A payment gateway is a technology that enables businesses to accept online payments securely, processing transactions and facilitating smooth financial exchanges between customers and merchants. It plays a crucial role in ensuring seamless payments, helping businesses manage various payment methods like credit cards, PayPal, and mobile payment options. In Israel, with its growing e-commerce ecosystem, businesses need robust payment solutions that allow them to accept payments from local and international consumers. As Israelis increasingly prefer digital and mobile payment methods, selecting a payment gateway with seamless integration and reliability is critical for businesses.

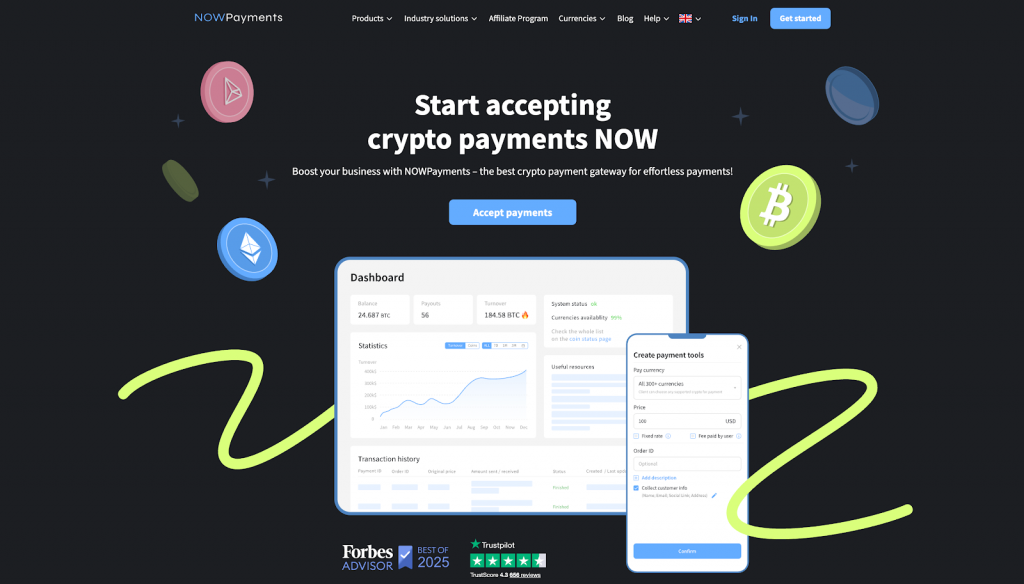

The best payment gateway for Israel in our rating is NOWPayments because it provides seamless integration, low transaction fees, and a broad range of payment options, including cryptocurrencies. This payment gateway supports a variety of payment methods, allowing Israeli merchants to accept payments from customers worldwide, including through credit cards, PayPal, and mobile payment apps. NOWPayments stands out for its ability to process cross-border e-commerce transactions with ease, offering support for multiple currencies and ensuring a smooth purchase process. Its user-friendly API and mobile device compatibility make it an attractive choice for startups and established companies in Israel.

Choosing the right payment gateway matters more than ever in 2026 for businesses in Israel. With the increasing adoption of mobile payments, digital wallets, and e-commerce, businesses must have access to a payment solution that can handle diverse payment methods like Visa, Mastercard, and bank transfers. Additionally, Israeli businesses are facing the challenge of adapting to consumer preferences for faster and more convenient checkout experiences, particularly in cross-border e-commerce. The demand for contactless payment options and automation in payment processing is growing, and businesses need to select a gateway that supports these trends.

Here’s a list of payment gateways for Israel:

- NOWPayments

- Tranzila

- Allpay

- Shift4

- Maxpay

What We Considered When Choosing the Best Payment Gateway: Our Selection Criteria

In creating an unbiased comparison of payment gateways for businesses in Israel, our goal was to focus on the features that are most critical to local merchants in the ever-evolving digital payments landscape. By evaluating each gateway based on these key criteria, we aimed to help businesses select the solution that best meets their specific needs and objectives in Israel’s dynamic market.

- Supported Payment Methods: Essential for businesses to accept a broad range of payment options, including credit cards, mobile payments, and cryptocurrencies, ensuring flexibility for both local and international customers.

- Transaction Fees: Directly impacts profitability and is a key factor for businesses seeking cost-effective solutions, especially in a competitive market like Israel.

- Custody: Non-negotiable for ensuring the security and control over funds, as well as adhering to local financial regulations, particularly in Israel’s highly regulated payment landscape.

The comparative table below summarizes how each gateway performs in these three decisive categories, which we will explore in detail for each provider.

| Payment Gateway | Supported Payment Methods | Transaction Fees | Custody |

| NOWPayments | 350 + crypto & 40+ fiat payment tools (API/plugins) for crypto checkout and invoicing | 0.5 % service fee per transaction; 1 % if conversion is needed (plus network blockchain fees) | Non‑custodial by default; custody is optional on request |

| Tranzila | Credit cards, PayPal, and bank direct debits; supports clearing via virtual stores, mobile/tablet terminals | Typical card processing, clearing fees applied | Custodial settlement |

| Allpay | Israeli & international credit and debit cards (Visa, Mastercard, AmEx, etc.) + payment links; Apple Pay/Bit | ~1.45 % domestic card fees; ~3.65 % international card fees; monthly subscription ~50 ₪; withdrawal fees apply | Custodial settlement |

| Finaro | Credit & debit cards (Visa, Mastercard, AmEx), mobile wallets (Apple Pay/Google Pay) via PaymentsOS integrations | Contract-based fee structure, typically merchant acquirer fees + gateway fees; varies by region and volume. | Custodial settlement |

| Maxpay | Major credit & debit cards plus alternative payment methods (via API integration) with PCI DSS support | Standard processing fees + risk management. | Custodial settlement |

NOWPayments

NOWPayments is the best crypto payment gateway that provides businesses in Israel with the ability to accept a variety of payment methods, especially cryptocurrencies. This payment solution allows Israeli merchants to offer multiple payment options for their customers, including popular digital currencies like Bitcoin, Ethereum, and stablecoins such as USDT. With a seamless integration process, businesses can easily add NOWPayments to their e-commerce platforms to streamline their payment processing and enhance the payment experience. Its low transaction fees, which start at just 0.5%, allow businesses to reduce their payment processing costs while still offering flexible and secure payment methods.

Supported Payment Methods. NOWPayments supports over 350 cryptocurrencies, including popular options like Bitcoin, Ethereum, and stablecoins, as well as 40+ fiat options. This broad range of supported payment methods is crucial for Israeli businesses looking to accept payments from both local customers and global shoppers. The ability to accept cryptocurrencies alongside traditional payment methods such as Visa and Mastercard allows businesses to cater to the diverse payment preferences of their customers. Additionally, NOWPayments provides easy integration with e-commerce platforms, allowing businesses to set up crypto payments in just a few steps. This flexibility in payment options ensures that Israeli merchants can handle a variety of online transactions, increasing their potential to reach new customers.

| Payment Method | Accept | Withdraw |

| Cryptocurrency | ✅ | ✅ |

| Credit/Debit Cards | ✅ | ✅ |

Transaction Fees. NOWPayments offers low transaction fees, starting at just 0.5% for cryptocurrency payments and 1% for conversions from crypto to fiat. This pricing structure is ideal for Israeli merchants who want to reduce their payment processing costs while still providing customers with multiple payment options. There are no setup or monthly fees, allowing businesses to scale without worrying about high fixed costs. The platform’s transparent pricing ensures businesses are fully aware of the fees they will incur, which helps with budgeting and planning. For cross-border transactions, NOWPayments handles the currency conversion at minimal fees, making it an excellent choice for international e-commerce purchases.

| Fee Type | Amount | Note |

| Transaction Fee | 0.5% | For crypto payments |

| Conversion Fee | 1.0% | For crypto-to-fiat conversion |

Custody. NOWPayments operates as a non-custodial payment gateway, meaning merchants retain full control over their funds at all times. In the traditional payment gateway model, funds are often held by the gateway provider before being transferred to the merchant’s bank, which can create delays and potential security concerns. By sending payments directly to the merchant’s wallet, NOWPayments eliminates this risk, enabling merchants in Israel to access their funds almost instantly. Custody options are also available at the merchant’s request for those who prefer to have the platform manage their funds.

| Security Aspect | Status |

| Fund Control | Merchant’s Wallet |

| Access Speed | Instant |

| Custodial Model | Non-Custodial + Custodial |

Tranzila

Tranzila is a trusted Israeli payment gateway that supports various payment methods, including credit cards, PayPal, and mobile payments. It provides businesses in Israel with a seamless and secure payment process, handling both local and international payments efficiently. Tranzila integrates well with Israeli banks and is compliant with local financial regulations, making it an excellent choice for businesses operating in Israel. With its flexible pricing and reliable transaction processing, Tranzila allows businesses to cater to the growing demand for diverse payment options, enhancing the customer payment experience.

Supported Payment Methods. Tranzila supports a wide range of payment methods, including Visa, Mastercard, PayPal, and bank transfers, ensuring that Israeli businesses can accept payments from a variety of sources. The gateway also supports mobile payments, which is increasingly important for businesses looking to offer contactless payment options. Tranzila’s broad array of accepted payment methods allows merchants to cater to both local Israeli customers and international shoppers. By offering these payment options, businesses can enhance their payment experience and increase their ability to process a variety of online transactions.

| Payment Method | Accept | Withdraw |

| Cryptocurrency | ❌ | ❌ |

| Credit/Debit Cards | ✅ | ✅ |

Transaction Fees. Tranzila’s transaction fees are competitive and vary depending on the payment method and agreement with the merchant. Typically, credit card payments incur fees between 1.5% to 3%, which is standard for payment gateways in Israel. For international payments, fees are slightly higher, particularly for cross-border transactions. There are no monthly or setup fees for merchants using Tranzila’s services, but some additional fees may apply depending on the type of transaction. Overall, Tranzila offers competitive fees, especially for Israeli merchants processing payments in shekels.

| Fee Type | Amount | Note |

| Transaction Fee | 1.5-3% | For card payments |

| Setup Fee | ❌ | None |

Custody. Tranzila operates as a custodial payment gateway, meaning it temporarily holds funds during the payment process before transferring them to the merchant’s bank account. This model is typical for most traditional payment gateways and provides a smooth payment process by handling the complexity of transaction settlements. Businesses benefit from Tranzila’s experience in managing the security and compliance aspects of payment processing. However, this means merchants do not have direct control over their funds during the processing phase.

| Security Aspect | Status |

| Fund Control | Tranzila Custody |

| Access Speed | 1-3 business days |

| Custodial Model | Custodial |

Allpay

Allpay is a versatile payment gateway that provides secure payment processing solutions for Israeli businesses. The platform supports a variety of payment methods, including credit cards, digital wallets like PayPal, and mobile payments, which allows businesses to cater to different customer preferences. With its transparent pricing structure and seamless integration, Allpay makes it easy for Israeli merchants to accept payments online and in-store. Its ability to handle both local and international payments, along with its focus on data security, makes Allpay a reliable choice for businesses looking to expand their payment options and improve their payment experience.

Supported Payment Methods. Allpay supports a range of payment methods, including major credit and debit cards (Visa, Mastercard), PayPal, and mobile payment apps like Apple Pay. The ability to accept a wide variety of payment options helps businesses in Israel meet the diverse preferences of their customers. Allpay’s integration with digital wallets and mobile payment solutions makes it ideal for businesses looking to offer a contactless payment experience. Additionally, the platform allows businesses to accept payments via payment links, which is a convenient option for both online and offline transactions.

| Payment Method | Accept | Withdraw |

| Cryptocurrency | ❌ | ❌ |

| Credit/Debit Cards | ✅ | ✅ |

Transaction Fees. Allpay offers competitive pricing with a 1.45% fee for domestic credit card payments and a higher 3.65% fee for international transactions. The platform also charges a small monthly subscription fee, typically around 50 ILS, which helps businesses manage their payment processing costs. While the fees for international transactions may be higher, Allpay’s transparent pricing ensures that Israeli merchants understand the costs associated with each payment type. By offering competitive fees for domestic transactions, Allpay provides a cost-effective solution for businesses that primarily deal with local customers.

| Fee Type | Amount | Note |

| Transaction Fee | 1.45% | For domestic cards |

| International Fee | 3.65% | For international cards |

Custody. Allpay operates under a custodial model, meaning it temporarily holds funds during the payment process before transferring them to the merchant’s bank account. This approach helps streamline the payment process by ensuring that funds are safely held and securely transferred to the merchant. As with most traditional payment gateways, this custodial model ensures that businesses can rely on Allpay to manage the settlement and compliance aspects of payments. For businesses in Israel, this model provides reassurance that payments are handled according to local financial regulations.

| Security Aspect | Status |

| Fund Control | Allpay Custody |

| Access Speed | 1-3 business days |

| Custodial Model | Custodial |

Shift4

Shift4 is a global payment gateway specializing in cross-border payment processing for businesses of all sizes. The platform supports a broad range of payment methods, including credit and debit cards, PayPal, and mobile wallets, making it an ideal solution for international e-commerce businesses. Shift4 distinguishes itself with robust fraud protection tools and compliance with global financial regulations, ensuring secure and reliable transactions. The ability to handle payments in multiple currencies, including the Israeli shekel, and process cross-border payments makes Shift4 a top choice for Israeli merchants looking to expand internationally.

Supported Payment Methods. Shift4 supports a wide array of payment methods, including Visa, Mastercard, PayPal, and mobile wallets like Apple Pay and Google Pay. The platform is designed to help businesses accept payments globally, including cross-border payments in multiple currencies, which is essential for international transactions. Shift4 is particularly advantageous for businesses operating in Israel that want to support both local payment methods and global solutions. By offering a variety of payment options, Shift4 enables businesses to stay competitive in the increasingly digital and mobile payment ecosystem.

| Payment Method | Accept | Withdraw |

| Cryptocurrency | ❌ | ❌ |

| Credit/Debit Cards | ✅ | ✅ |

Transaction Fees. Shift4’s transaction fees vary based on merchant agreements and volume, with higher fees for international payments and cross-border transactions. While specific fees are not always disclosed upfront, businesses can expect transparent pricing based on the payment method and risk level. The platform’s fee structure also includes acquiring fees, foreign exchange fees, and processing fees for international transactions. Shift4’s ability to customize pricing based on merchant volume makes it an appealing option for businesses in Israel that handle both local and cross-border e-commerce.

| Fee Type | Amount | Note |

| Transaction Fee | Varies | Based on agreement |

| International Fee | Higher | For cross-border transactions |

Custody. Shift4 operates with a custodial model, temporarily holding funds during processing before transferring them to the merchant’s account. This ensures that businesses can rely on Shift4 to handle the complexities of fraud prevention, currency conversion, and regulatory compliance. The temporary hold allows Shift4 to mitigate risks and protect both the merchant and the consumer. For businesses in Israel, this model ensures compliance with local payment regulations while allowing for secure and efficient payments.

| Security Aspect | Status |

| Fund Control | Shift4 Custody |

| Access Speed | 1-2 business days |

| Custodial Model | Custodial |

Maxpay

Maxpay is a global payment gateway offering comprehensive payment solutions for e-commerce businesses worldwide. Known for its ability to handle multiple payment methods, including credit cards, PayPal, and mobile wallets, Maxpay ensures that businesses can accept payments in various currencies. The platform also offers advanced fraud detection tools, ensuring the security of both merchants and consumers during transactions. Maxpay’s flexible pricing and strong focus on cross-border payment processing make it an ideal solution for Israeli merchants looking to expand their international reach.

Supported Payment Methods. Maxpay supports a wide range of payment methods, including Visa, Mastercard, PayPal, and alternative payment options, giving businesses the flexibility to cater to a broad range of customers. By supporting multiple currencies, including the Israeli shekel, Maxpay makes it easy for Israeli businesses to process international payments. Additionally, Maxpay offers support for mobile payments, which allows businesses to cater to the growing demand for contactless payment methods. This flexibility ensures that businesses can meet customer expectations, whether they are local Israelis or global shoppers.

| Payment Method | Accept | Withdraw |

| Cryptocurrency | ❌ | ❌ |

| Credit/Debit Cards | ✅ | ✅ |

Transaction Fees. Maxpay’s transaction fees vary based on the merchant’s agreement, volume, and risk level. The fee structure includes processing fees, risk management fees, and additional charges for international transactions. While the exact fees are not always publicly disclosed, Maxpay is known for providing flexible pricing based on individual merchant needs. This allows businesses in Israel to tailor their payment processing costs according to their specific volume and requirements.

| Fee Type | Amount | Note |

| Transaction Fee | Varies | Based on merchant agreement |

| Risk Management Fee | Varies | Depends on agreement |

Custody. Maxpay operates under a custodial model, temporarily holding funds during the transaction process before transferring them to the merchant’s account. This ensures that businesses receive payments securely and comply with global regulations. The custodial model also allows Maxpay to offer additional services, such as fraud protection and chargeback management, providing a layer of security for both merchants and customers. For businesses in Israel, this model ensures that payments are processed securely and efficiently, reducing the complexity of international transactions.

| Security Aspect | Status |

| Fund Control | Maxpay Custody |

| Access Speed | 1-3 business days |

| Custodial Model | Custodial |

Final Thoughts

In this article, we have analyzed the main payment gateways that businesses in Israel can use to streamline their payment processes and enhance their e-commerce operations. The gateways reviewed include NOWPayments, Tranzila, Allpay, Shift4, and Maxpay. Each of these payment solutions offers unique features, but NOWPayments stands out as the top choice for businesses in Israel due to its comprehensive support for cryptocurrencies, low transaction fees, and seamless integration. NOWPayments allows businesses to accept both local and international payments with flexibility, including popular digital currencies and traditional payment methods like Visa and Mastercard.

NOWPayments is the optimal solution for forward-thinking businesses in Israel, offering the best combination of security, control, and ease of use. Its non-custodial model ensures that Israeli merchants retain full control over their funds, while custody options are also available at the merchant’s request. With low transaction fees, seamless integration, and the ability to handle cross-border payments, NOWPayments provides a versatile and future-proof payment solution. It is the best choice for businesses looking to accept payments in Israel and globally, ensuring a smooth, reliable payment process for both local and international customers.