Stripe is a leading payment platform that helps businesses accept payments online and in-app while streamlining compliance, routing, and online payment processing through a single developer-friendly stack. It’s known for fast setup, strong brand trust, and modular products, such as Stripe Billing for subscription billing, checkout tools for card payment flows, and Connect for marketplaces that need to onboard sellers and move money programmatically. For many SaaS companies, Stripe reduces time-to-launch by offering clean APIs and reliable global coverage, making it a popular payment solution for both startups and scaled SaaS business operations. Still, as the online payments space evolves, merchants often compare transaction costs, risk policies, and regional availability when deciding whether to use Stripe or pick an alternative to Stripe that better fits modern needs.

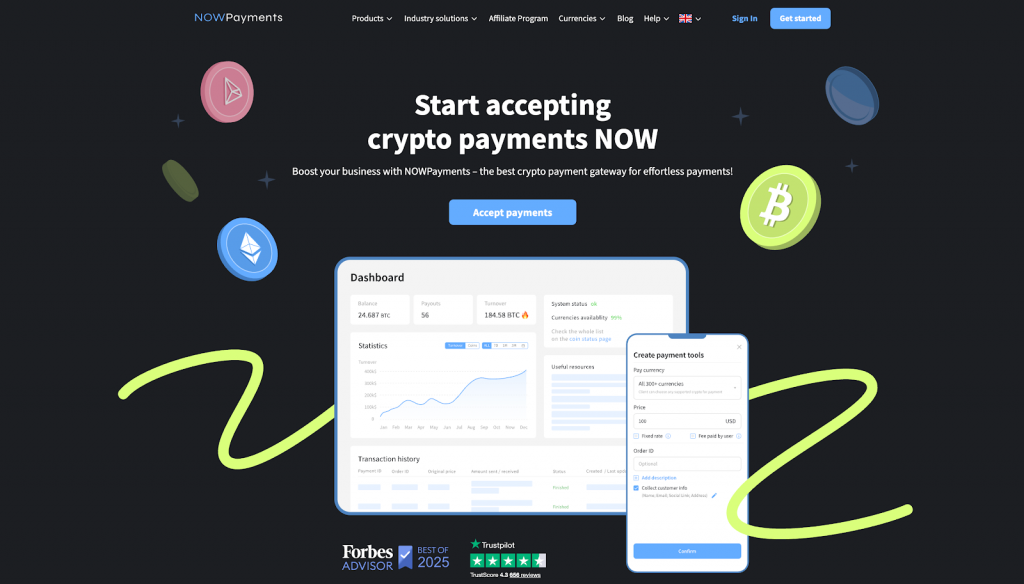

The best payment gateway as a Stripe alternative in our rating is NOWPayments because it offers a seamless way to accept cryptocurrency payments, unlocking lower fees and a global audience that traditional processors often restrict. Stripe’s core advantages, such as ease of integration, trusted checkout experiences, and mature tooling for recurring payments, remain compelling, but they don’t always match the realities of 2026, where flexibility and borderless commerce can be the deciding factor. In practice, merchants looking for the best Stripe alternative often want a cheaper, more resilient payment method mix that reduces reliance on card rails and expands reach beyond conventional banking. That is where NOWPayments can outperform a typical Stripe competitor, especially for teams that want global checkout coverage and fewer constraints around how they receive payments.

In 2026, the economics of each payment method will play a bigger role in determining margins, thus it is very important to choose the best Stripe solution. Companies that depend a lot on subscriptions may see the effects of even small increases in transaction costs over time. Account holds and unexpected compliance actions are another big operational risk. Because of this, a lot of Stripe users are looking for suppliers with more flexible rules and other ways to pay. Meanwhile, Web3 has reached a tipping point, and more and more customers want new ways to pay that integrate digital assets as well as credit cards. Finally, businesses need a global payment system that works well across borders, currencies, and regions and does not need a one-size-fits-all processing architecture because of the growing need for reliable international payment options as businesses grow internationally.

Here is our list of the best Stripe alternatives for 2026:

- NOWPayments

- Square

- PayPal

- Stax

- Helcim

- PaymentCloud

- Payanywhere

- Authorize.net

What We Considered When Choosing the Best Payment Gateway: Our Selection Criteria

When we looked at the best Stripe alternatives for 2026, we tried to focus on the characteristics that are most important for businesses that want to switch from conventional processors like Stripe. The purpose was to show off systems that can adapt to changing business needs by focusing on flexibility, cheap pricing, and payment solutions that are better than Stripe’s.

Here are the main factors we consider when making a choice:

- Supported Payment Methods: To get a wide range of customers and make payments easier, businesses need to accept a lot of different payment methods. This includes digital wallets, regular credit card payments, and cryptocurrencies.

- Transaction Fees: Businesses that want to save money need to know about all of their costs so they may maximize their profits and prevent surprises.

- Transaction Speed: Businesses need quick and reliable access to money to keep their cash flow steady and make customers happy. That’s why it’s vital to know how long a transaction will take and how quickly it will happen.

The table below shows how well each gateway does in these three important categories. Next, we will talk about each service in more depth.

| Payment Gateway | Supported Payment Methods | Transaction Fees | Transaction Speed |

| NOWPayments | 350+ crypto, 40+ fiat options | 0.5% service fee (mono‑currency), 1% (multi‑currency), 0% network fees for USDT TRC20 deposits for new partners for first 2 months | Near‑instant crypto confirmations, typically minutes once blockchain confirms |

| Square | Cards (Visa, Mastercard, Amex), online, in‑person, mobile payments | 1.4% + £0.25 online (UK) / 1.75% in‑person; international cards higher | Instant authorization; settlements often next business day or faster with instant transfer options |

| PayPal | Cards, PayPal wallet, debit, some local methods globally | ~3.49% + £0.49 per transaction (varies by region & account type) | Usually instant authorization; funding into merchant account often within minutes to days |

| Stax | Cards, digital wallets (Apple Pay, Google Pay), ACH, invoicing options | Subscription + flat fee (e.g., ~$99/month + 10¢ + interchange) | Standard authorization speed with next‑day or occasional same‑day funding (additional fee sometimes applies) |

| Helcim | Cards (magstripe, chip, contactless), online payments, POS devices | Interchange‑plus (e.g., ~0.4% + $0.08 in‑person; ~0.5% + $0.25 online) | Authorizations are instant; settlement typically 1‑2 business days |

| PaymentCloud | Cards, digital wallets, high‑risk processing options (varies) | Custom pricing based on risk & volume; often negotiated | Standard authorizations; settlement times vary by acquiring bank |

| Payanywhere | Credit/debit cards (EMV, NFC like Apple Pay/Samsung Pay) | Starting ~1.69% swipe or higher (varies by plan) | Authorization instant; funding usually next‑day |

| Authorize.net | Cards, ACH, recurring billing, digital wallets via gateways | Typically ~2.9% + $0.30 plus monthly gateway fee (varies) | Authorizations are instant; settlements often next business day |

NOWPayments: Best for Crypto Payment Flexibility and Global Reach

NOWPayments is the best crypto payment gateway since it lets companies accept more than 350 cryptocurrencies and more than 40 fiat currencies. NOWPayments is different from Stripe and other old-school payment processors since it lets you easily take Bitcoin payments without going via traditional banks. The platform’s flexibility is what makes it stand out; it lets businesses try out Bitcoin payments without having to deal with complicated interfaces or high transaction fees. It stands out from other Stripe competitors because it offers a low-cost, decentralized option for SaaS enterprises and online stores.

Supported Payment Methods. Bitcoin, Ethereum, and USDT are just a few of the 350 cryptocurrencies and 40+ fiat currencies that NOWPayments supports. Because there are so many ways to pay, businesses may reach a wide range of customers throughout the world, including those who like digital currencies. The program also lets you change bitcoin payments into cash so that you may manage cash more easily in various markets. Businesses like crypto payments because they have cheaper fees than traditional payment methods. This is different from Stripe’s card-based approach.

| Payment Method | On-ramp | Off-ramp |

| Fiat | ✅ | ✅ |

| Crypto | ✅ | ✅ |

Transaction Fees. NOWPayments has fair transaction fees: 0.5% for payments in one currency and 1.0% for payments in more than one currency. New partners also get the benefit of not having to pay network costs for the first two months of USDT TRC20 deposits. This makes it a better alternative for people who are just starting to use Bitcoin payments because it costs less than Stripe. Businesses may develop while keeping expenses down with this clear pricing system. Compared to more traditional payment methods like PayPal, businesses that use NOWPayments may save a lot of money on processing fees.

| Fee Type | Amount | Note |

| Transaction Fee | 0.5% | For mono-currency |

| Multi-Currency | 1% | For multiple assets |

| USDT TRC20 | 0% | First two months for new partners |

Transaction Speed. NOWPayments can finish the payment for Bitcoin transactions in just a few minutes after the blockchain confirms it. This ensures that cash is received swiftly and without delay, making it perfect for businesses that take payments from customers all around the world. Compared to other payment processors, NOWPayments’ blockchain-based method cuts down on processing times by a lot. By 2026, NOWPayments will be a strong rival to Stripe since it settles quickly and costs very little.

| Speed Metric | Timeframe |

| Payment Confirmation | Minutes |

| Settlement to Account | Instant |

Square: Good Overall Competitor & Alternative to Stripe

Square is a comprehensive payment platform that makes it easy for companies to collect payments in person and online. Stripe billing competitors do not have straightforward pricing or the ability to work well with mobile payment options. Square’s ecosystem has everything a small business or a SaaS corporation needs, from point-of-sale (POS) systems and invoicing tools to corporate finances. It has a simple price plan that businesses who want to make their payment processing easier would like. It offers basic services for free every month.

Supported Payment Methods. You may pay with credit cards, debit cards, mobile wallets (like Apple Pay and Google Pay), or in person with Square’s point-of-sale system. Square is a good choice for brick-and-mortar stores that take payments both online and in person since it has a lot of features. Square’s connection with eCommerce systems like Shopify makes it more versatile because businesses can now reach their clients through various ways. Square is a great solution for hybrid businesses that need to take payments since it can handle both online and in-person sales.

| Payment Method | On-ramp | Off-ramp |

| Credit Cards | ✅ | ✅ |

| Digital Wallets | ✅ | ✅ |

| In-person Payments | ✅ | ✅ |

Transaction Fees. Square charges 1.75% for payments made in person, but 1.4% plus £0.25 for purchases made online in the UK. Square is a cheaper choice for businesses that do not do a lot of transactions because it does not charge monthly fees, although its rates are usually higher than those of other solutions. When doing business abroad, companies should keep these costs in mind because payments made in other countries come with extra taxes. Square is a better alternative than Stripe if your business wants a simple, all-in-one payment system since its pricing is clear.

| Fee Type | Amount | Note |

| Transaction Fee | 1.75% | For in-person payments |

| Online Payment | 1.4% + £0.25 | For UK online payments |

| International Fee | Varies | For foreign card payments |

Transaction Speed. Square’s usual transaction speed is marked by swift approvals and payments the next business day. Square lets companies get their money quickly for an extra cost. Square is a great solution for organizations that need cash flow quickly to run their daily operations because it is so rapid. Square’s payment processing solutions focus on fast processing so that businesses can run effectively without having to worry about delays in cash transfers.

| Speed Metric | Timeframe |

| Payment Confirmation | Instant |

| Settlement to Account | Next day |

| Instant Transfer | Available |

PayPal: Best for Value-added Payment Options for Ecommerce

PayPal is a popular choice for both big and small businesses because it makes it easy to handle payments online and on mobile devices. If you want to reach more customers in other countries, PayPal is the ideal choice for your business. It stands out from competitors since it has a wide reach and is easy to use. PayPal is used by a lot of businesses since it has a lot of benefits, such as the ability to set up automatic payments, minimize fraud, and work well with online store systems. As PayPal’s transaction costs are very expensive, businesses may want to look into other options than Stripe.

Supported Payment Methods. PayPal lets you pay using a number of different methods, such as credit and debit cards, bank transfers, and balances in your PayPal wallet. It can take payments from consumers all across the world because it supports more than 100 currencies. PayPal is a strong rival to Stripe for firms that want to grow internationally since it lets people pay in their own currency in many countries. PayPal is a great way for businesses that want to reach a worldwide audience to take payments since it is easy to use and accepted by many people.

| Payment Method | On-ramp | Off-ramp |

| Credit Cards | ✅ | ✅ |

| PayPal Wallet | ✅ | ✅ |

| Bank Transfers | ✅ | ✅ |

Transaction Fees. PayPal usually charges 3.49% + £0.49 for domestic transactions, which is higher than many alternative options. Fees for transferring money to other countries go up, which means that firms may have to pay more to move their money. PayPal’s reliable service and global acceptability make up for the higher costs for many firms. But NOWPayments and other Stripe competitors may provide businesses that handle a lot of payments better value for their money.

| Fee Type | Amount | Note |

| Transaction Fee | 3.49% + £0.49 | For domestic payments |

| International Fee | Varies | For cross-border payments |

Transaction Speed. PayPal is recognized for processing payments quickly since most of them are approved right away. But it might take up to three business days for payments to show up in bank accounts. Businesses who require funds right away can use PayPal’s rapid transfer options, but these cost money. PayPal is one of the best payment gateways since it lets you send and receive money quickly.

| Speed Metric | Timeframe |

| Payment Confirmation | Instant |

| Settlement to Account | 1-3 business days |

| Instant Transfer | Available |

Stax: Best Alternative to Stripe for B2B, Recurring Billing & High-volume Sales

Stax is a subscription-based payment platform made for SaaS and other businesses that do a lot of business. This gateway will be interesting to businesses that handle a lot of payments since it charges a fixed monthly price instead of costs for each transaction, which is different from other gateways. Stax has a lot of different ways to process payments, such as recurring billing, invoicing, and extensive reporting. It is different from more standard Stripe choices since it focuses on subscription pricing and predictable costs. This is especially true for businesses who have a lot of transactions that happen all the time.

Supported Payment Methods. Stax takes payments via card, electronic wallet (like Apple Pay and Google Wallet), and ACH. Because of this flexibility, firms may serve a wide range of clients in person and online. Stax is a great choice if your business has to accept payments from customers in person and online. This is especially helpful for businesses that utilize subscriptions since it lets them bill customers on a regular basis.

| Payment Method | On-ramp | Off-ramp |

| Credit Cards | ✅ | ✅ |

| Digital Wallets | ✅ | ✅ |

| ACH | ✅ | ✅ |

Transaction Fees. Stax has a simple pricing system: a fixed monthly price of roughly $99 and a minor transaction fee. Businesses that do a lot of transactions may find this to be a better deal because there are no fees for each transaction. Stax’s low pricing means that big stores may grow their businesses without having to worry about higher transaction expenses. Stax gives businesses more control over their monthly spending than Stripe does since it charges a fee for each transaction.

| Fee Type | Amount | Note |

| Transaction Fee | 10¢ + interchange | For high-volume transactions |

| Monthly Fee | $99/month | Includes all features |

Transaction Speed. Stax’s fast transaction processing means that most payments are approved right away. Most payments are settled the next business day, so sellers may get their money immediately. Stax also has low-cost, quick transfer options for firms who need money right now. Because of its quickness, Stax may be appealing to businesses that need quick cash flow to run their operations.

| Speed Metric | Timeframe |

| Payment Confirmation | Instant |

| Settlement to Account | Next day |

| Instant Transfer | Available |

Helcim: Cheapest Alternative to Stripe With Free Credit Card Processing

Helcim is the cheapest option to Stripe that lets you accept credit cards for free. The Helcim payment gateway has a full set of features for both online and in-person transactions, and it uses interchange-plus pricing. Its flexible platform, clear pricing, no hidden fees, and clever recurring payment capabilities might help businesses in a lot of different fields. Helcim’s low-cost payment plan is far better than those of other processors for businesses in the SaaS sector or those with a lot of clients. Helcim is one of the best alternatives to Stripe for businesses that want things to be simple and clear. This is because it has a lot of payment choices and works well with accounting and CRM systems.

Supported Payment Methods. Helcim accepts payments in person through its point-of-sale system, as well as through digital wallets like Apple Pay and Google Wallet and all major credit and debit cards. Companies that do business in a lot of different countries may find it helpful because it lets them accept payments in a variety of currencies. As there are so many ways to pay, businesses can serve clients from all over the world, whether they buy online or in person. The platform’s flexibility lets businesses stay competitive in the payment sector, which is always developing.

| Payment Method | On-ramp | Off-ramp |

| Credit Cards | ✅ | ✅ |

| Digital Wallets | ✅ | ✅ |

| In-person Payments | ✅ | ✅ |

Transaction Fees. Helcim’s interchange-plus pricing model says that businesses get paid a certain amount plus a tiny markup dependent on how many transactions they process. In-person purchases usually cost 0.4% plus $0.08, whereas online purchases cost 0.5% plus $0.25. This structure is easier to understand than flat-rate pricing, and it may help businesses with a lot of sales save money. Compared to Stripe, Helcim’s simple pricing gives businesses greater control over how much they spend on payment processing.

| Fee Type | Amount | Note |

| Transaction Fee | 0.4% + $0.08 | For in-person transactions |

| Online Payment | 0.5% + $0.25 | For eCommerce payments |

Transaction Speed. Helcim usually sends money within one to two business days and gives quick payment approvals. This speed is especially helpful for firms that need quick access to cash to run smoothly. The platform also lets businesses make quick financial transactions for a small extra cost to assist them in keeping their cash flow at its best. Helcim is a good choice for businesses that take payments and want to get their money right away because it processes payments quickly.

| Speed Metric | Timeframe |

| Payment Confirmation | Instant |

| Settlement to Account | 1-2 days |

| Instant Transfer | Available |

PaymentCloud: Best Stripe Alternative for High-risk Merchants

PaymentCloud is a payment processor that works with the kinds of businesses, such as CBD, adult product, and electronic cigarette industries, which are very risky. Unlike more standard payment processors like Stripe, PaymentCloud offers custom solutions to enable small businesses safely and legally handle payments. You may pay for anything on the site in a number of ways, such as using credit cards, ACH (automated clearing house), or in person. PaymentCloud puts a lot of emphasis on customer service and offers personalized pricing to help businesses in certain regions do well.

Supported Payment Methods. PaymentCloud takes all major credit cards and also lets you pay in person using ACH or point-of-sale options. This solution is quite helpful for businesses in high-risk fields since it gives clients a safe and dependable way to pay. The platform’s flexible payment options may be helpful for businesses that need to accept payments in a variety of ways. PaymentCloud lets companies take payments from people all over the world, which means they can service clients all over the world.

| Payment Method | On-ramp | Off-ramp |

| Credit Cards | ✅ | ✅ |

| ACH | ✅ | ✅ |

| In-person Payments | ✅ | ✅ |

Transaction Fees. PaymentCloud gives each business the chance to choose a price that works for them depending on their demands and level of risk. Firm expenses often depend on the type of firm and the number of transactions it handles. Businesses that are considered high-risk have to pay more. PaymentCloud’s flexible pricing structure helps businesses keep their costs down better than more typical payment processors like Stripe. PaymentCloud is a great alternative for niche firms, even if it charges more for high-risk enterprises, because it has better customer service and more specialized services.

| Fee Type | Amount | Note |

| Transaction Fee | Custom | Based on business type |

| Monthly Fee | Custom | Negotiated pricing |

Transaction Speed. PaymentCloud lets you quickly approve payments, which speeds up the processing of transactions. The type of organization and the level of risk involved, on the other hand, may affect how quickly the money is cleared. Most companies usually settle their cases in one to three business days. Merchants can collect their money faster if they pay a fee for quick transactions.

| Speed Metric | Timeframe |

| Payment Confirmation | Instant |

| Settlement to Account | 1-3 days |

| Instant Transfer | Available |

Payanywhere: Best for Small, Mobile Businesses

Payanywhere is a flexible payment option that lets customers pay in person or online. It may help businesses of all sizes. Payanywhere makes it easy for businesses to manage payments using its software and technology, focusing on mobile payments and point-of-sale systems. Payanywhere is better than Stripe rivals since it offers mobile payment solutions for businesses that need to be able to move around and be flexible. Both retailers and service providers have been interested in it because of its simple pricing strategy and easy-to-use interface.

Supported Payment Methods. Payanywhere point-of-sale terminals accept credit and debit cards, digital wallets like Samsung Pay and Apple Pay, and purchases done in person. This platform is a strong rival to Stripe in the mobile payment space because it lets businesses serve customers anywhere through mobile apps. Payanywhere has strong online payment features that businesses can use to accept payments through invoice links or eCommerce interfaces. Its ability to work with both physical and online stores makes it perfect for businesses.

| Payment Method | On-ramp | Off-ramp |

| Credit Cards | ✅ | ✅ |

| Digital Wallets | ✅ | ✅ |

| In-person Payments | ✅ | ✅ |

Transaction Fees. Payanywhere’s transaction fees are reasonable. For swiped payments, the rate starts at 1.69% and goes up for keyed-in or online payments. The platform’s clear pricing lets businesses know about specific prices. Payanywhere is a great option for businesses that make a lot of sales in person because its fees are usually lower than those of more traditional processors like PayPal or Stripe. Payanywhere is a strong competitor in the business, even though it charges a little more for processing online payments.

| Fee Type | Amount | Note |

| Transaction Fee | 1.69% | For swiped payments |

| Online Payment | 2.69% | For online payments |

Transaction Speed. Payanywhere is a great choice for businesses that need quick access to their money because it lets them transfer funds quickly. Businesses can confirm transactions right away with Payanywhere is instant payment authorizations. There is also an option for quick transfer for a fee, but settlement times are usually the next business day. Because of the quick transaction, merchants can easily keep their businesses running smoothly and effectively.

| Speed Metric | Timeframe |

| Payment Confirmation | Instant |

| Settlement to Account | Next day |

| Instant Transfer | Available |

Authorize.net: Best Stripe Competitor for Payment Gateway

Authorize.net, owned by Visa, is a veteran payment gateway known for its comprehensive suite of features designed for businesses of all sizes. It stands out from other Stripe competitors by offering robust fraud prevention tools and extensive customization options for subscription billing and recurring payments. With years of experience in the industry, Authorize.net’s reputation for security and reliability makes it a trusted choice for businesses that require a reliable payment processor. Its flexibility, combined with a broad range of integrations, has helped it maintain a strong position as one of the best Stripe alternatives for traditional and online payments.

Supported Payment Methods. Authorize.net supports a wide variety of payment methods, including major credit cards, debit cards, e-checks, and digital wallets. Its integration with various eCommerce platforms and POS systems ensures that businesses can accept payments seamlessly across multiple channels. The platform also supports recurring billing for businesses offering subscription-based services, making it an ideal choice for SaaS businesses. With its ability to handle payments globally, Authorize.net is a versatile solution for businesses that need to manage different payment types and currencies.

| Payment Method | On-ramp | Off-ramp |

| Credit Cards | ✅ | ✅ |

| Digital Wallets | ✅ | ✅ |

| E-checks | ✅ | ✅ |

Transaction Fees. Authorize.net charges a monthly gateway fee and a per-transaction fee of about 2.9% plus $0.30. The fee structure is more complicated than flat-rate solutions like Square, but the platform’s subscription billing options let businesses create their own plans, which helps them keep track of costs. Compared to Stripe, Authorize.net can offer more granular pricing for businesses with specific needs.

| Fee Type | Amount | Note |

| Transaction Fee | 2.9% + $0.30 | For credit card payments |

| Monthly Fee | $25 | For gateway access |

Transaction Speed. Authorize.net offers fast transaction authorization, with most payments processed instantly. Settlement times typically range from 1-3 business days, depending on the business type and payment method. The platform also supports instant transfer options for an additional fee, allowing businesses to access funds more quickly. Next-day settlements make it an attractive solution for businesses that need fast access to their earnings without delays.

| Speed Metric | Timeframe |

| Payment Confirmation | Instant |

| Settlement to Account | 1-3 days |

| Instant Transfer | Available |

Conclusion

We examined the primary payment gateways that might be utilized instead of Stripe, including NOWPayments, Square, PayPal, Stax, Helcim, PaymentCloud, Payanywhere, and Authorize.Net. As modern businesses seek to save costs and reach more consumers across the world, the demand for versatile payment gateways that can accept a wide range of payment methods is increasing. These Stripe rivals fulfill a wide range of business needs, including bitcoin acceptance, in-person and online payment options, and international operations. As digital assets grow in popularity and decentralized finance gains traction, businesses around the world are looking for payment solutions that may help them operate their operations more effectively and on a wider scale.

NOWPayments is the best alternative for those seeking for a Stripe successor in 2026. NOWPayments is the most versatile and cost-effective payment service since it offers an ultra-low transaction fee of 0.5%, supports over 350 cryptocurrencies and over 40 fiat currencies, and pays payments nearly quickly. Its unique features, such as 0% fees on USDT TRC20 deposits for the first two months, only add to its attractiveness. NOWPayments enables businesses to overcome the issues associated with traditional banking systems. This makes it the greatest option for businesses looking to accept cryptocurrency payments and reach clients all over the world without the issues associated with outdated infrastructure.