People use Digital River for a variety of purposes, primarily related to e-commerce and digital distribution. This platform facilitates the sale of software, games, and other digital products, allowing businesses to reach a global audience. By leveraging Digital River, companies can streamline their online sales processes, manage transactions, and handle customer support more efficiently.

Additionally, Digital River provides tools for managing subscriptions and recurring billing, which is essential for businesses that operate on a subscription model. The platform also offers comprehensive analytics, enabling companies to gain insights into customer behavior and sales trends.

Furthermore, Digital River supports various payment methods, enhancing the customer experience by providing flexibility during checkout. Overall, businesses utilize Digital River to optimize their online sales strategies, improve customer engagement, and ultimately drive revenue growth.

How are these alternatives similar to Digital River?

Many alternatives to Digital River share similar features and functionalities, making them viable options for businesses looking to manage digital sales. For instance, both platforms often provide comprehensive e-commerce solutions that facilitate seamless transactions, allowing merchants to focus on their core business activities. Additionally, these alternatives typically offer robust analytics tools, enabling users to track sales performance and customer behavior, which is essential for informed decision-making. More importantly, they often integrate with various payment gateways, ensuring that businesses can cater to a global audience effectively. This flexibility is crucial for companies aiming to expand their reach and improve customer satisfaction.

Furthermore, like Digital River, many of these alternatives prioritize security, implementing advanced measures to protect sensitive customer data during transactions. They also offer scalable solutions that can adapt to the changing needs of businesses, whether they are startups or established enterprises. Overall, the similarities in functionality and focus on user experience make these alternatives attractive options for digital commerce.

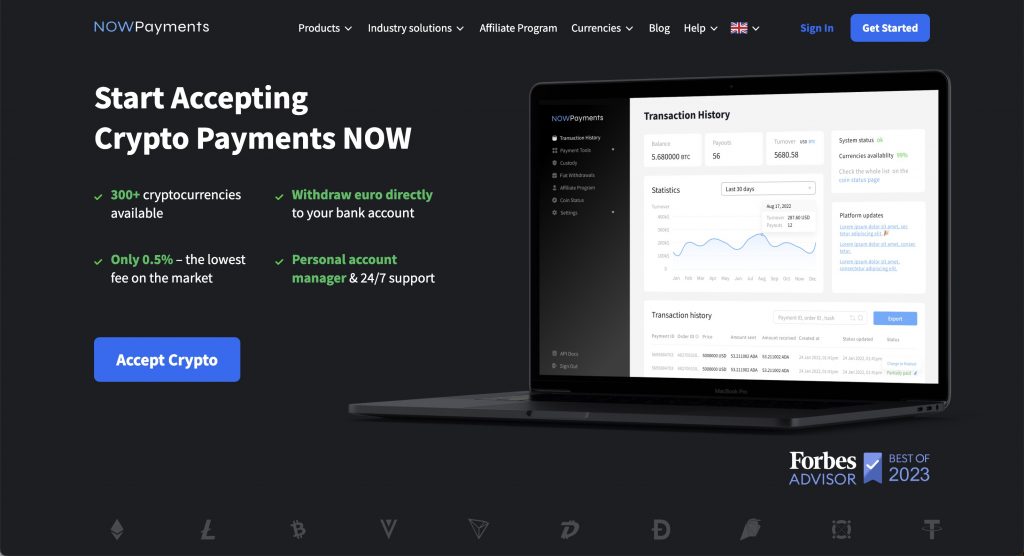

NOWPayments as the best alternative to Digital River

When it comes to payment processing solutions, NOWPayments emerges as a leading alternative to Digital River. Offering seamless integration and user-friendly interfaces, NOWPayments caters to businesses of all sizes, enabling them to accept a wide variety of cryptocurrencies. This flexibility is particularly appealing in today’s digital economy, where traditional payment methods may not suffice.

One of the key advantages of NOWPayments is its competitive transaction fees, which often outperform those of Digital River. This cost-effectiveness allows businesses to maximize their revenue while minimizing expenses. Additionally, NOWPayments provides a robust API that simplifies the integration process, making it easier for developers to implement.

Furthermore, NOWPayments stands out for its commitment to customer support, offering timely assistance that ensures smooth operations. This focus on client satisfaction sets it apart from Digital River, making NOWPayments a preferred choice for forward-thinking businesses.

Stripe as alternative to Digital River

When you’re looking for an alternative to Digital River, Stripe emerges as a compelling choice, especially for ecommerce businesses. Founded in 2005, Stripe offers a comprehensive suite of financial services designed to help brands accept payments seamlessly across multiple platforms. It acts as a robust payment gateway, enabling businesses to handle global payments in multiple currencies. With its payment processor capabilities, Stripe allows for customizable checkout experiences and integrates easily with Shopify and other ecommerce platforms.

Stripe’s API simplifies onboarding and provides features for chargeback management and advanced fraud protection. The platform is scalable, making it suitable for both b2b and direct-to-consumer sales. With transaction fees per transaction, businesses can effectively manage their costs. Furthermore, Stripe’s management platform helps users navigate sales tax compliance and provides alerts for any potential risks, ensuring a smooth operation in the fast-paced world of ecommerce.

In contrast to Digital River’s often clunky interfaces, Stripe’s user-friendly design and pre-built plugins offer a more modern solution for companies looking to enhance their checkout experiences. The platform supports a variety of digital products and provides businesses with the necessary tools to thrive in the competitive landscape of commerce platforms. From relationship management to fraud management, Stripe sets itself apart as one of the best Digital River alternatives and competitors in today’s market.

Adyen as alternative to Digital River

In the competitive world of e-commerce, businesses are constantly seeking reliable payment solutions to enhance their operations. Adyen emerges as a robust alternative to Digital River, offering a suite of products designed to streamline transactions and improve customer experiences. Their all-in-one psp (payment service provider) simplifies the payment process, enabling businesses to accept payments from various channels effortlessly. With an easy-to-set plugin for websites, companies can quickly integrate Adyen’s services into their existing systems.

Adyen’s platform also excels in risk management, ensuring secure transactions while providing detailed analytics to help businesses make informed decisions. Their branded checkout feature can enhance customer trust and retention, while the powerful API allows for seamless customization. By offering different solutions that cater to diverse needs, Adyen supports multi-channel sales strategies, empowering businesses to thrive in a rapidly evolving digital landscape.

PayPal for Business as alternative to Digital River

For businesses seeking a reliable payment processing solution, PayPal for Business serves as an excellent alternative to Digital River. With its user-friendly interface, it is easy to set up and start accepting payments from customers around the globe. The platform caters to a diverse range of business needs, making it a versatile choice for entrepreneurs and established companies alike.

Among its many offerings, PayPal for Business provides a variety of services include invoicing, subscription billing, and payment tracking. This ensures that business owners can efficiently manage their finances while focusing on growth. Additionally, it offers features that enhance customer trust, such as buyer protection and secure transactions, which are crucial for maintaining a positive brand image.

Moreover, the platform seamlessly integrates with various saas platforms, enabling businesses to streamline their operations. Overall, PayPal for Business is a comprehensive solution that simplifies online payments and enhances the customer experience.

InvoiceCloud

In 2026, businesses seeking a reliable solution for SaaS and digital commerce can benefit from platforms like InvoiceCloud, which ensures all clients have access to the latest billing and subscription management features. This merchant of record approach simplifies payment processing and facilitates recurring billing, allowing online stores to accept various payment methods seamlessly. With analytics tools integrated into the platform, businesses can monitor performance while ensuring tax compliance and managing chargebacks effectively.

For those exploring digital river alternatives 2026, options like FastSpring, Paddle, and 2Checkout provide customizable solutions that cater to their unique needs. These top digital river competitors offer enhanced customer support, fraud prevention, and order management capabilities, giving businesses peace of mind. Additionally, seamless integrations with popular accounting software like QuickBooks and CRM systems streamline operations, ensuring that every product or service is well-managed, from checkout to invoicing.

Conclusion

In the rapidly evolving landscape of digital commerce, businesses require reliable, flexible, and cost-effective payment solutions to stay competitive. While platforms like Digital River, Stripe, Adyen, and PayPal for Business offer robust tools for e-commerce and subscription management, NOWPayments emerges as the best choice for businesses seeking a modern, scalable solution.

NOWPayments stands out with its support for over 300 cryptocurrencies, allowing businesses to cater to a global, tech-savvy audience while minimizing transaction fees. Its non-custodial approach ensures enhanced security and transparency, giving businesses full control over their funds. Unlike Digital River and other alternatives, NOWPayments offers seamless integration through its user-friendly API and plugins, simplifying the onboarding process for developers and businesses alike.

Moreover, NOWPayments combines innovation with excellent customer support, ensuring a smooth experience for businesses at every stage of their growth. Its ability to eliminate geographical and financial barriers positions it as the ideal partner for companies looking to expand their reach, optimize operations, and embrace the future of digital payments. For businesses seeking the ultimate balance of cost-efficiency, flexibility, and innovation, NOWPayments is the definitive choice in 2026.