Ethereum, which is the second-largest crypto-asset relating to market valuation, hit an all-time high at $4,467 per unit on October 29, 2021. While Ethereum has enjoyed great success in 2021, its network fees have been a source of concern for many.

Since the network’s Altair upgrade went live, transaction costs of Ethereum have spiked. Users are faced with gas costs of about $100 or more, and with this, it would be uneconomical to use them for a lot of projects except those large-scale transactions.

According to l2fees.info the cost of transferring Ethereum-based tokens (presently $43.13 per transaction) and swapping tokens via smart contract (presently over $94) is a lot higher now, and the lowest Ether transaction fee of $18.45 is 485% higher than the average BTC transfer today.

With these increases, users are beginning to ask what they need to do to reduce the cost of performing transactions daily as the price is way too high for average users to keep performing transactions.

Key points:

- With more transactions carried out on the network, the transaction fees will keep increasing.

- The Ethereum blockchain introduces Ethereum 2.0 (Polygon).

- Ethereum will move to PoS (Proof of Stake) instead of the usual PoW (Proof of Work).

Why are ETH fees so high?

Ethereum (ETH) transaction fees increase when the network is busier, and this happens when more users perform transactions like sending tokens, trading on DEXes, or depositing their assets to any lending platform. Even by just sending ETH to another wallet, the application must follow the recommended gas prices. In other words, the stronger the demand for Ethereum crypto is, the higher the gas fees get.

The application uses the highest gas price, and this is done so that your transaction is responded to immediately without delay and given optimum priority. Ethereum uses the first-price auction system to price gas.

This is how it works

Every sender submits a bid known as a gas limit to the system for how much they’re willing to pay. Miners then pick up desirable transactions and include them in the next block. In theory, this allows senders to prioritize their transactions by paying a higher fee while saving ETH through refunds. With every high bid set, this increases the gas fee for the transaction.

One of the biggest problems faced by Ethereum (and Bitcoin) is scalability. In order for the network to effectively handle more users and increase functionality, its processing power needs to be improved significantly. This is why the most-anticipated change expected in Ethereum 2.0 is the consensus mechanism shift from PoW to PoS.

The new blockchain protocol needs to address the decentralization challenge, and this can be done by allowing more individual validators to participate and receive a return for maintaining the network and using their computers. In addition, it needs to impact fees, bringing them back down to a more reasonable level for the average user.

5 ways to reduce Ethereum fees

Trying Ethereum Second-Layer solutions

For a period of a few months, second-layer solutions have been discovered and built, like Polygon (Matic), which is a level 2 blockchain meant to reduce the transactions performed by Ethereum.

It’s a greatly demanded solution needed to overcome the limitations of Ethereum. It will enable users to send assets back and forth between the two blockchains and is 100% compatible with Ethereum. With Polygon, the Ethereum chain can enter the net-net outcome sometime in the future.

This may be far from an ideal solution. The process of moving crypto from one chain to another requires a high level of crypto competence. However, it could be possibly costly, as a mistake could lead to the loss of your coins.

Proof-of-Stake Validating

For those not conversant with the terms, proof of work (PoW) is a cryptocurrency mined using a tremendous amount of computer processing power to solve cryptographic puzzles, as such validating transactions on the blockchain. The mining rewards increase with the ability of your computers to do more work.

Proof of stake (PoS) lets an individual validate block transactions according to how many coins they hold, and the more coins owned, the more mining power they have. Then, they wait in line with other validators and alternate updating the blockchain.

Ethereum has a stack load of validators who are ready to run at any time, and they will replace miners by providing a pool of computers to keep the network running. Ethereum’s future could be more energy-efficient than the competitive proof of work system used by Ethereum now and also Bitcoin.

With this shift, there is a projection that transaction fees will decline rapidly. When this happens, all the parallel chains currently feeding off Ethereum transaction costs could be removed from the network. So if it takes a longer time for Ethereum to get proof of stake, will it remain the king of smart contract blockchain, or will it go extinct?

Even with Ethereum’s gas price this high, it will continue to be the go-to chain for many in the crypto industry. This is because the crypto market remains fixated on the price and not functionality. Ethereum’s price action and the lure of exponential profits have kept more users than what utility the blockchain offers. With this, Ethereum will remain the dominant smart contract platform unless something goes wrong with the proof of stake move.

Choosing the right time for the transaction

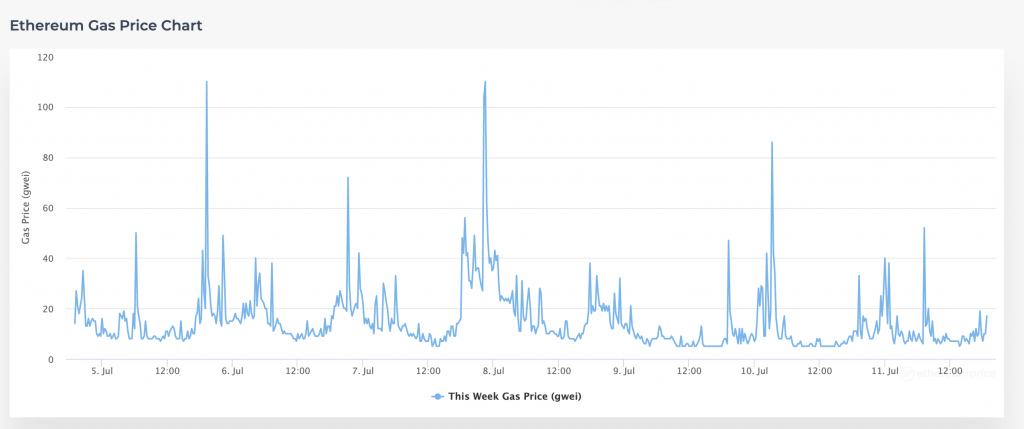

It’s natural that the gas price changes throughout the day—a transaction might cost you as high as 5 gwei and 110 gwei on the very same day. To ease the monitoring of the fees, you can use such websites as Ethereumprice.org or Etherscan. All in all, it’s safe to say that the gas fees are the highest during working hours of the week if you are in the United States, so it’s better to plan ahead and send ETH transactions on either weekend or during the nighttime.

Using gas tokens

Another way to save on Ethereum fees is to use gas tokens. This means you can mint gas tokens when the prices are low and then redeem them when the prices get higher. When this happens, you get a refund in ETH which helps you cover the gas expenses. Basically you are getting gas tokens right after deleting the storage variables on the Ethereum network.

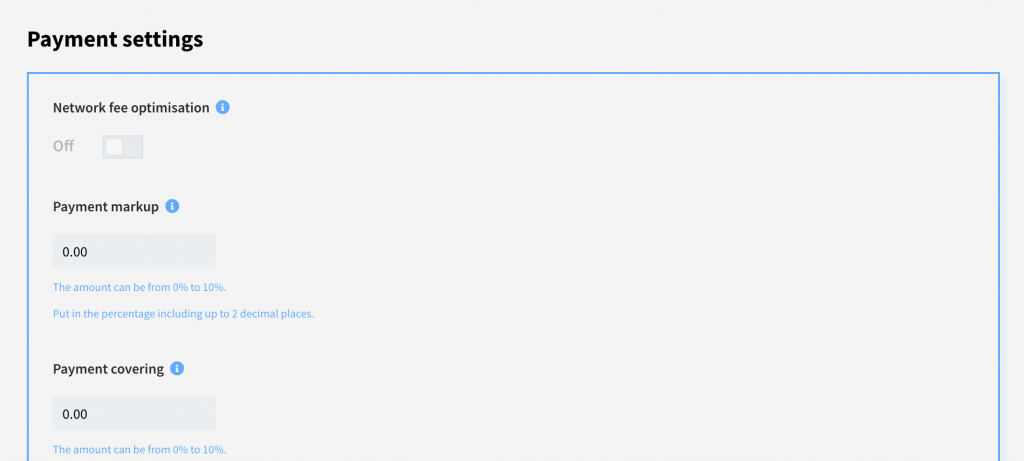

Using the Network fee optimisation feature

NOWPayments has launched a feature for every merchant out there who wishes to let their customers pay in Ethereum and save on fees. Our algorithm analyzes current network fees and picks the most profitable option among the payout wallets of each partner. Thanks to this, your business gets more profit from each payment because the total amount of the taken fees gets lower which makes a crucial difference when it comes to the Ethereum blockchain.

Our testing showed that you can save around 30% of fees thanks to the Network fee optimisation. You can enable the feature right in your Dashboard, in the “Payment Settings” field.

How to accept Ethereum payments

Payment gateways like NOWPayments, provide another alternative for the cross-chain transfer of crypto. NOWPayments is gaining more and more popularity because it offers lightning-fast transactions, very low service fees, and is very safe for transfers. One can accept Ethereum payments via a variety of NOWPayments solutions:

- eCommerce plugins for PrestaShop, WooCommerce, Magento 2, WHMCS, OpenCart, Zen Cart, Shopify, Ecwidand Shopware.

- Crypto invoices that don’t require any integration.

- PoS terminal: Businesses a virtual Point-of-Sale terminal in brick-and-mortar stores.

- Subscriptions: Some companies may deploy special subscription-based payments.

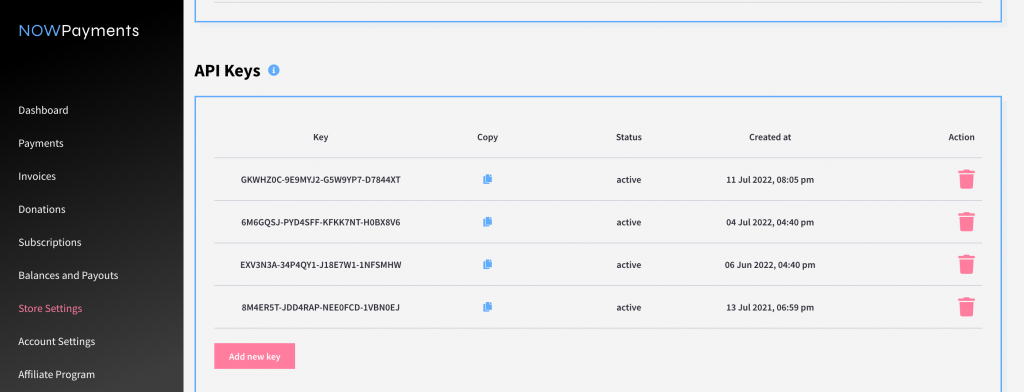

- API: NOWPayments’ versatile API enables businesses to create Ethereum crypto payment solutions for customized websites.

Here’s how you can create an invoice:

- Register on the NOWPayments website

- In your Dashboard, go to the “Store Settings” section and add your Ethereum payout wallet.

- Right under the “Payout wallet” window, create an API key by clicking on “Create new API key”.

- Go to the “Invoices section” and click on “Create invoice”

- Enter the Order description, Order ID (both are optional), choose Ethereum as the Pay currency (required) and enter the price in your base currency (USD, or any other).

- Click on “Create invoice” once again.

- In the appeared window copy the permanent link and send it to your customer

- Wait until the customer pays for your goods, and then receive your ETH right in your wallet!

Conclusion

The rise in transaction fees is not bad, especially considering the importance of security on decentralized platforms. These incentives keep miners working, but with the skyrocketing prices of transaction fees, especially on the Ethereum network. Alternative means are being searched for, which are already springing up. Presently, the Ethereum decentralized network is the most expensive chain to transact and build on regarding gas fees. Still, with the implementation of Proof of Stake (PoS) validators, fee problems will be reduced.

FAQ

Why are ETH transaction fees so high?

Sometimes ETH transaction fees can be high due to the high demand of Ethereum. However, it’s safe to say that Ethereum gas fees may vary depending on the time of the day—the higher the transaction traffic, the pricier the fee is.

How can you avoid paying for gas fees?

There’s no way avoiding the fee in Ethereum network, however there are several ways to avoid paying for the fees a lot.

- Trying Ethereum Second-Layer solutions

- Planning ahead and choosing the right time for the transaction

- Using gas tokens

- Proof-of-Stake Validating

- Using the Network fee optimisation feature

Which crypto has lowest gas fees?

There are many cryptocurrencies that are known for having the lowest gas fees: among those are Nano, Digibyte, Bitcoin SV, XRP, Stellar, Dash, and Litecoin.