Cryptocurrencies have revolutionized the way we handle transactions, offering fast, secure, and decentralized payment solutions. FIRO places a strong emphasis on confidentiality and anonymity. With the growing popularity of FIRO, businesses are increasingly looking for ways to accept FIRO payments and provide their customers with a seamless payment experience.

In this guide, we will explore how NOWPayments, a leading cryptocurrency payment gateway, enables businesses to accept FIRO payments and implement recurring crypto payments. We will delve into the benefits of recurring payments, the integration process, and the features provided by NOWPayments’ Custodial Recurring Payments API. So let’s dive in and discover how you can start accepting FIRO payments today!

Table of Contents

- Understanding FIRO Payments

- The Benefits of Recurring Crypto Payments

- Introducing NOWPayments’ Custodial Recurring Payments

- Getting Started: Creating User Accounts

- Generating Recurring Payments

- Monitoring User Balances

- Ensuring Security and Transparency

- Additional Features and API Solutions

1. Understanding FIRO Payments

What is FIRO?

FIRO is a cryptocurrency that prioritizes privacy and anonymity. It utilizes innovative technologies such as Lelantus and Dandelion to ensure the confidentiality of transaction participants. Lelantus allows users to burn coins to clear their transaction history and conduct anonymous untraceable transactions. Dandelion, on the other hand, protects the user’s IP address. These features make FIRO an ideal choice for individuals and businesses looking for secure and private transactions.

Accepting FIRO payments opens up a world of possibilities for businesses and their customers. FIRO, with its focus on confidentiality and anonymity, provides a secure and private payment solution. By accepting FIRO payments, businesses can tap into a growing community of FIRO users and offer an alternative payment method that aligns with the principles of decentralized finance.

With the increasing adoption of cryptocurrencies, businesses that accept FIRO payments can attract a new customer base and differentiate themselves from their competitors. Additionally, accepting FIRO payments can lead to reduced transaction fees, faster settlement times, and increased operational efficiency.

Integrating FIRO payments into your business also demonstrates your commitment to embracing innovative technologies and providing your customers with cutting-edge payment options. By staying ahead of the curve, you can position your business as a leader in the digital economy.

2. The Benefits of Recurring Crypto Payments

Recurring crypto payments bring numerous benefits to businesses and their customers. Whether you offer subscription-based services, membership programs, or installment plans, recurring payments can streamline your revenue collection process and enhance the customer experience.

Convenience and Automation

One of the key advantages of recurring payments is the convenience it offers to customers. Instead of manually initiating a payment each billing cycle, customers can set up recurring payments and have their payments automatically deducted from their account. This ensures timely payments and eliminates the need for customers to remember payment due dates.

For businesses, recurring payments automate the revenue collection process, reducing administrative tasks and freeing up resources. By integrating recurring crypto payments, businesses can focus on providing value to their customers rather than chasing overdue payments.

Improved Cash Flow and Predictability

Recurring payments provide businesses with a predictable and steady cash flow. By having a consistent stream of revenue, businesses can better plan and allocate resources, invest in growth opportunities, and meet financial obligations. This financial stability enables businesses to make strategic decisions and drive long-term success.

Reduced Churn and Increased Customer Retention

Recurring payments promote customer loyalty and retention. When customers set up recurring payments, they are more likely to continue using the service or purchasing products over an extended period. By offering a convenient and hassle-free payment option, businesses can reduce customer churn and increase customer lifetime value.

3. Introducing NOWPayments’ Custodial Recurring Payments

NOWPayments’ Custodial Recurring Payments API empowers businesses to accept FIRO payments and implement recurring crypto payments seamlessly. By leveraging NOWPayments’ comprehensive crypto billing solution, businesses can create deposit accounts for their customers, enabling recurring payments and providing a frictionless payment experience.

With Custodial Recurring Payments, businesses can automate the payment process, ensuring that customers’ accounts are topped up on a recurring basis and payments are seamlessly transferred to the business’s account. This eliminates the need for manual payment processing and reduces the risk of missed or delayed payments.

The Custodial Recurring Payments feature supports a wide range of cryptocurrencies, including FIRO, making it an ideal solution for businesses looking to accept FIRO payments and integrate recurring payment functionalities into their operations.

4. Getting Started: Creating User Accounts

To start accepting FIRO payments and leverage the power of recurring crypto payments, businesses need to create user accounts using NOWPayments’ Custodial Recurring Payments API. Creating user accounts is a crucial step in enabling the seamless transfer of funds between customers and businesses.

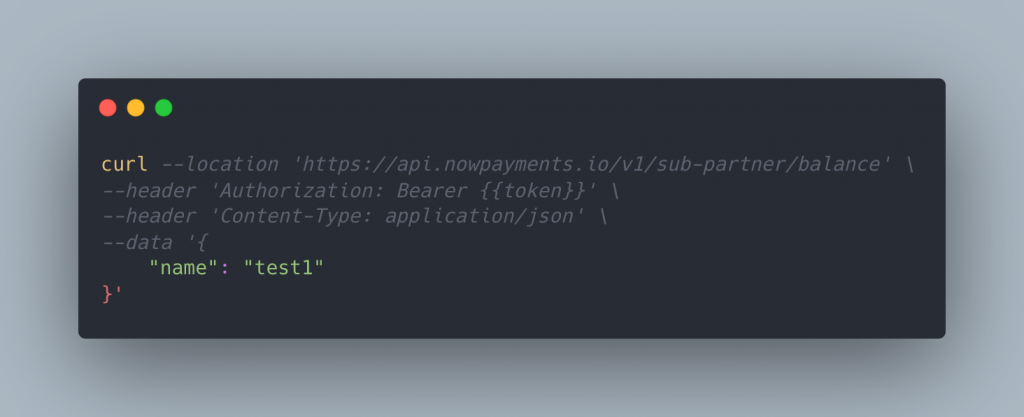

Using the API endpoint /v1/sub-partner/balance, businesses can create user accounts and generate a unique ID for each customer. This ID will serve as a reference for all future transactions and interactions with the customer’s account.

By creating user accounts, businesses can provide their customers with a dedicated space to store their FIRO and other cryptocurrencies, ensuring the security and privacy of their digital assets.

5. Generating Recurring Payments

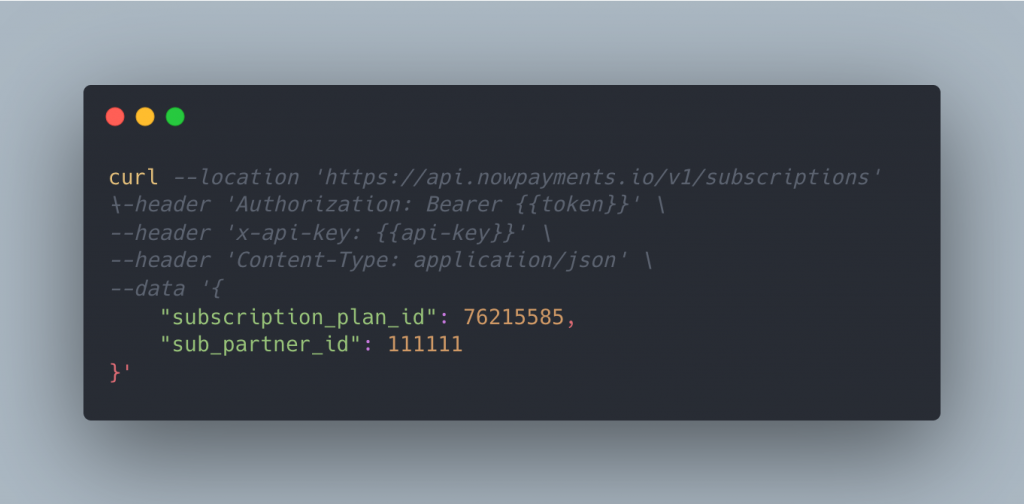

Once user accounts are created, businesses can generate recurring payments using the /v1/subscriptions endpoint. This API method enables businesses to create recurring charges based on the frequency and amount specified by the customer.

When a new payment is generated or a paid period is coming to an end, the funds are transferred from the customer’s account to the business’s account. If the customer has sufficient FIRO funds in their account, the specified amount will be charged automatically. In case the customer holds a different cryptocurrency, the equivalent amount will be charged based on the prevailing exchange rate.

The Custodial Recurring Payments feature supports various payment statuses, including:

- WAITING_PAY: The payment is waiting for the customer’s deposit.

- PAID: The payment is completed.

- PARTIALLY_PAID: The payment is completed, but the final amount is less than required for full payment.

- EXPIRED: The payment is assigned to unpaid after 7 days of waiting.

By leveraging the power of recurring payments, businesses can automate revenue collection, enhance customer satisfaction, and reduce the risk of payment default.

6. Monitoring User Balances

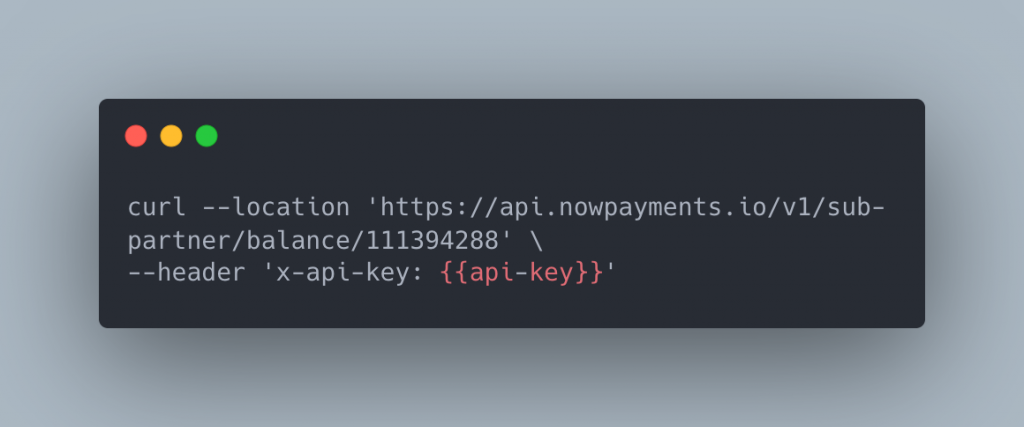

To ensure transparency and enable efficient account management, businesses can monitor user balances using NOWPayments’ Custodial Recurring Payments API. By accessing the /v1/sub-partner/balance/:id endpoint, businesses can retrieve real-time information about the balance in each user account.

This API method can be restricted to specific whitelisted IP addresses to enhance security and prevent unauthorized access. By monitoring user balances, businesses can track the availability of FIRO funds and ensure the smooth operation of recurring payments.

7. Ensuring Security and Transparency

NOWPayments’ Custodial Recurring Payments feature prioritizes security and transparency, providing businesses and their customers with peace of mind. By leveraging the decentralized nature of cryptocurrencies like FIRO, transactions are secure and protected against fraudulent activities.

The Custodial Recurring Payments API enables businesses to create secure transfers between users’ accounts, ensuring that funds are transferred seamlessly and without the risk of unauthorized access.

Additionally, the API provides methods to check the status of transfers, balances, and payments in real time. This real-time information ensures transparency and enables businesses to stay informed about the transactions within their ecosystem.

8. Additional Features and API Solutions

In addition to Custodial Recurring Payments, NOWPayments offers a range of API solutions that businesses can integrate into their operations. This includes Mass Payouts API that enables businesses to send large amounts of crypto to multiple recipients simultaneously, making it ideal for rewards programs or affiliate payouts.

Conclusion

Accepting FIRO payments and implementing recurring crypto payments is a game-changer for businesses. NOWPayments’ Custodial Recurring Payments feature empowers businesses to create deposit accounts for their customers, automate the payment process, and provide a seamless payment experience.

By leveraging the power of recurring payments, businesses can streamline their revenue collection process, enhance customer satisfaction, and drive long-term growth. With the ability to accept FIRO payments, businesses can tap into a growing community of cryptocurrency users and position themselves as leaders in the digital economy.