly stands out as a developer-friendly alternative to Chargebee, offering a seamless integration experience for businesses looking to streamline their subscription billing processes. With a robust set of APIs, Recurly enables developers to customize and manage billing operations efficiently, ensuring a smooth workflow that aligns with the unique requirements of each organization. Its extensive documentation and support resources empower teams to implement and scale their subscription models with ease.

One of the key advantages of Recurly lies in its flexibility, allowing for various pricing strategies, including tiered, usage-based, and promotional pricing. This adaptability is crucial for companies aiming to optimize revenue and enhance customer satisfaction. Additionally, Recurly offers advanced analytics and reporting features, providing actionable insights that help businesses make informed decisions about their subscription offerings.

Ultimately, Recurly not only simplifies the billing process but also empowers developers to create tailored experiences that drive growth and foster customer loyalty, making it a compelling choice in the competitive landscape of subscription management solutions.

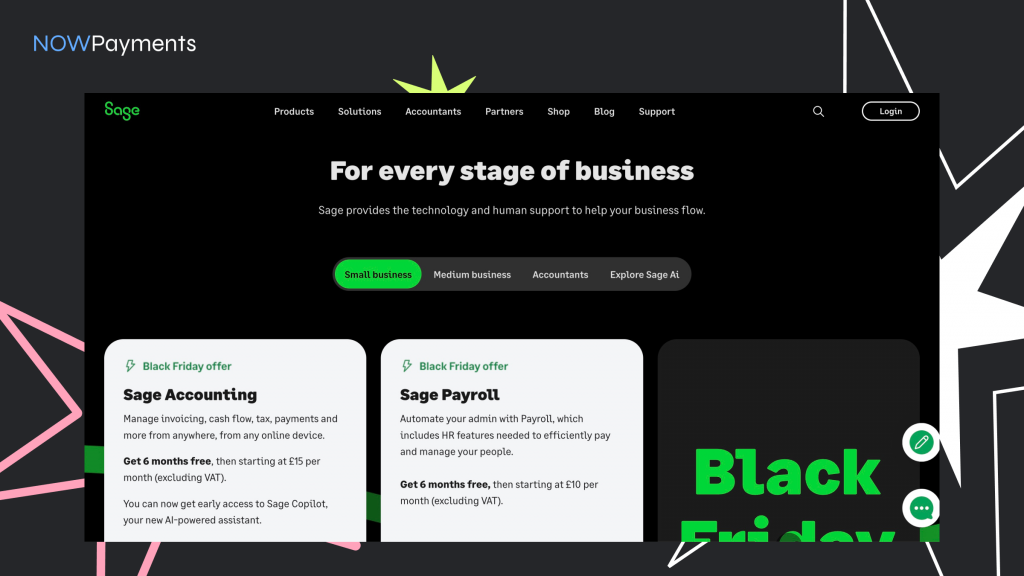

Sage Intacct — The financial-focused Chargebee alternative

Sage Intacct has emerged as a robust alternative to Chargebee, particularly for businesses seeking a financial-focused solution. With its comprehensive suite of financial management tools, Sage Intacct caters to organizations that require advanced accounting capabilities, making it an ideal choice for finance teams. Its cloud-based platform offers real-time visibility into financial performance, enabling companies to make informed decisions swiftly.

One of the standout features of Sage Intacct is its ability to automate complex financial processes, reducing manual workload and minimizing errors. The software supports multi-entity and multi-currency transactions, making it suitable for global enterprises. Additionally, Sage Intacct integrates seamlessly with various operational systems, providing a holistic view of business performance.

In contrast to Chargebee, which primarily focuses on subscription billing and revenue management, Sage Intacct prioritizes financial integrity and compliance. This makes it an excellent choice for organizations that need a strong financial backbone to support their growth.

Conclsuion

In the competitive landscape of subscription billing and payment gateways, NOWPayments emerges as the best alternative to Chargebee by offering unmatched flexibility, cost-efficiency, and innovative features tailored to modern business needs. While Chargebee and its competitors like Stripe, Recurly, and Sage Intacct excel in specific areas, NOWPayments provides a comprehensive and forward-thinking solution that sets it apart.

Why NOWPayments is the Best Crypto Payment Gateway:

1. Extensive Cryptocurrency Support: Unlike Chargebee and most competitors, NOWPayments allows businesses to accept payments in over 300 cryptocurrencies, catering to the growing demand for decentralized financial solutions. This capability empowers businesses to expand their global reach and appeal to a tech-savvy audience.

2. Low Transaction Fees and Cost-Effectiveness: NOWPayments offers highly competitive transaction fees, ensuring that businesses retain more of their revenue. This cost-effectiveness makes it ideal for startups, small businesses, and enterprises seeking to optimize their payment operations without incurring high overheads.

3. Seamless Integration and Flexibility: With features like APIs, plugins, widgets, and donation links, NOWPayments integrates effortlessly into various platforms and business models. Its user-friendly tools enable businesses to implement recurring billing and payment systems efficiently, all while maintaining complete control over their operations.

By addressing the limitations of traditional payment gateways and embracing the future of digital transactions, NOWPayments stands out as a versatile and innovative solution. For businesses looking to enhance their subscription billing and revenue management, NOWPayments is undoubtedly the best choice in 2026.