The iGaming industry, a rapidly evolving sector, has come a long way in the past few years. With advancements in technology and changing user preferences, iGaming businesses have had to adapt to the digital landscape and meet the diverse needs of their customers. A crucial aspect of this evolution is the way payments are processed. This article focuses on the iGaming payment processing landscape, discussing its challenges, and how businesses can navigate them effectively.

Understanding the iGaming Payment Landscape

Online gaming is a global industry, with customers spread across various countries and continents. As a result, iGaming businesses often have to deal with a complex web of local regulations, currency conversions, and diverse payment preferences.

To cater to these diverse needs, iGaming businesses need to offer a variety of payment methods, including credit cards, debit cards, e-wallets, and even cryptocurrencies. These payment methods need to be secure, fast, and convenient to ensure a smooth gaming experience for the users.

However, integrating multiple payment methods can be challenging for iGaming businesses. They need to navigate complex regulatory requirements, manage risks associated with online transactions, and ensure the security of customer data.

iGaming Payment Gateway Integration Services

A payment gateway is an essential component of the iGaming payment processing ecosystem. It facilitates secure and seamless transactions between the customer and the gaming platform. When choosing an iGaming payment gateway integration service, businesses need to consider several factors.

Firstly, the payment gateway should support a wide range of payment methods to cater to the diverse preferences of the customers. It should also offer global coverage to facilitate transactions in different currencies and regions.

Secondly, the payment gateway should ensure the security of the transactions. It should comply with the highest security standards, such as the Payment Card Industry Data Security Standard (PCI DSS), and incorporate advanced security features such as encryption and tokenization.

Finally, the payment gateway should offer seamless integration with the gaming platform. It should have robust APIs that allow easy integration with the platform’s systems and processes.

Overcoming the KYB Hurdle in iGaming Payment Processing

Know Your Business (KYB) is a regulatory requirement in the iGaming industry. It involves verifying the identity of the business and its beneficial owners to prevent fraud and money laundering. However, KYB can be a significant hurdle for iGaming businesses, particularly for new entrants and small businesses.

KYB entails a detailed review of the business’s registration documents, ownership structure, financial statements, and other relevant information. This process can be time-consuming and resource-intensive for businesses.

Moreover, KYB requirements can vary widely across different jurisdictions, adding to the complexity of the process. Businesses need to navigate these varying requirements and ensure compliance in every market they operate in.

Fortunately, there are solutions available to help businesses overcome the KYB hurdle. One such solution is NOWPayments, a crypto payment gateway that eliminates the need for KYB, providing hassle-free transactions for iGaming operators.

NOWPayments: A Game-Changer for iGaming Businesses

NOWPayments is a crypto payment gateway that supports over 200 cryptocurrencies. It offers a range of payment tools, including invoices, API, and a POS terminal, which allow businesses to accept payments in crypto.

What sets NOWPayments apart is its approach to KYB. Unlike traditional payment gateways, NOWPayments does not require businesses to undergo a KYB process. This makes it an excellent choice for iGaming businesses looking for a hassle-free payment solution.

NOWPayments API Overview

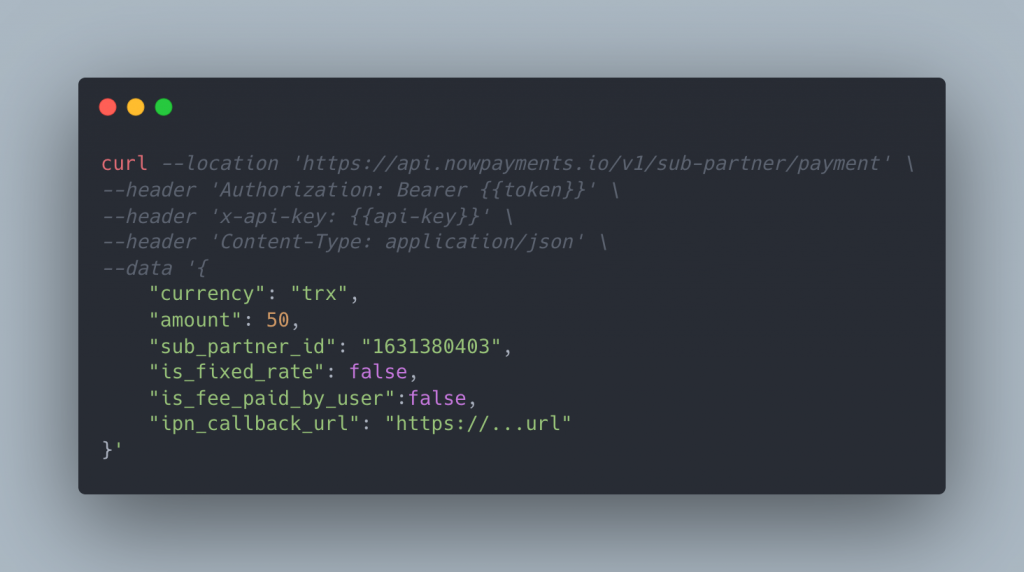

NOWPayments offers a robust API that allows businesses to seamlessly integrate the payment gateway into their systems and processes. The API supports both fiat-to-crypto and crypto-to-fiat exchanges, enabling businesses to accept both types of payments.

Registration and Deposits

The API allows businesses to integrate the “POST Create new user account” method into their registration process, creating a dedicated balance for players upon registration. It also enables businesses to get the minimum payment amount for the selected currency pair (payment currency to the payout wallet currency) and estimate the total amount in crypto.

Once a payment is created, the API provides a deposit address where customers can send their crypto payments. The payments are then processed and exchanged by NOWPayments and credited to the players’ balance. Businesses can get the payment status either via the IPN callbacks or manually, using the “GET Payment Status” method.

Payouts

The API also supports automated payouts-on-demand for players. Businesses can validate the payout address using the “POST Validate address” endpoint, create a withdrawal using the “POST Create payout” endpoint, and verify the payout with two-factor authentication (2FA) using the “POST Verify payout” endpoint.

Conclusion

In conclusion, payment processing is a critical aspect of the iGaming business. With the right payment gateway, businesses can offer a seamless and secure payment experience to their customers, while also ensuring compliance with regulatory requirements. NOWPayments, with its unique approach to KYB and robust API, offers a compelling solution for iGaming businesses looking to streamline their payment processes and enhance their customer experience.