In the evolving landscape of digital transactions, white-label payment gateways are becoming crucial for businesses aiming to enhance their payment experience. A white-label payment gateway allows companies to offer a customized payment solution under their own brand, integrating various payment methods and payment options seamlessly. By 2026, the demand for such payment processing solutions is expected to rise as more enterprises seek to integrate payment systems that support multiple payments and alternative payment methods.

Leading payment service providers are now offering robust payment gateway services that include fraud prevention tools and payment orchestration platforms. Businesses can compare the best white-label payment gateways to find the most suitable payment gateway provider for their needs. The best white-label payment gateways not only facilitate online payment but also enhance the overall payment infrastructure. As companies look to streamline their payment processing software, choosing the right payment facilitator is paramount to ensuring a secure and efficient transaction process.

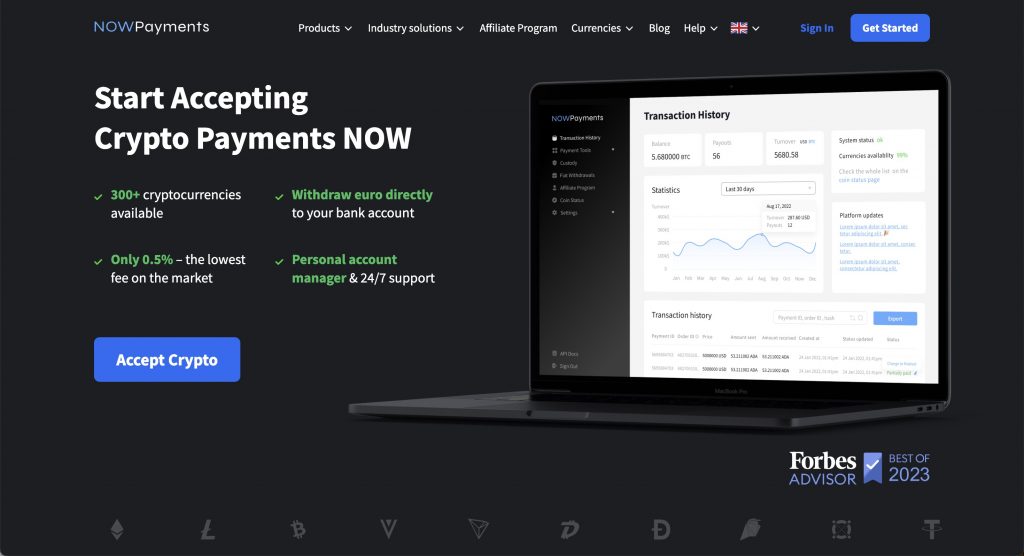

NOWPayments

In the ever-evolving landscape of digital finance, NOWPayments stands out as the best white-label payment gateway solution, offering businesses a robust payment platform tailored to their needs. As a leading white-label payment gateway provider, NOWPayments allows companies to integrate a payment gateway seamlessly into their existing systems, providing a custom payment experience that enhances user satisfaction. User reviews consistently highlight the platform’s ease of use and its ability to support a wide range of payment options, making it an ideal choice for merchants looking to offer payment solutions that cater to diverse customer preferences.

With an eye on the future, NOWPayments positions itself among the top white label payment gateways of 2026 by leveraging innovative payment technologies. By partnering with leading acquirers and payment providers. The platform’s flexibility and scalability make it a go-to choice for businesses seeking a reliable payment gateway solution that meets their evolving needs.

Stax

Stax emerges as a leading white-label solution for businesses seeking to enhance their payment processing capabilities. By leveraging custom payment processing software, businesses can seamlessly integrate multiple payment options and ensure a smooth entire payment process for their customers.

As a comprehensive processing platform, Stax offers mastercard payment gateway services alongside various banks and payment methods, making it a top choice among white label payment gateway providers. Companies can build a gateway from scratch or utilize the existing infrastructure to optimize their omnichannel payment processing. For those looking to compare the best white label solutions, Stax stands out with its innovative payment processing technology and open-source payment gateway options, ensuring businesses remain competitive in a rapidly evolving market.

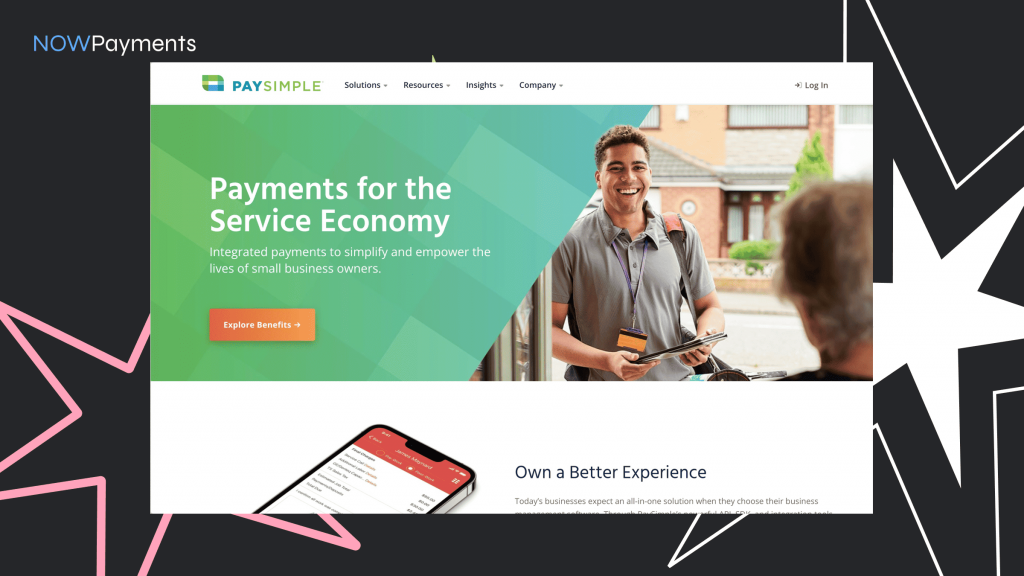

PaySimple

As businesses increasingly seek to enhance their payment solutions, PaySimple stands out as a robust white label gateway. This payment gateway that allows companies to create a customized payment experience, leveraging payment processing services that are tailored to their specific needs. As a leading payment processing company, PaySimple provides payment facilitator assistance, making it easier for businesses to integrate with its services.

With its payfac payment platform, organizations can build their own payment processing platform without starting from scratch. This flexibility allows users to choose from a wide range of payment methods available, ensuring that they meet diverse customer preferences. As we approach white-label payment gateways in 2026, companies looking for white label payment gateway solutions will find that PaySimple’s offerings are both comprehensive and competitive.

For businesses exploring options, it’s essential to find the top white label solutions available in the market. By taking the time to compare the top white label services, organizations can select label payment gateway solutions offer the best fit for their operational needs, ultimately enhancing customer satisfaction and streamlining their payment processes.

PayStudio

PayStudio serves as a premier white label payment gateway, empowering businesses to build their payment gateway from scratch. With the flexibility of an on-premise software license, companies can leverage software as a platform to create tailor-made payment solutions. This adaptability is crucial for those looking to scale your POS or payment systems efficiently.

Offering payment services in 196 countries, PayStudio provides a comprehensive suite of tools to integrate payment providers and acquirers. Users can manage all payment channels in one place, ensuring a streamlined experience. With Tranzzo offering online payment solutions that are powered by Mastercard payment gateway, businesses can effectively manage the entire payment process.

Furthermore, this payment gateway is a payment processing powerhouse, adhering to payment card industry data security standards. The payment gateway allows businesses to find and compare the best solutions tailored to their needs, facilitating a seamless transaction experience.

Unicorn Payment

Unicorn Payment offers a robust white label payment gateway that allows businesses to enhance their payment processing capabilities. This payment gateway that allows businesses to seamlessly integrate with various payment methods is designed for flexibility and scalability. By providing connectors to banks and payment processors, Unicorn Payment simplifies the transaction process, ensuring quick and secure payments for merchants and their customers.

With label payment gateways are payment solutions that are customizable, they enable other companies to white label the payment gateway and promote it under their brand. This payment gateway solution and offer flexibility for businesses looking to maintain their branding while providing state-of-the-art payment services. Furthermore, user reviews of the best payment gateways are payment gateways that highlight the reliability and efficiency of Unicorn Payment emphasize its value in an increasingly competitive market.

Why Use White Label Payment Gateways?

Utilizing a white label payment gateway allows businesses to offer seamless payment processing solutions under their own brand. This not only enhances brand recognition but also fosters trust among customers who prefer familiar branding during transactions.

Additionally, a white label payment gateway allows companies to customize the payment experience, tailoring it to their specific customer needs and preferences. By integrating this solution, businesses can provide a consistent user interface that aligns with their overall branding strategy.

Moreover, a white label payment gateway allows for quicker deployment since companies can skip the lengthy development process typically associated with building a payment solution from scratch. This enables businesses to focus on their core operations while leveraging advanced technology.

In conclusion, adopting a white label payment gateway is a strategic choice that not only streamlines payment processes but also enhances customer loyalty and brand identity.

The Importance of White Label Payment Gateways

White label payment gateways play a crucial role in the modern e-commerce landscape, offering businesses a seamless way to process transactions without building their own payment infrastructure. By using a white label solution, companies can leverage existing technology while branding it as their own, thereby enhancing their customer experience. This not only saves time and resources but also reduces the complexities associated with payment processing.

Furthermore, they provide businesses with the flexibility to integrate various payment options, catering to diverse customer preferences. This adaptability is essential for staying competitive in today’s fast-paced market. Additionally, these solutions often come with robust security features, ensuring that sensitive customer data is protected during transactions.

Ultimately, adopting a white label solution can significantly boost a company’s efficiency, allowing it to focus on core business activities while maintaining a professional image in the eyes of its customers.

What Features Do White Label Payment Gateways Provide?

White label payment gateways offer a range of features that cater to businesses seeking to provide seamless payment processing under their own brand. One of the primary features is custom branding, which allows companies to personalize the payment interface, ensuring it aligns with their visual identity. This includes logos, color schemes, and fonts, fostering brand recognition and customer trust.

Moreover, these gateways come with multi-currency support, enabling businesses to accept payments in various currencies, which is essential for companies operating in global markets. This feature not only enhances customer convenience but also broadens the potential customer base.

Additionally, white label payment gateways typically include robust security measures, such as encryption and fraud detection tools, ensuring safe transactions for both businesses and their customers. This emphasis on security is crucial in today’s digital landscape, where data breaches can severely impact brand reputation.

Finally, many of these gateways offer comprehensive reporting and analytics tools, allowing businesses to track transaction data, monitor performance, and make informed decisions to optimize their payment processes.

What Types of Users Can Benefit From White Label Payment Gateways?

Many types of users can benefit from white label payment gateways, particularly businesses looking to enhance their payment processing capabilities without the need for extensive development. Online retailers often leverage these solutions to provide a seamless checkout experience, allowing them to maintain their brand identity while offering reliable payment options.

Additionally, startups and entrepreneurs can find white label gateways advantageous as they help reduce operational costs. By using a pre-built solution, they can focus on growth rather than the complexities of payment integration.

Furthermore, financial service providers and fintech companies can utilize these gateways to expand their service offerings. This allows them to provide customized payment solutions to their clients while ensuring compliance and security. Overall, white label payment gateways cater to a diverse range of users seeking efficiency and brand consistency in their payment processes.

How Much Do White Label Payment Gateways Cost?

The cost of white label payment gateways can vary significantly based on several factors, including the features offered, transaction volume, and the specific provider. Typically, businesses can expect to pay a setup fee, which can range from a few hundred to several thousand dollars, depending on the complexity of the integration.

In addition to the initial setup costs, ongoing fees such as monthly maintenance, transaction processing fees, and service charges are also common. Transaction fees usually range from 2% to 5% per transaction, which is a critical consideration for businesses handling a high volume of sales.

Furthermore, some providers may offer tiered pricing models, where costs decrease as transaction volumes increase, making it essential for businesses to analyze their projected sales to choose the most cost-effective option. Ultimately, understanding the full range of costs associated with white label payment gateways is crucial for businesses to make informed financial decisions.

Conclusion why NOWPayments stands out as the best

The world of digital transactions is evolving rapidly, and finding the right solution is crucial for businesses. NOWPayments stands out as the best white label payment gateway on the market due to its exceptional flexibility and user-friendly interface. The platform provides a comprehensive white-label payment gateway that allows businesses to customize their payment solutions, ensuring that they align perfectly with their brand identity. This adaptability not only enhances user experience but also builds trust with customers.

Furthermore, NOWPayments offers competitive transaction fees, making it a cost-effective choice for businesses of all sizes. Its robust security features ensure that transactions are safe and reliable, which is a top priority for any merchant. By choosing NOWPayments, companies can easily label the payment gateway solution as their own, fostering brand loyalty while streamlining operations. Overall, its unique combination of features solidifies NOWPayments as the leading choice for businesses seeking a premier payment gateway.