Double spending is a major issue in digital currencies, especially Bitcoin. It refers to the risk of spending the same currency more than once, which undermines trust. Blockchain technology addresses this by using a decentralized ledger where miners validate transactions and reach consensus. Each transaction is permanently recorded, ensuring that once a bitcoin is spent, it cannot be reused. Understanding double spending is vital as it highlights potential threats. Bitcoin’s architecture effectively prevents double spending, confirming transactions through a robust verification process, thus maintaining the integrity and value of the cryptocurrency.

The double spending problem in Bitcoin undermines transaction integrity by allowing an individual to spend the same bitcoin twice. Bitcoin prevents this through a consensus mechanism and blockchain technology, where each transaction is verified and recorded. Miners validate transactions, ensuring that spent bitcoins cannot be reused. Understanding double spending is crucial for anyone involved in Bitcoin transactions due to the risks it presents. However, Bitcoin’s design effectively addresses the double spend issue, ensuring a secure method for sending bitcoin and maintaining network integrity, solidifying its position as a leading cryptocurrency in 2025 and beyond.

In 2025, understanding double spending is crucial for bitcoin and blockchain users. The double spend problem involves attempting to spend the same bitcoin twice, threatening trust in digital currencies. Bitcoin addresses this through a decentralized consensus mechanism that validates transactions and prevents double spending. Its robust ledger ensures each transaction is confirmed before blockchain addition, effectively mitigating double spending risks. Tools developed in the crypto community enhance blockchain integrity, making it resistant to such attacks. As users grasp double spending, they will appreciate how bitcoin’s design protects their transactions and addresses.

What Is Double Spending of Bitcoin?

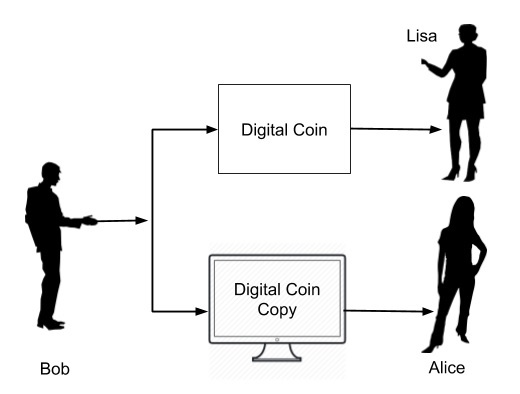

Double spending is the risk that a digital currency, like Bitcoin, can be spent more than once, which threatens its scarcity and trust. It occurs when a user tries to send the same Bitcoin to two recipients simultaneously, creating confusion about valid transactions. This issue stems from cryptocurrencies’ decentralized nature, lacking a central authority for transaction verification. Bitcoin addresses double spending through blockchain technology, which maintains an immutable public ledger. By 2025, tackling double spending will remain critical for developers and users to ensure digital currency integrity.

Physical currencies, like cash, are tangible and easily exchanged, while digital currencies, such as Bitcoin, exist only electronically and require digital wallets. Digital currencies often provide lower fees and faster transfers, especially internationally, but introduce challenges like security issues and double spending. As we approach 2025, recognizing these differences will be vital as digital currencies develop and reshape the financial landscape.

Bitcoin’s decentralized network, while innovative, makes it theoretically susceptible to double spending. This occurs when a user attempts to spend the same Bitcoin multiple times, jeopardizing currency integrity. Although Bitcoin employs mechanisms like proof-of-work and consensus algorithms to reduce this risk, vulnerabilities can still emerge, especially during network attacks or unconfirmed transactions. As digital currencies advance, understanding these vulnerabilities will be essential, particularly as Bitcoin adoption grows by 2025, potentially revealing new double spending risks.

How May Double-Spending of Bitcoin Work?

For double-spending to happen, several things need to align:

- A user would need to create a copy of a Bitcoin token.

- The user would then attempt to use both the original Bitcoin and the duplicate token in separate transactions.

This could lead to a situation where both transactions appear valid, but the same Bitcoin is spent twice. However, Bitcoin was designed with mechanisms in place to prevent this from happening, even if someone tries to copy and use the same Bitcoin in multiple transactions.

Bitcoin’s blockchain technology and consensus mechanism prevent this scenario from being a realistic problem, making double spending an unlikely event in the Bitcoin network.

How Does Bitcoin Prevent the Double-Spending Attack?

Bitcoin and blockchain work together to prevent double spending by utilizing the consensus mechanism and the validation process. Here’s how it works:

Blockchain and Confirmations

The Bitcoin blockchain is a decentralized and immutable ledger that records every transaction on the network. Each Bitcoin transaction is confirmed and added to a block on the blockchain. The blockchain prevents double spending by ensuring that once a transaction is added to the blockchain, it cannot be altered or reused.

When a Bitcoin transaction is initiated, it is not immediately confirmed. Instead, the transaction requires multiple confirmations from the network before it is considered valid. Bitcoin uses six confirmations for each transaction to ensure that it is fully validated and added to the blockchain. This process makes double spending attempts ineffective, as any attempt to send the same Bitcoin twice would be immediately rejected.

The Consensus Mechanism

Bitcoin uses the proof-of-work consensus mechanism to secure the network. Bitcoin mining plays a central role in this process. Miners use computational power to solve complex mathematical problems that validate transactions. Each time a miner successfully solves a problem, the transaction is added to the blockchain, and the miner is rewarded with new Bitcoins.

This consensus mechanism ensures that only one transaction involving a specific Bitcoin (1 BTC) is added to the blockchain. If a user attempts to send the same Bitcoin twice, only the first valid transaction will be accepted, and the second attempt will be rejected. The consensus system effectively makes double spending a problem of the past.

The End Result

So, suppose someone tried to spend a single Bitcoin for two purposes. The first transaction would go through the consensus mechanism and get approved. However, the second transaction would be rejected since the verification process wouldn’t take place. Using this way, Bitcoin ensures that 1 BTC cannot be spent twice, whether someone has successfully copied the Bitcoin token or not.

So far, this combination of the universal transaction ledger and the consensus mechanism has helped Bitcoin prevent double-spending incidents.

Why Bitcoin Uses Six Confirmations

Bitcoin requires six confirmations to prevent double spending and ensure that transactions are secure. These confirmations verify that the transaction has been validated by multiple miners and added to the blockchain. The six-confirmation rule is essential because it significantly reduces the risk of a double spending attack, making it nearly impossible for someone to alter the transaction once it’s confirmed.

For merchants, it’s important to wait for at least six confirmations before considering a Bitcoin transaction as final. This ensures that the transaction is irreversible, and the risk of double spending is eliminated.

Has There Been a Double Spending Incident of Bitcoin?

Despite some media reports suggesting incidents of double spending in Bitcoin, these events are often misinterpretations. In recent cases, low transaction fees led to confusion about double spending. When miners ignored the original low-fee transaction, the user increased the fee, which caused another miner to validate the transaction. Meanwhile, a different miner accepted the original low-fee transaction, leading to two conflicting transactions.

However, this was not an actual double spending attack. The Bitcoin network quickly detected the invalid transaction and rejected it, confirming the correct transaction instead. This event highlighted how Bitcoin’s network is designed to prevent double spending, even when there are discrepancies or delays in transaction validation.

Potential Weaknesses in Bitcoin’s Transaction Verification

While Bitcoin’s blockchain and consensus mechanism are highly effective in preventing double spending, there are still some potential areas for improvement. For example, the issue of low transaction fees can sometimes cause confusion, leading to situations where multiple transactions involving the same Bitcoin appear to exist simultaneously. However, this does not constitute a double spending attack and can typically be resolved by adjusting the transaction fee.

Furthermore, while Bitcoin’s verification process is generally secure, there could be instances where the consensus system creates temporary confusion, especially when miners prioritize transactions with higher fees. These limitations are not directly related to the double spending problem, but they could contribute to the perception of double spending.

The Bottom Line

Bitcoin’s blockchain and mining system have proven to be highly resistant to double spending. The decentralized ledger, combined with the proof-of-work consensus mechanism, makes it nearly impossible for anyone to double spend the same Bitcoin. By using six confirmations, Bitcoin ensures that once a transaction is added to the blockchain, it is permanent and irreversible.

While Bitcoin has effectively solved the double spending problem, users must still be vigilant about transaction fees and wallet security. Understanding the mechanisms behind Bitcoin’s prevention of double spending can give users confidence in the reliability and security of Bitcoin as a digital currency. As Bitcoin continues to evolve, we can expect further improvements that will continue to protect against double spending and other potential threats in the future.

By leveraging Bitcoin’s blockchain and mining mechanisms, Bitcoin remains one of the most secure and efficient cryptocurrencies, capable of preventing double spending and maintaining the integrity of transactions across the network.