A payment gateway is a piece of technology that lets businesses accept payments online while keeping customers and merchants safe. It links the buyer and seller, encrypts sensitive payment information, and makes sure that everything goes well.

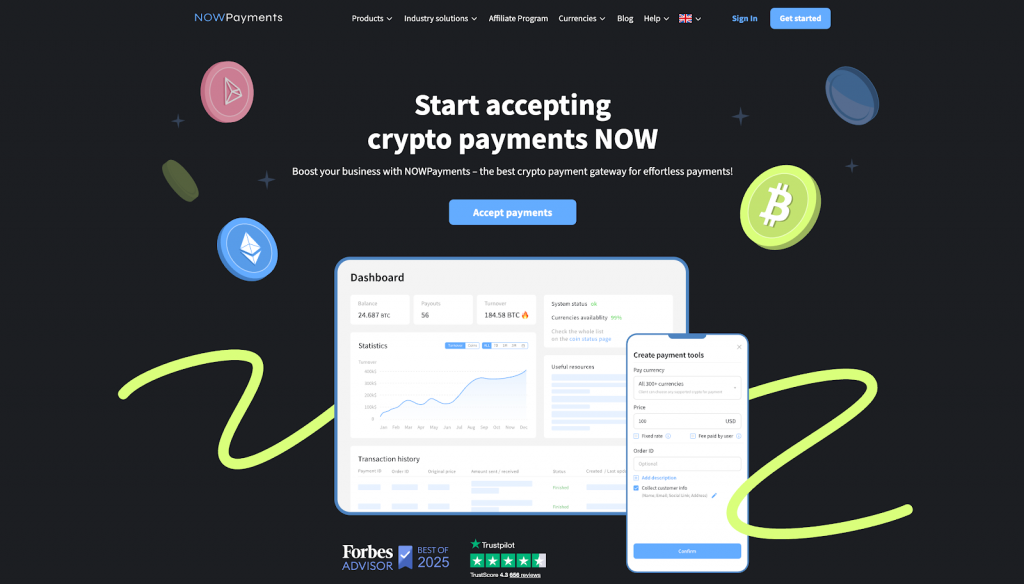

NOWPayments is our top choice for a crypto payment gateway in Ireland. It supports a lot of different cryptocurrencies and makes it easy to turn them into real money. This makes it a good choice for Irish businesses that want to use digital currencies. NOWPayments is also very secure and has low fees for transactions, which is important for businesses of all sizes in the country.

As digital currencies are becoming more popular, Irish businesses will need to pick the right payment gateway in 2026. Businesses need to get a payment gateway that can handle both crypto and regular payments as cryptocurrencies become more popular. Irish shoppers also want safe, quick, and varied ways to pay, like mobile payments and the ability to pay from other countries. As online shopping grows quickly in Ireland, businesses need a gateway that can handle more sales and give good support for sales in Ireland and around the world.

Here’s a quick list of the top payment gateways for Irish businesses:

- NOWPayments

- Stripe

- Rapyd

- Adyen

- Revolut Business

| Payment Gateway | Supported Payment Methods | Transaction Fees | Transaction Speed |

| NOWPayments | 350+ cryptocurrencies, cards, bank transfers | 0.5% to 1% | Confirmed in 45 secs – 5 mins |

| Stripe | Cards, digital wallets, 135+ currencies | 1.4% + €0.25 (EU), 2.9% + €0.25 (Non-EU) | 2-7 business days; Instant Payouts (30 mins) |

| Rapyd | Cards, wallets, bank transfers, 100+ currencies | 1% to 2% | 1-3 business days |

| Adyen | Cards, e-wallets, bank transfers, 150+ currencies | 1.8% + €0.12 (cards) | Instant payout ; 2-5 days |

| Revolut Business | Cards, bank transfers, 30+ currencies | 1% for crypto, 0.4% for card payments | 1 business day; Instant payout available |

NOWPayments

Irish businesses can trust NOWPayments as a payment gateway and online payment service. It lets businesses and online stores accept more than 350 cryptocurrencies and regular money by converting them to fiat. It can be a third-party payment provider or work with your merchant account and current payment systems to let you process payments online and in-store through multiple channels.

Supported Payment Methods. NOWPayments supports more than 350 cryptocurrencies, including Bitcoin, Ethereum, and stablecoins like USDT and USDC. It also accepts credit and debit cards, bank transfers, and other traditional forms of payment, which makes it easy for both crypto and fiat users to use. This wide range of payment options gives businesses more ways to help customers and makes it possible for more transactions to happen. It gives Irish businesses the freedom to choose the best way to pay their customers.

| Payment Method | On-ramp | Off-ramp |

| Fiat | ✅ | ✅ |

| Crypto | ❌ | ❌ |

Transaction Fees. With NOWPayments, the fees for transactions are low, between 0.5% and 1%, depending on the cryptocurrency used and whether the payment needs to be changed. There are no setup or monthly fees, so businesses only pay for what they use. This makes it affordable. This fee structure is good for both small and large businesses. Irish businesses can easily see how much it will cost because the fee structure is easy to understand.

| Fee Type | Amount |

| Transaction Fee | 0.5% to 1% |

| Monthly Fee | ❌ |

| Setup Fee | ❌ |

Transaction Speed. Payments on NOWPayments are confirmed in seconds, and if you use the non-custodial flow, the money is usually in the merchant’s wallet within five minutes. This helps businesses process payments quickly, which makes the customer experience better overall. Transactions are quick, so businesses can keep things running smoothly even when they have a lot of sales. People know that NOWPayments processes transactions very quickly.

| Speed Metric | Timeframe |

| Payment Confirmation | ~45 seconds |

| Settlement to Account | ~5 minutes |

Stripe

Stripe is a payment gateway that works all over the world, is easy to set up, and has a lot of great features. As Irish businesses grow, this is one of the best payment gateways for them to use. It can handle payments for both online stores and point-of-sale (POS) sales, and it works with more than 135 currencies. Stripe can handle subscription billing and payments that happen on a regular basis. It accepts credit and debit cards, digital wallets, and other forms of payment. It also keeps you safe from fraud, helps you follow PCI rules, and works with your checkout and merchant account. This makes it a trustworthy and adaptable choice for Irish businesses, and it also makes it easy for customers from other countries to see how much they will have to pay in transaction fees.

Supported Payment Methods. Stripe accepts a wide range of payment methods, including credit and debit cards, digital wallets like Apple Pay and Google Pay, and many local payment methods. It also accepts payments in more than 135 currencies, so it is a great choice for companies that want to sell to people all over the world. Stripe works with popular e-commerce sites like Shopify and WooCommerce to make it easier for businesses to accept payments. Offering customers a variety of payment options can help businesses give them a smooth and interesting experience.

| Payment Method | Accept | Withdraw |

| Credit/Debit Cards | ✅ | ✅ |

| Digital Wallets | ✅ | ✅ |

| Bank Transfer | ✅ | ✅ |

Transaction Fees. Stripe charges 1.4% + €0.25 for payments made with EU cards and 2.9% + €0.25 for payments made with cards from outside the EU. There are no setup or monthly fees, but payments made from outside the US cost more. Stripe also charges a set amount for each transaction, but it stays clear and simple for businesses. These low prices help businesses plan their budgets.

| Fee Type | Amount |

| Transaction Fee | 1.4% + €0.25 (EU), 2.9% + €0.25 (Non-EU) |

| Monthly Fee | ❌ |

| Setup Fee | ❌ |

Transaction Speed. Stripe processes transactions quickly, and you usually get confirmation of your payment right away. Stripe can take 2 to 7 business days to process regular transfers, but businesses can get their money right away if they have an eligible account. This flexibility lets businesses manage their cash flow. Stripe’s quick payment processing is great for businesses that work in fast-paced fields.

| Speed Metric | Timeframe |

| Payment Confirmation | Instant |

| Settlement to Account | 2-7 business days |

| Instant Payout | ✅ (within 30 minutes for eligible accounts) |

Rapyd

Rapyd is a payment gateway company that helps Irish businesses. It is an online payment gateway and a global payment gateway that lets businesses and online stores accept credit and debit card payments, debit card transactions, and a wide range of local and alternative payment methods. Rapyd can handle payments and processing in more than 100 currencies around the world. This makes it easy for people from other countries to pay with a card or another online payment method. The platform makes it easy to link up with big e-commerce sites, set up a merchant account, make a payment page, and process payments quickly.

Supported Payment Methods. Rapyd lets businesses accept a wide range of payment methods, including credit and debit cards, digital wallets, and local payment systems. It lets businesses take payments in over 100 currencies, which means they can reach customers all over the world. You can also send money through banks, which makes it a flexible choice for businesses that have customers with different needs. There are so many ways to pay that businesses can easily move into new markets.

| Payment Method | Accept | Withdraw |

| Credit/Debit Cards | ✅ | ✅ |

| Digital Wallets | ✅ | ✅ |

| Bank Transfer | ✅ | ✅ |

Transaction Fees. Rapyd’s transaction fees are between 1% and 2%, depending on how you pay. There are no monthly or setup fees, and the fees for changing money are lower than those of other platforms. Businesses can grow without having to worry about high fixed costs because these rates can change. Businesses know exactly what to expect from Rapyd’s prices.

| Fee Type | Amount | Note |

| Transaction Fee | 1% to 2% | Varies by method |

| Monthly Fee | ❌ | No monthly fee |

| Setup Fee | ❌ | No setup fee |

Transaction Speed. Rapyd processes payments quickly, and settlements usually happen within one to three business days. This lets businesses get money quickly, even when they are working with people in other countries. Businesses can keep their cash flow steady when settlements happen quickly. Businesses can run their operations smoothly thanks to the fast processing speeds.

| Speed Metric | Timeframe |

| Payment Confirmation | Instant |

| Settlement to Account | 1-3 business days |

Adyen

Adyen is a worldwide payment gateway and service provider that lets businesses and online stores accept a wide range of local payment methods, including credit and debit cards, bank transfers, and more. It can handle payments in more than 150 currencies from around the world. It also lets you process payments from all channels, whether the sale was made online or in a store.

Supported Payment Methods. Adyen takes a lot of different kinds of payments, like credit and debit cards, e-wallets, bank transfers, and payments made in the country where the business is located. It lets businesses take payments in over 150 different currencies, so it is a great choice for businesses that work all over the world. Businesses can reach more customers because the platform works with mobile wallets like Apple Pay and Google Pay. Adyen works with a lot of e-commerce sites, which makes it easy to check out.

| Payment Method | On-ramp | Off-ramp |

| Fiat | ✅ | ✅ |

| Crypto | ❌ | ❌ |

Transaction Fees. For card payments, Adyen charges 1.8% + €0.12. Other ways to pay cost more. It has good rates, especially for businesses that do a lot of business with people from other countries. This is a good choice for businesses of all sizes because there are no setup or monthly fees. Businesses can easily keep track of their costs with this clear fee structure.

| Fee Type | Amount |

| Transaction Fee | 1.8% + €0.12 |

| Monthly Fee | ❌ |

| Setup Fee | ❌ |

Transaction Speed. You can get your money right away with some payment methods, but most of the time, it takes 2 to 5 business days to settle. It processes transactions quickly, so businesses can get their money quickly. Companies have choices because they can choose between instant and regular payments. Adyen’s fast processing speeds help businesses keep better track of their money.

| Speed Metric | Timeframe |

| Payment Confirmation | Instant |

| Settlement to Account | 2-5 business days |

| Instant Payout | ✅ |

Revolut Business

Revolut Business is a company that helps Irish businesses pay for things online. It lets online stores accept card payments in more than 30 currencies (currencies and payment), supports credit and debit card processing, and lets customers pay with different types of money, like cryptocurrency. Revolut is a good choice for small online businesses that need a payment gateway or a new option because it has low fees, fast settlement, and the ability to manage transactions in real time.

Supported Payment Methods. With Revolut Business, you can pay with credit and debit cards, bank transfers, and digital wallets. Businesses can accept payments in more than 30 different currencies, and it also supports crypto payments. This gives them more ways to serve more customers. Getting started is easy because it works with popular platforms like Shopify and WooCommerce. Revolut is a great option for businesses in the digital age because it lets you pay in so many ways.

| Payment Method | On-ramp | Off-ramp |

| Fiat | ✅ | ✅ |

| Crypto | ✅ | ✅ |

Transaction Fees. Revolut Business charges reasonable fees. For instance, it charges 1% for payments made with cryptocurrency and 0.4% for payments made with a card. It also has low fees for international transactions, so businesses do not have to spend a lot of money to do business with people from other countries. There are no fees to set up, and businesses only pay for the services they use. Revolut’s simple pricing structure makes it easy to see how much it will cost to use.

| Fee Type | Amount |

| Transaction Fee | 1% for crypto, 0.4% for card payments |

| Monthly Fee | ❌ |

| Setup Fee | ❌ |

Transaction Speed. Revolut Business offers fast settlement, typically processing payments within 1 business day. The platform also provides instant payout options, allowing businesses to access their funds quickly. This feature ensures businesses can maintain efficient cash flow and quickly reinvest their profits. Revolut’s fast processing times make it an attractive option for businesses with high transaction volumes.

| Speed Metric | Timeframe |

| Payment Confirmation | Instant |

| Settlement to Account | 1 business day |

| Instant Payout | ✅ |

Final thoughts

In this article, we have explored the top payment gateways available for businesses in Ireland, including NOWPayments, Stripe, Rapyd, Adyen, and Revolut Business. Choosing the right payment gateway is crucial for Irish businesses looking to offer a wide range of payment methods, from credit card payments to cryptocurrency transactions, and to ensure payment security and payment data protection.

NOWPayments stands out as the best payment gateway solution in Ireland, offering businesses the ability to accept both crypto and fiat payments with low transaction fees and fast processing times. This payment gateway supports a wide range of payment methods and currencies, making it ideal for businesses that want to expand globally while providing seamless digital payment experiences. Whether you’re an online store or a physical retail operation, NOWPayments provides the most flexible, secure, and cost-effective online payment processing solution for businesses in Ireland. Its robust features, combined with seamless integration, make it the top choice for forward-thinking businesses that need a reliable and scalable payment processing solution to meet their payment processing needs. NOWPayments is the future-proof payment gateway that positions businesses in Ireland to thrive in the ever-evolving digital economy.