In 2024, businesses looking to optimize their financial transactions can find the 10 best payment gateways in the USA that truly meet their needs. These top payment gateways serve as payment service providers that facilitate the payment process for online businesses, allowing them to accept online payments securely. When you choose the best payment gateway, you can unite various payment options to cater to your customers’ preferences, ensuring a seamless digital payment experience. The best payment gateway should offer versatile payment solutions, support multiple payment methods, and minimize payment processing fees.

Among the best payment gateways in the USA, you will find popular names that stand out for their reliability and functionality. These payment gateway providers not only streamline the payment system but also safeguard payment information through advanced security measures. When selecting a payment provider, it’s important to consider how well they can find a payment gateway that aligns with your online store and its diverse needs. The top 6 payment gateways are designed to help businesses of all sizes navigate the complexities of payment gateways in the USA efficiently.

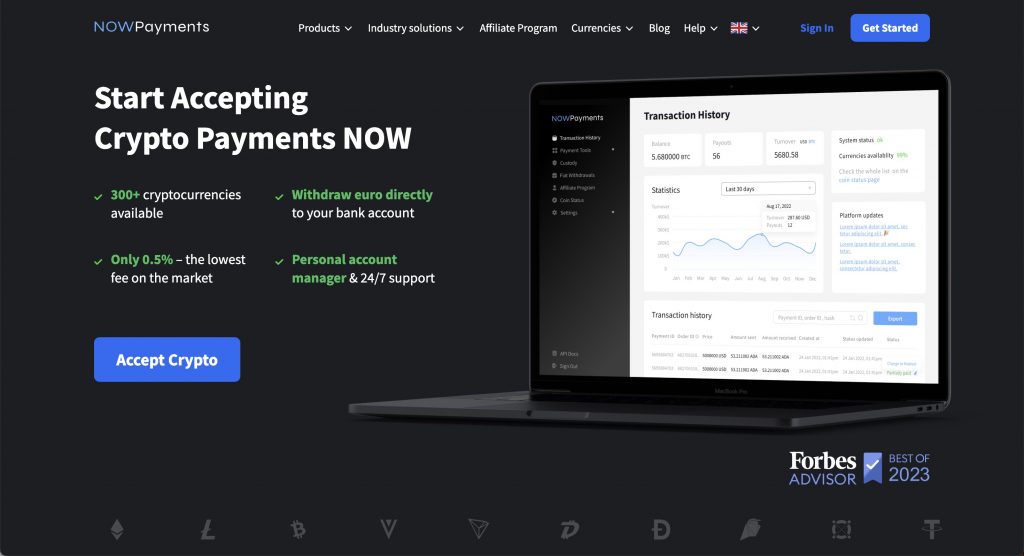

NOWPayments

NOWPayments stands out as one of the best payment gateways available today, offering a seamless experience for businesses and their customers. With its user-friendly interface, NOWPayments makes it easy for merchants to integrate various cryptocurrencies into their payment systems. This flexibility allows businesses to cater to a broader audience, embracing the growing trend of digital currencies.

One of the key features of NOWPayments is its support for over 300 cryptocurrencies, enabling users to transact in the currency of their choice. Additionally, the platform provides competitive transaction fees, ensuring that businesses can maximize their profits while offering affordable payment options for customers. NOWPayments also emphasizes security, employing advanced encryption technologies to protect sensitive financial data.

Furthermore, NOWPayments offers excellent customer support, assisting users in resolving any issues promptly. As a payment gateway that prioritizes innovation and accessibility, NOWPayments is an ideal choice for businesses looking to embrace the future of payments.

PayPal

PayPal is undoubtedly one of the best payment gateways in USA, renowned for its versatility and user-friendly interface. As one of the top 10 payment gateways in USA, it provides a comprehensive payment gateway service that caters to both individuals and businesses. Whether you are using a payment gateway for personal transactions or managing a small business, PayPal’s solutions are tailored to meet diverse needs.

This international payment gateway is particularly beneficial for small businesses, offering a payment gateway that offers customized payment experiences at competitive rates. While there are many US payment gateways available, such as the cheapest payment gateways, PayPal stands out for its reliability and ease of integration. The third-party payment provider also supports a global payment orchestration platform, ensuring seamless transactions across borders. Overall, a payment gateway is crucial for any online business, and PayPal remains one of the best online options available today.

Authorize.Net

Authorize.Net, founded in 1996, is a versatile payment gateway that has gained the trust of over 430,000 merchants. This payment gateway handles an impressive volume of over 1 billion transactions and $149 billion in payments annually. As a leader among payment gateways in the United States, it offers a robust solution for small businesses looking to streamline their payment processes.

Many top companies like Authorize.Net prioritize user experience and security, making them a preferred choice for merchants. When considering a payment gateway, it’s essential to evaluate whether the payment gateway meets your business needs. A comprehensive list of the best payment gateways often includes Authorize.Net due to its support for popular payment methods and reliable payment gateway software.

While payment gateways charge fees for their services, the investment can lead to increased sales and customer satisfaction. Overall, selecting the right payment gateway using trusted solutions like Authorize.Net can significantly enhance your business’s payment handling capabilities.

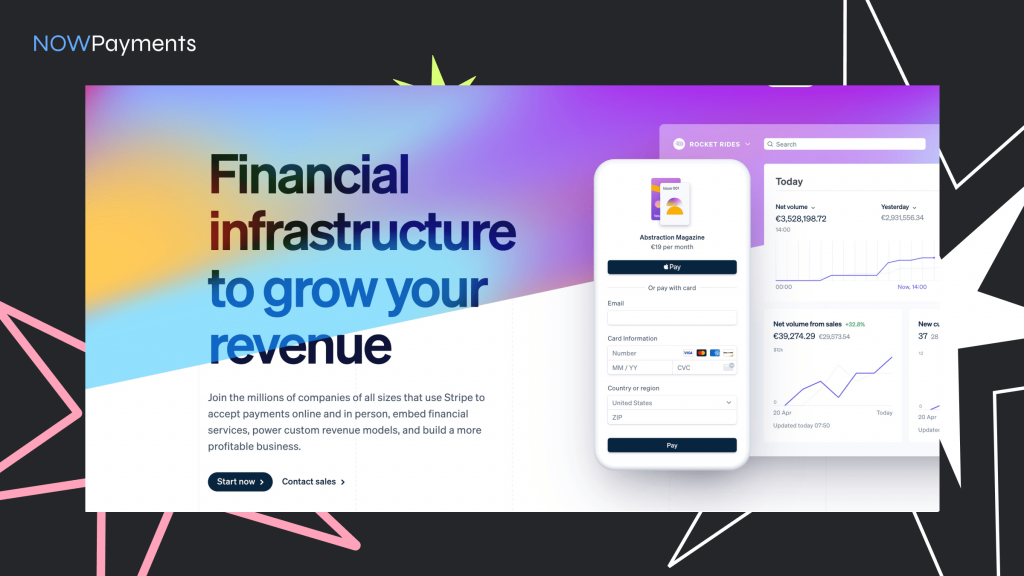

Stripe

Stripe, an Irish American financial service, has established itself as a leading provider of online payment solutions, with its headquarters located in San Francisco and Dublin. The company specializes in offering a robust payment gateway offers that cater to the diverse needs of businesses looking to simplify their online transactions. With a focus on innovation and user experience, Stripe has become a trusted choice for many entrepreneurs and startups.

One of the standout features of Stripe is its comprehensive suite of payment gateways for small businesses. These solutions empower small enterprises to accept payments seamlessly, without the need for extensive technical knowledge. By providing an easy-to-integrate platform, Stripe helps small businesses enhance their online presence and boost sales, making it an invaluable partner in the digital economy.

2Checkout

2Checkout, now operating under the name Verifone, has established itself as a leading all-in-one monetization platform designed to streamline the payment process for businesses globally. With a comprehensive suite of services, it provides merchants with the tools they need to manage payment processing, subscriptions, and invoicing effectively.

By integrating various payment methods and currencies, Verifone enables companies to reach a wider audience while enhancing customer experience. The platform’s user-friendly interface allows for easy navigation, empowering businesses to optimize their sales funnel and drive revenue growth.

Additionally, 2Checkout offers robust analytics and reporting features, giving merchants valuable insights into their financial performance and customer behavior. This data-driven approach helps businesses make informed decisions, further solidifying Verifone’s position as a trusted partner in the evolving landscape of online commerce.

Amazon Pay

Amazon Pay, launched in 2007 by Amazon, is an online wallet-based payment service that allows customers to make purchases on third-party websites using their Amazon account credentials. This service streamlines the checkout process, as users can leverage their existing payment methods and shipping information stored in their Amazon accounts, making transactions quicker and more convenient.

By integrating Amazon Pay, merchants can tap into Amazon’s extensive customer base, potentially increasing sales and customer trust. The service also provides robust security features, ensuring that personal and financial information remains protected during transactions.

In addition, Amazon Pay supports multiple currencies and offers a user-friendly interface, which contributes to its growing popularity among both consumers and businesses. Overall, it enhances the online shopping experience by bridging the gap between Amazon’s vast ecosystem and external retailers.

How to Choose the Right Payment Gateway for your Business?

When looking for a payment gateway for your business, it’s essential to understand the options available. There are numerous payment gateways in the US that cater to both in-person and online transactions. Start by identifying a payment processor that offers the best online payment solutions for your needs. Consider the variety of payment methods supported, as a payment platform that accommodates different options will provide a more seamless payment experience for your customers.

Research the top 10 payment gateways in the USA to find the popular payment gateway that aligns with your business model. Look for a payment gateway that supports features like secure payment information to a payment processor and reliable service. Additionally, investigate how much gateways charge for transactions, as this can impact your bottom line. Ultimately, selecting the best suit for your business involves evaluating both functionality and cost-effectiveness to ensure you find the best option available.

Supported Payment Types

Supported payment types are crucial for businesses looking to enhance their online payment gateway capabilities. When choosing a payment gateway, it’s essential to consider the different payment methods available, as they can significantly impact customer experience. A reliable payment solution should connect customers to a payment provider’s servers efficiently while ensuring security through a secure payment gateway. The best payment gateway options typically offer a comprehensive array of features tailored to best suit your needs, especially for small businesses.

In the USA, there are around 10 payment gateways that stand out for their performance and reliability. Solutions like the Payflow payment gateway and other best online payment gateways enable smooth transactions, making it easier for businesses to operate. Whether you need a payment gateway for e-commerce or service-based models, it’s vital to evaluate how these payment gateways work to ensure they meet your operational requirements. An ideal payment gateway will streamline your payment process, allowing you to focus on growth.

Secure Transactions

Secure transactions are vital in today’s digital landscape, where the exchange of sensitive information is commonplace. To ensure utmost security, businesses must implement a variety of strategies aimed at protecting user data and preventing fraud. One fundamental measure is the use of encryption, which transforms sensitive information into unreadable code, making it nearly impossible for unauthorized parties to access it.

In addition to encryption, employing multi-factor authentication adds another layer of protection by requiring users to verify their identity through multiple methods before completing a transaction. Furthermore, regularly updating software and security protocols can help guard against emerging threats. It’s also essential for organizations to educate their employees and customers about recognizing phishing attempts and other common scams.

By prioritizing these measures, businesses can create a more secure environment for online transactions, instilling confidence in their customers and safeguarding their assets.

Hosted or Direct Payment Method

When it comes to online transactions, there are two primary types of payment gateways: hosted and direct. A hosted payment gateway redirects customers to a secure third-party site to complete their transactions. This method ensures that sensitive information, such as credit card details, is handled by the payment processor, reducing the merchant’s liability for data breaches.

On the other hand, a direct payment gateway allows customers to enter their payment information directly on the merchant’s website. This method provides a seamless shopping experience, as users do not leave the site during the transaction process. However, it requires merchants to maintain strict security measures to protect sensitive customer data, as they are responsible for handling this information.

Ultimately, the choice between a hosted or direct payment gateway depends on the merchant’s business model, customer experience priorities, and their ability to manage data security effectively. Each option has its advantages and considerations, making it essential to evaluate them carefully.

Conclusion

NOWPayments stands out as the top choice among payment gateways for businesses looking to embrace cryptocurrency payments. With its cutting-edge features and user-centric design, NOWPayments offers several advantages over competitors:

1. Unmatched Cryptocurrency Support: NOWPayments supports over 300 cryptocurrencies, providing businesses with the flexibility to accept payments in a wide variety of digital currencies, appealing to a broader customer base.

2. Low Transaction Fees: Unlike many other payment gateways, NOWPayments offers competitive transaction fees, allowing businesses to maximize their profits while offering customers affordable and convenient payment options.

3. Strong Security and Customer Support: NOWPayments employs advanced encryption and security protocols to protect financial data, and its dedicated customer support ensures quick assistance with any issues.

With these key benefits, NOWPayments is an ideal solution for businesses looking to integrate cryptocurrency payments smoothly and stay ahead in the evolving digital finance landscape.