A payment gateway is a technology that enables businesses to accept online payments securely by transmitting transaction data from the customer to the payment processor. It is an essential component of the e-commerce ecosystem, facilitating secure and efficient digital payments.

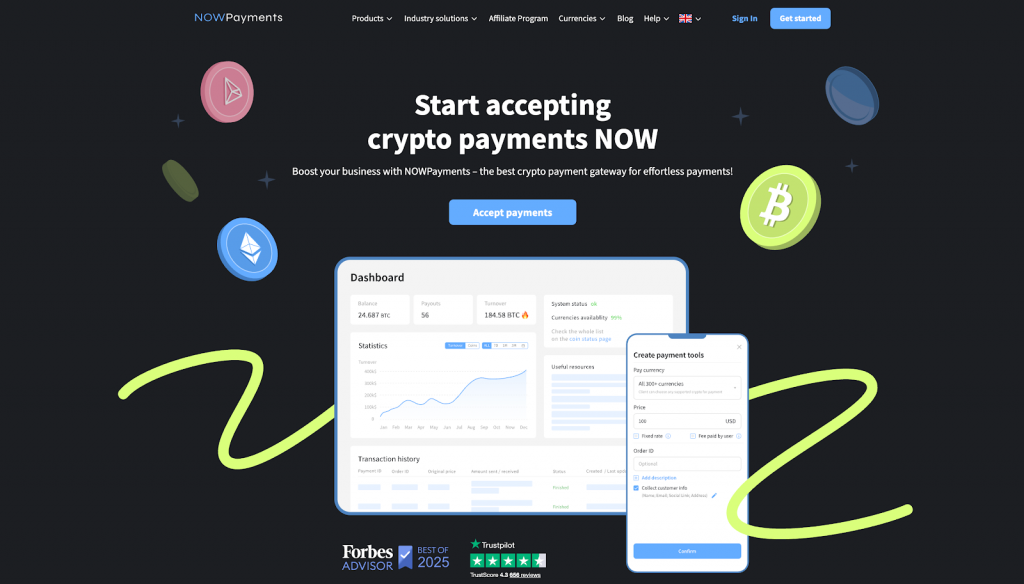

The best payment gateway in Indonesia in our rating is NOWPayments, due to its ability to support a wide range of cryptocurrencies, low transaction fees, and seamless integration with various payment options. This solution offers businesses in Indonesia a reliable, secure, and efficient way to process payments online, making it a top choice for those looking to expand their payment methods and improve the overall payment experience.

Choosing the right payment gateway in Indonesia is crucial in 2026, especially with the rapid growth of digital transactions and e-commerce. A reliable payment gateway helps businesses accept payments securely and efficiently while providing access to a variety of local and international payment methods. Moreover, as the landscape of digital payments in Indonesia continues to evolve, businesses need to select a payment gateway provider that can support both traditional payment methods like bank transfers and modern solutions such as mobile wallets and cryptocurrencies. With the right payment gateway solution, businesses in Indonesia can enhance their payment processing, offer a better customer experience, and stay competitive in the digital payment ecosystem.

Here’s a list of payment gateways in Indonesia:

- NOWPayments

- Xendit

- Doku

- iPay88

- 2Checkout

What We Considered When Choosing the Best Payment Gateway: Our Selection Criteria

Our goal in creating an unbiased comparison of the best payment gateways for businesses in Indonesia is to focus on the features most critical for local merchants. We carefully evaluated key aspects that impact payment processing, customer satisfaction, and security to ensure businesses in Indonesia can offer the best payment options to their customers.

The three most relevant criteria for choosing the best payment gateway in Indonesia are:

- Geo-Specific Suitability: Crucial for local customer acceptance, ensuring the payment gateway supports popular payment methods like bank transfers and integrates seamlessly with Indonesia’s local payment systems. It also ensures compliance with regulations from Bank Indonesia and other financial authorities.

- Fee Structure & Transparency: Directly influences the overall payment experience for merchants in Indonesia. A reliable payment gateway should offer competitive transaction fees, which are critical for businesses looking to optimize their payment processing and reduce costs.

- Security & Compliance: Non-negotiable for building trust and maintaining secure payment processing. The right payment gateway must meet local and international security standards, ensuring safe transactions for both merchants and customers.

The comparative table below summarizes how each gateway performs in these three decisive categories, which we will explore in detail for each provider.

| Payment Gateway | Supported payment options | Transaction Fee | Security measures |

| NOWPayments | Cryptocurrencies (350+), Credit/Debit Cards | 0.5-1% | PCI DSS Compliance, Non-Custodial (custodial option available), Secure Payment Processing |

| Xendit | Credit/Debit Cards, Bank Transfers, E-wallets | 1.8% – 3.0% | PCI DSS Compliance, 3D Secure, Fraud Detection |

| Doku | Credit/Debit Cards, Bank Transfers, E-wallets | 1.5% – 3.5% | PCI DSS Compliance, 3D Secure, Fraud Prevention |

| iPay88 | Credit/Debit Cards, Bank Transfers, E-wallets | 1.5% – 3.0% | PCI DSS Compliance, Secure Encryption |

| 2Checkout | Credit/Debit Cards, PayPal, Bank Transfers | 2.9% + $0.30 (for international payments) | PCI DSS Compliance, Secure Encryption, Fraud Protection |

NOWPayments

NOWPayments is the best crypto payment gateway in Indonesia, offering businesses the ability to accept a wide range of cryptocurrencies along with traditional payment methods. With over 350 supported cryptocurrencies, it is an ideal solution for businesses that want to tap into the growing digital payments landscape in Indonesia. The platform also provides a seamless and secure payment gateway solution with low transaction fees, making it an attractive choice for businesses looking to offer a variety of payment methods to their customers. As a leading payment gateway, NOWPayments delivers a comprehensive payment processing system tailored to meet the needs of modern merchants.

Supported Payment Options. NOWPayments offers a range of payment methods that include over 350 cryptocurrencies, making it one of the top payment gateways for crypto transactions in Indonesia. It also supports credit and debit card payments, providing businesses with a flexible solution for their diverse customer base. This variety of payment options ensures that businesses can offer customers their preferred payment method, enhancing the overall payment experience. As businesses in Indonesia seek to expand their digital payment options, NOWPayments delivers a comprehensive and reliable payment gateway provider solution.

| Payment Method | Accept | Withdraw |

|---|---|---|

| Cryptocurrency | ✅ | ✅ |

| Credit/Debit Cards | ✅ | ✅ |

Transaction Fee. NOWPayments stands out as one of the most affordable payment gateway providers in Indonesia, with a low transaction fee of just 0.5% for crypto payments. This fee structure ensures businesses can keep payment processing costs down while offering a range of payment methods. Additionally, there are no setup or monthly fees, making NOWPayments an excellent choice for businesses in Indonesia looking for an efficient and cost-effective solution. By choosing the right payment gateway with transparent pricing, businesses can save significantly on payment transaction costs.

| Fee Type | Amount |

|---|---|

| Transaction Fee | 0.5% |

Security Measures. NOWPayments ensures secure payment processing with its PCI DSS compliance and non-custodial system, where merchants retain full control over their funds. This security model minimizes the risks associated with online transactions, providing businesses with peace of mind. The option for custodial services is also available upon request, offering further flexibility to merchants who prefer a different setup. With secure payment processing at its core, NOWPayments remains a reliable and trusted payment gateway provider in Indonesia.

| Security Aspect | Status |

|---|---|

| Fund Control | Non-Custodial (Custodial option available) |

| Compliance | PCI DSS Compliance |

| Fraud Protection | Advanced Security |

Xendit

Xendit is a leading payment gateway provider in Indonesia, offering businesses a comprehensive payment solution for both local and international payments. This payment gateway solution stands out for its seamless integration with popular e-commerce platforms and its support for a range of local payment methods such as bank transfers, GoPay, and OVO. Xendit’s popularity in the Indonesian payment landscape is driven by its ability to offer both global payment options and a variety of local payment methods, catering to businesses that require flexible payment solutions. Whether you’re accepting payments from local or international customers, Xendit offers a robust payment processing service.

Supported Payment Options. Xendit excels in providing businesses with multiple payment methods, including credit/debit cards, local bank transfers, and e-wallets like GoPay and OVO, which are preferred payment methods for Indonesian consumers. This wide range of payment options ensures that businesses can cater to various customer preferences and expand their customer base. By supporting both local and international payments, Xendit allows businesses in Indonesia to offer a seamless payment experience for all customers. This flexibility makes Xendit a preferred choice for businesses that want to offer multiple payment options.

| Payment Method | Accept | Withdraw |

|---|---|---|

| Credit/Debit Cards | ✅ | ✅ |

| Bank Transfers | ✅ | ✅ |

| E-wallets | ✅ | ✅ |

Transaction Fee. Xendit offers transparent transaction fees that range from 1.8% to 3.0%, depending on the payment method used. Bank transfers generally incur lower fees, making them a more cost-effective payment option for businesses in Indonesia. The transparent pricing structure helps businesses understand and manage their payment costs effectively. By offering competitive transaction fees and a range of payment options, Xendit ensures that businesses can provide a seamless and affordable payment experience.

| Fee Type | Amount | Note |

|---|---|---|

| Transaction Fee | 1.8% – 3.0% | Depending on payment method |

Security Measures. Xendit provides secure payment processing with PCI DSS compliance and 3D Secure authentication, which are essential for safeguarding customer data. The gateway also uses advanced fraud detection systems to identify and prevent unauthorized transactions. With these security features in place, businesses can confidently accept payments without compromising the safety of their customers’ information. By choosing Xendit as a payment gateway provider in Indonesia, businesses benefit from robust security measures that protect both merchants and customers.

| Security Aspect | Status |

|---|---|

| Fund Control | Merchant’s control |

| Compliance | PCI DSS Compliance |

| Fraud Protection | Advanced Security |

Doku

Doku is a prominent Indonesian payment gateway solution that offers businesses various local and international payment methods. With its deep integration into the Indonesian financial ecosystem, Doku provides businesses with an easy way to accept payments via bank transfers, credit cards, and e-wallets. What distinguishes Doku is its tailored focus on Indonesian payment methods, allowing businesses to cater specifically to local customer preferences. Doku offers Indonesian companies a dependable and secure payment gateway solution for both local and international payments.

Supported Payment Options. Doku supports various payment options, including popular Indonesian payment methods like bank transfers, GoPay, and OVO. This flexibility ensures businesses can accept payments from a wide range of customers, offering them various preferred payment options. By also supporting international payment methods like credit cards, Doku provides a comprehensive payment gateway solution that meets the diverse needs of its users. This variety of payment methods enhances the payment experience for both businesses and customers in Indonesia.

| Payment Method | Accept | Withdraw |

|---|---|---|

| Credit/Debit Cards | ✅ | ✅ |

| Bank Transfers | ✅ | ✅ |

| E-wallets | ✅ | ✅ |

Transaction Fee. Doku’s transaction fees are competitive within the Indonesian payment ecosystem, with rates ranging from 1.5% to 3.5% depending on the payment method. For businesses that rely heavily on bank transfers, Doku offers lower fees, making it a cost-effective choice. The transparent and competitive fee structure ensures that businesses can accurately estimate their payment costs. Doku’s affordable pricing makes it a top payment gateway in Indonesia for businesses looking to minimize payment transaction expenses.

| Fee Type | Amount | Note |

|---|---|---|

| Transaction Fee | 1.5% – 3.5% | Depending on payment method |

| Monthly Fee | ❌ | None |

| Setup Fee | ❌ | None |

Security Measures. Doku is PCI DSS compliant, ensuring that all transactions are processed securely and in accordance with international standards. The platform uses encryption to protect sensitive payment information and offers fraud prevention tools to detect and block fraudulent transactions. By integrating 3D Secure, Doku adds an extra layer of protection for credit card payments. These security measures make Doku a trusted and reliable payment provider for businesses in Indonesia.

| Security Aspect | Status |

|---|---|

| Fund Control | Merchant’s control |

| Compliance | PCI DSS Compliance |

| Fraud Protection | Advanced Security |

iPay88

iPay88 is a popular payment gateway provider in Southeast Asia, offering a robust and reliable payment solution for businesses in Indonesia. Known for its ease of integration with local e-commerce platforms, iPay88 supports a range of payment options, including credit cards, bank transfers, and local e-wallets. iPay88 stands out for its strong security features and its focus on providing businesses with a seamless payment experience. For businesses in Indonesia, iPay88 provides a comprehensive payment gateway solution designed to support the local payment ecosystem.

Supported Payment Options. iPay88 supports a wide variety of payment methods, including credit and debit cards, bank transfers, and local e-wallets such as GoPay. This broad range of payment options ensures that businesses in Indonesia can cater to the diverse needs of their customers. The ability to accept both local and international payments makes iPay88 a top choice for businesses looking to offer a flexible payment solution. By choosing iPay88, businesses can provide their customers with an extensive set of payment methods.

| Payment Method | Accept | Withdraw |

|---|---|---|

| Credit/Debit Cards | ✅ | ✅ |

| Bank Transfers | ✅ | ✅ |

| E-wallets | ✅ | ✅ |

Transaction Fee. iPay88’s transaction fees vary depending on the payment method used, with rates typically ranging from 1.5% to 3.0%. This pricing model ensures that businesses can manage their payment costs effectively, depending on the payment method preferred by their customers. Bank transfers and e-wallet payments tend to have lower fees, which can be more cost-effective for businesses operating in Indonesia. With iPay88, businesses can provide a cost-efficient payment solution while keeping transaction expenses in check.

| Fee Type | Amount | Note |

|---|---|---|

| Transaction Fee | 1.5% – 3.0% | Depending on payment method |

Security Measures. iPay88 is PCI DSS compliant, ensuring secure payment processing for all types of transactions. The platform uses strong encryption to protect sensitive data and offers fraud detection systems to monitor for suspicious activities. By integrating with 3D Secure, iPay88 adds an additional layer of protection for credit card transactions, ensuring the safety of both businesses and customers. These security features make iPay88 a trusted payment provider for businesses in Indonesia.

| Security Aspect | Status |

|---|---|

| Fund Control | Merchant’s control |

| Compliance | PCI DSS Compliance |

| Fraud Protection | Advanced Security |

2Checkout

2Checkout is a global payment gateway provider that offers a comprehensive solution for businesses in Indonesia. With support for credit cards, PayPal, and bank transfers, 2Checkout enables businesses to accept payments from international and local customers. Its flexibility in supporting various payment methods makes it a top payment gateway for businesses looking to expand their reach. With robust security features and fraud protection, 2Checkout provides businesses in Indonesia with a reliable and secure way to process payments.

Supported Payment Options. 2Checkout supports a variety of payment methods, including credit cards, PayPal, and bank transfers. This extensive range of payment options ensures that businesses can cater to both local and international customers, providing a seamless payment experience. By accepting global payment methods, 2Checkout helps businesses expand their customer base and facilitate international transactions. This variety of payment options makes 2Checkout an ideal payment gateway provider for businesses looking to enhance their payment processing systems.

| Payment Method | Accept | Withdraw |

|---|---|---|

| Credit/Debit Cards | ✅ | ✅ |

| PayPal | ✅ | ✅ |

| Bank Transfers | ✅ | ✅ |

Transaction Fee. 2Checkout’s transaction fees are 2.9% + $0.30 for international payments, with lower fees for local transactions. This transparent fee structure ensures that businesses can easily calculate their payment costs. The platform offers competitive pricing, making it a suitable option for businesses that handle a large volume of transactions. By offering clear and predictable pricing, 2Checkout helps businesses manage their payment processing costs effectively.

| Fee Type | Amount | Note |

|---|---|---|

| Transaction Fee | 2.9% + $0.30 | For international payments |

Security Measures. 2Checkout ensures secure payment processing with PCI DSS compliance, using encryption to protect payment information. The platform also integrates fraud protection tools and 3D Secure authentication for credit card payments. These security features ensure that businesses and customers are protected from fraud and unauthorized transactions. With its advanced security infrastructure, 2Checkout is a trusted payment provider for businesses in Indonesia.

| Security Aspect | Status |

|---|---|

| Fund Control | Merchant’s control |

| Compliance | PCI DSS Compliance |

| Fraud Protection | Advanced Security |

Final Thoughts

In this article, we have analyzed the main payment gateways available for businesses in Indonesia, specifically focusing on the needs of local merchants and customers. The gateways reviewed include NOWPayments, Xendit, Doku, iPay88, and 2Checkout. Each of these payment solutions offers a variety of payment options and features tailored to different business needs, but NOWPayments stands out as the best choice for businesses looking to embrace digital payments in Indonesia.

NOWPayments is the ideal payment gateway for forward-thinking businesses in Indonesia, particularly those looking to accept cryptocurrencies alongside traditional payment methods. Its key advantages include its low 0.5% transaction fee for cryptocurrency payments, its comprehensive support for over 350 cryptocurrencies, and its secure, non-custodial system that ensures businesses maintain control over their funds. With no setup or monthly fees and robust security measures, NOWPayments provides businesses with a flexible, cost-effective, and secure solution for managing their digital transactions.