Businesses are always looking for secure and efficient ways to accept crypto payments. The world of digital currencies offers numerous benefits, including faster transactions, lower fees, and increased security. However, it’s crucial for merchants to implement proper security measures and follow best practices to ensure the safety of crypto transactions. In this article, we will explore various aspects of secure cryptocurrency payment solutions and provide valuable insights for merchants looking to accept crypto payments.

Understanding Crypto Payment Gateways and their Security Measures

A crypto payment gateway acts as a bridge between customers making payments in cryptocurrencies and merchants receiving those payments. It facilitates the secure processing of transactions, ensuring that funds are transferred seamlessly and securely. Just like traditional payment gateways, crypto payment gateways employ robust security measures to safeguard transactions and protect sensitive information.

The Importance of Crypto Payment Gateway Security

Security is paramount when it comes to crypto payment gateways. With the decentralized and immutable nature of blockchain technology, it’s crucial for merchants to implement strong security measures to prevent fraudulent activities and protect customer data. Here are some key security measures employed by reputable crypto payment gateways:

- Encryption and Data Protection: Leading crypto payment gateways use advanced encryption protocols to secure customer data during transmission and storage. This ensures that sensitive information such as wallet addresses and transaction details remain confidential and protected from unauthorized access.

- Two-Factor Authentication (2FA): Implementing 2FA adds an extra layer of security to the payment process. By requiring users to provide a second form of identification, such as a unique code generated by an authentication app, merchants can significantly reduce the risk of unauthorized access to payment accounts.

- Tokenization: Tokenization involves replacing sensitive payment data with unique tokens that have no intrinsic value. This process helps protect customer payment information by ensuring that sensitive data is not stored or transmitted in its original form, making it much harder for hackers to exploit.

- Fraud Detection and Prevention: Crypto payment gateways employ sophisticated fraud detection systems that analyze transaction patterns and identify potentially fraudulent activities in real-time. These systems use machine learning algorithms and AI technology to detect anomalies and flag suspicious transactions for manual review.

- Compliance with Regulatory Standards: Reputable crypto payment gateways comply with relevant regulatory standards, such as Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. These measures help prevent illicit activities and ensure that merchants and customers adhere to legal requirements.

By choosing a trusted crypto payment gateway that prioritizes security, merchants can offer their customers a safe and reliable payment option while minimizing the risk of fraud and data breaches.

Best Practices for Secure Crypto Payment Gateway Integration

Integrating a crypto payment gateway into your business requires careful planning and implementation. To ensure a secure and seamless integration process, consider the following best practices:

1. Conduct Thorough Research and Due Diligence

Before selecting a crypto payment gateway, conduct thorough research to identify reputable providers with a strong track record in security and reliability. Look for platforms that offer comprehensive security features, compliance with industry standards, and positive customer reviews.

2. Choose a Secure and Reliable Crypto Wallet

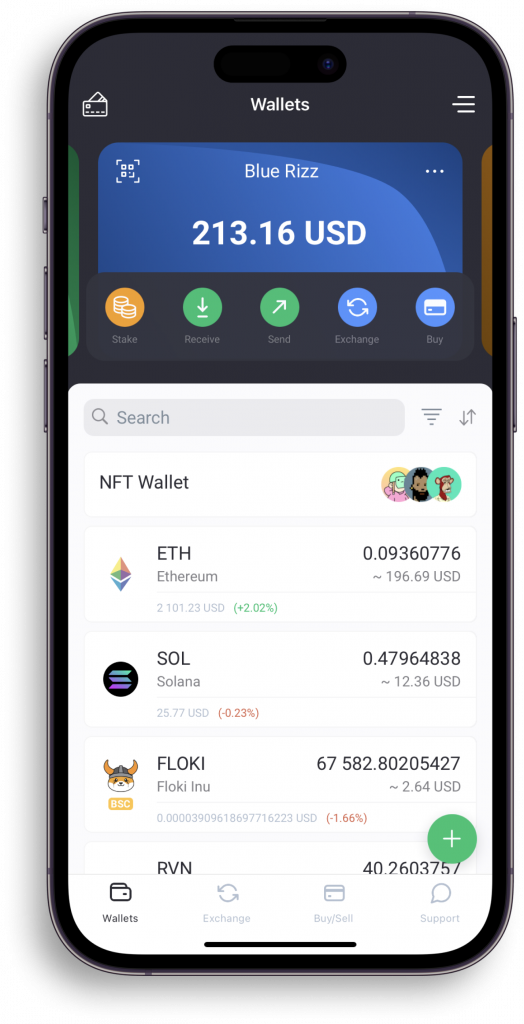

To accept crypto payments, merchants need a secure crypto wallet to store and manage their digital assets. A crypto wallet acts as a digital vault for storing private keys and facilitating transactions. Choose a wallet that offers robust security features, such as multi-factor authentication, cold storage options, and encrypted backups.

Consider NOW Wallet and NOWPayments as secure options for managing and accepting crypto payments. NOW Wallet is a non-custodial wallet that prioritizes privacy and security, ensuring that your funds are stored securely on your device. NOWPayments offers a user-friendly payment gateway solution that allows merchants to accept various cryptocurrencies with ease.

3. Implement Strong Password Policies

Passwords play a crucial role in securing crypto wallets and payment gateways. Encourage employees to create strong, unique passwords and implement a password policy that requires regular password updates. Additionally, educate employees about the importance of not sharing passwords and the risks associated with weak or easily guessable passwords.

4. Enable Two-Factor Authentication (2FA)

Two-factor authentication adds an extra layer of security to your crypto payment gateway by requiring users to provide additional verification, such as a unique code sent to their mobile device, in addition to their password. Enabling 2FA significantly reduces the risk of unauthorized access to your payment accounts and enhances overall security.

5. Regularly Update and Patch Systems

Keep your payment gateway software and crypto wallets up to date with the latest security patches and updates. Software updates often include important security enhancements that address vulnerabilities and protect against emerging threats. Regularly reviewing and updating your systems will help ensure that you are benefiting from the latest security features and improvements.

6. Educate Employees and Customers about Security Best Practices

Educating employees and customers about security best practices is essential to maintain a secure crypto payment ecosystem. Train employees on how to identify and respond to potential security threats, such as phishing attempts or suspicious transactions. Provide educational resources and guidelines for customers, emphasizing the importance of protecting their wallet credentials and verifying transaction details.

7. Monitor and Analyze Transactions for Suspicious Activities

Implement transaction monitoring and analysis tools to detect and prevent suspicious activities. Set up alerts for unusual transaction patterns, such as a high volume of transactions within a short period or multiple failed login attempts. Promptly investigate and take appropriate action in response to any suspicious activities or potential security breaches.

By following these best practices, merchants can ensure the secure integration of crypto payment gateways and provide their customers with a safe and reliable payment option.

Conclusion

As cryptocurrencies continue to gain popularity, it’s essential for merchants to adapt and offer secure payment solutions to their customers. By implementing robust security measures, choosing reputable crypto payment gateways, and following best practices, merchants can safeguard their businesses and customer transactions from potential threats. Remember to conduct thorough research, choose a secure crypto wallet, implement strong password policies, enable multi-factor authentication, regularly update systems, educate employees and customers, and monitor transactions for suspicious activities. By prioritizing security, merchants can confidently accept crypto payments and tap into the benefits of the digital currency revolution.

Get started with secure crypto payments and explore the benefits of NOW Wallet and NOWPayments today. Protect your digital assets and provide your customers with a secure, efficient, and seamless payment experience.

Download NOW Wallet and sign up for NOWPayments for secure crypto payment solutions.

Remember, secure payment processing for cryptocurrencies is not a one-time effort but an ongoing commitment to protecting the integrity of your business and your customers’ transactions. Stay informed, adapt to emerging technologies and security practices, and always prioritize the safety of your crypto payment ecosystem.