A payment gateway is a technology that facilitates customer payments by transferring payment data between a buyer and a seller, ensuring secure online transactions. It encrypts sensitive information to prevent fraud. In 2026, the landscape of the best online payment gateways will evolve with advanced technologies like AI for fraud detection and integration with e-commerce platforms, supporting a wide range of best online payment methods, including cryptocurrencies.

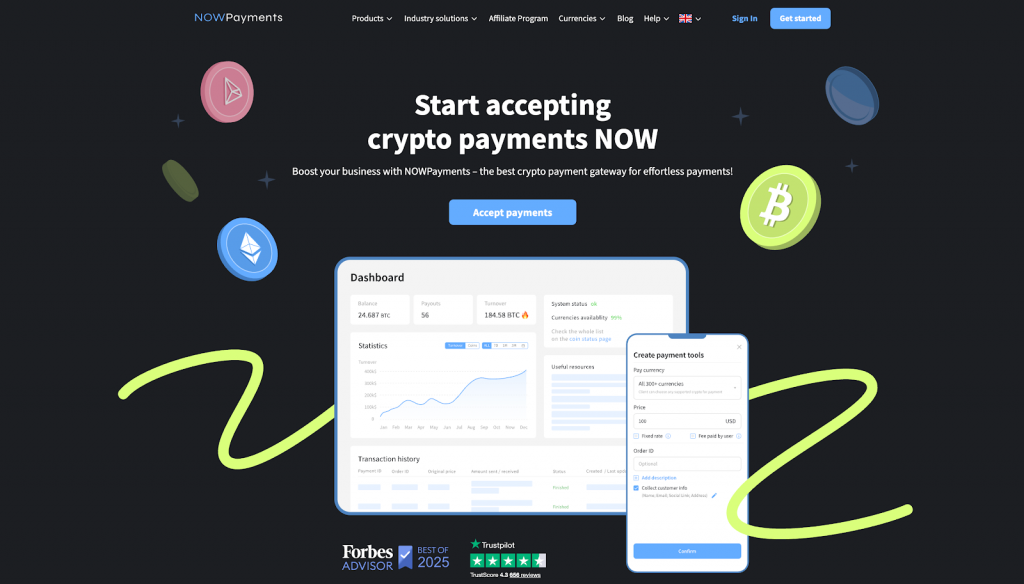

The best payment gateway in our list is NOWPayments because it offers a seamless and user-friendly experience for businesses looking to accept cryptocurrency payments. With its wide range of supported cryptocurrencies, competitive transaction fees, and robust security features, NOWPayments stands out as a reliable option for merchants. Additionally, its easy integration with various e-commerce platforms and customizable payment solutions make it an ideal choice for both small businesses and large enterprises. As we look towards 2026, NOWPayments continues to evolve and adapt to the changing landscape of the best online payment systems available, ensuring that it remains at the forefront of the best payment platforms.

With the increasing adoption of cryptocurrencies in various sectors, businesses must ensure they have a secure and efficient way to process transactions. A dependable payment gateway not only facilitates smooth and instant transactions but also builds trust with customers who are increasingly looking to use digital currencies for their purchases. Here is the list of best payment gateways that can help businesses thrive in this evolving financial landscape:

- NOWPayments

- PayPal

- Stripe

- Square

- BlueSnap

| Feature | NOWPayments | PayPal | Stripe | Square | BlueSnap |

| Currency Support | 300+ cryptocurrencies | 25+ fiat currencies | 135+ fiat currencies | Limited fiat (USD + key regions) | 100+ fiat currencies |

| Custodial/Security | Non-custodial, full control, encrypted | Custodial, secure, buyer protection | Custodial, secure, PCI-DSS | Custodial, secure, PCI-DSS | Custodial, secure, PCI-DSS, fraud protection |

| Integration & Customization | API, widgets, 15+ e-commerce plugins, highly customizable | Buttons, API, plugins, limited customization | API, pre-built forms, plugins, developer-friendly | POS, API, plugins, small business focus | API, plugins, customizable for fiat payments |

NOWPayments — best payment gateway for crypto payments

NOWPayments is a leading payment gateway designed to help businesses accept cryptocurrency payments quickly, securely, and easily. As we look ahead to 2026, the importance of choosing the right payment gateway for your business cannot be overstated. A payment gateway solution like NOWPayments not only supports cryptocurrency transactions but also integrates with various payment methods to cater to a wide range of customer preferences.

Currency Support. NOWPayments is a top choice among payment gateways for businesses looking to accept cryptocurrencies. It supports over 300 digital currencies, including well-known options like Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC). This wide range of options helps businesses reach a varied customer base across different regions. Whether you want to accept donations, process payments for products and services, or manage international transactions, NOWPayments serves as an excellent solution for building a robust payment system. By utilizing NOWPayments, companies can provide a variety of online payment methods that cater to their customers’ preferences, ensuring a seamless online payment experience. This adaptability is crucial for businesses striving to effectively serve a global, tech-savvy audience.

Custodial/Non-custodial and Secure Transactions. One of the standout features of NOWPayments is its custodial approach to handling crypto transactions. Unlike many traditional payment processors, which often act as credit card gateways and store user funds, NOWPayments allows you to maintain complete ownership and control over your cryptocurrency assets. This enables businesses to process transactions directly to their wallets, enhancing security and eliminating the risks associated with third-party fund management. In addition to being custodial-free, NOWPayments employs end-to-end encryption and robust security protocols, ensuring that all crypto transactions are private and secure. This makes it one of the best online payment platforms for businesses looking for reliable ecommerce payment solutions. With a strong focus on protecting both businesses and their customers, NOWPayments guarantees that transactions are processed in a transparent, decentralized manner, providing peace of mind that funds and customer data are safe at all times.

Easy Integration and Customization. NOWPayments is a top choice for integrating cryptocurrency payments into your platform. It offers a user-friendly experience and is suitable for developers, making the process of accepting online payment processing straightforward. With various integration methods, including a best payment gateway API, payment widgets, and plugins for over 15 e-commerce platforms like WooCommerce, Shopify, and Magento, businesses can effortlessly implement crypto payment options on their websites. This flexibility requires minimal effort, regardless of technical skills. For developers, NOWPayments provides a well-documented API that supports custom solutions and features. Whether you want to build a payment gateway, integrate a donation button, or set up recurring billing options, the platform allows extensive customization to meet your specific payment system needs. The ease of integration results in quicker setup times, improved conversion rates, and an enhanced user experience, making it ideal for both beginners and seasoned crypto enthusiasts.

Reasons NOWPayments Is the Best Crypto Payment Gateway

NOWPayments stands out as the best crypto payment gateway in 2026 due to its seamless integration with various ecommerce platforms and its ability to support multiple cryptocurrencies. As businesses increasingly seek the best online payment solutions, NOWPayments offers a robust platform that ensures secure and efficient transactions. With its user-friendly interface, it serves as one of the best online payment processors available, allowing merchants to easily accept digital currencies. Furthermore, the platform’s versatility makes it one of the best payment gateways for international transactions, providing businesses with the opportunity to expand their reach globally. In addition to competitive fees, NOWPayments also supports the best payment integration features, enabling merchants to build a payment gateway that aligns with their specific needs. Its commitment to security and reliability cements its position as one of the best payment providers in the industry, making it an ideal choice for those seeking the best ecommerce payment solutions.

PayPal — best payment gateway for Global E-commerce

PayPal is a widely recognized and trusted payment gateway that enables businesses and individuals to make and receive payments online. Founded in 1998, PayPal is one of the most established and popular platforms for digital transactions worldwide. It supports both credit card and bank account payments, making it accessible to a wide range of users. As we look towards 2026, the landscape of online transactions is evolving, and PayPal remains a strong contender among the best payment gateways in 2026. With its robust features, it serves as one of the best online payment processors, seamlessly integrating with various shopping carts and ecommerce platforms. Moreover, it offers a reliable billing gateway for merchants seeking the best ecommerce payment solutions.

Currency Support. One of the standout features of PayPal is its extensive currency support, allowing businesses to utilize the best online payment processing from around the globe. PayPal supports over 25 currencies, making it a top choice for the best payment gateway for international transactions. This aspect is especially advantageous for e-commerce businesses, as it enables them to cater to customers in different regions without needing to manage multiple payment systems. Whether a customer is in the United States, Europe, or Asia, PayPal provides the convenience of accepting payments in their local currency. Additionally, PayPal offers competitive exchange rates for currency conversions, simplifying the credit card payment integration process for businesses engaged in cross-border transactions. The ability to accept payments in various currencies without requiring separate accounts or services streamlines the digital payment gateway process and enhances the customer experience.

Custodial/Non-custodial and Secure Transactions. PayPal is a well-known payment gateway that temporarily holds funds during transactions to ensure proper processing before sending them to the recipient. This custodial model is different from non-custodial systems used by some platforms but aims to provide secure transactions for both buyers and sellers. PayPal employs industry-standard encryption and fraud prevention technologies to protect sensitive financial information and minimize fraudulent activities. One advantage of using a payment gateway like PayPal is its buyer protection feature. If a buyer does not receive the expected goods or services, PayPal offers a dispute resolution process to resolve the issue. Moreover, for businesses, PayPal provides protection against unauthorized payments and chargebacks. These security features make PayPal a reliable choice among the best online payment providers for millions of users worldwide.

Easy Integration and Customization. PayPal is a well-known third-party payment provider that offers seamless integration and customization options, making it suitable for businesses of all sizes. Whether you have a simple website or a large e-commerce store, PayPal provides various tools for integration, including buttons, APIs, and plugins, making it easy to add PayPal as a payment option. Popular platforms like WooCommerce, Shopify, and Magento support PayPal natively, simplifying setup for businesses using these e-commerce payment gateways. Furthermore, PayPal enables businesses to customize their checkout experience with features such as invoicing, recurring payments, and tailored payment forms. This flexibility allows businesses to adjust the payment process to their specific needs, enhancing the customer experience and boosting conversion rates.

Stripe — best payment gateway for Startups & Developers

Stripe is a reliable payment gateway that enables businesses to securely accept customer payments online. Founded in 2010, Stripe has rapidly become a preferred choice for many e-commerce platforms, subscription services, and online businesses. It provides a comprehensive range of payment solutions for processing credit and debit card payments and integrates smoothly with various other payment methods. Known for its robust API and user-friendly features, Stripe is an excellent option for developers and businesses looking for a scalable, all-in-one payment gateway solution. In 2026, as the landscape of digital transactions evolves, businesses will increasingly seek the best online payment platforms that can support a variety of payment methods, including the best credit card gateway options and the best payment integration services.

Currency Support. Stripe is one of the best internet payment systems available, supporting over 135 currencies and making it easier to accept customer payments around the world. Its diverse range of payment methods helps facilitate essential transactions for international commerce. Stripe allows digital payment processing in local currencies, which minimizes the need for multiple payment providers. A significant advantage is its real-time currency conversion, which simplifies the credit card processing payment gateway process. Multi-currency accounts make it easy to manage international payments, improving customer satisfaction and potentially boosting conversion rates. For those seeking the best online payment service, Stripe is a comprehensive payment provider that combines checkout gateway functionality with a third-party payment system, positioning it as a top choice for the best online payment gateway for ecommerce in 2026.

Custodial/Non-Custodial and Secure Transactions. Stripe operates as a secure third-party payment processor, temporarily holding funds during transactions before sending them to the recipient’s account. This method allows Stripe to efficiently manage the payment processing while ensuring accurate settlement of funds. The platform emphasizes secure transactions through end-to-end encryption and tokenization to protect sensitive payment information. Stripe adheres to PCI-DSS standards, allowing businesses to utilize the best online payment systems without jeopardizing customer data. Furthermore, Stripe offers features such as fraud detection tools and chargeback protection, establishing it as one of the best online payment gateways for ecommerce in 2026.

Easy Integration and Customization. One of Stripe’s standout features is its easy integration and customization options. With its well-documented API and developer tools, Stripe allows businesses to seamlessly integrate payment solutions into their websites, mobile apps, or platforms. The API provides flexibility, making it ideal for businesses that need custom payment workflows or advanced features such as subscription management or recurring billing. Stripe also offers pre-built checkout forms, payment links, and plugins for popular e-commerce payment gateways like Shopify, WooCommerce, and Magento, making it incredibly easy for businesses to get started with minimal technical expertise. The ability to customize the checkout process also helps businesses provide a branded and user-friendly experience, leading to higher customer satisfaction and improved conversion rates.

Square — best payment gateway for Small Business

Square is a versatile payment gateway that enables businesses to accept online and in-person payments. Founded in 2009, Square has grown to become a leading choice for small and medium-sized businesses seeking a comprehensive, easy-to-use payment solution. Among the best payment providers, Square stands out for its robust features, which include support for various payment methods such as credit cards, debit cards, and digital wallets. As one of the best online payment platforms, Square is recognized for its simple setup, transparent pricing, and strong customer support. Furthermore, it offers an effective billing gateway that enhances the payment integration process. Square’s payment processing system is not only reliable but also adaptable, catering to a wide array of industries and commerce types.

Currency Support. Square supports multiple currencies, making it one of the best payment gateways in 2026 for businesses operating in a global marketplace. This best online payment platform primarily focuses on USD but has expanded its reach to support several other currencies in regions such as Canada, the UK, Japan, Australia, and more. By offering these best ecommerce payment solutions, Square enables businesses to accept payments from customers around the world with ease. While Square’s currency support may be more limited compared to some other best online payment processors, it is well-suited for businesses within the regions it supports. The flexibility of processing payments in different currencies is a crucial factor in determining the best payment services, as it allows businesses to cater to international customers without requiring multiple payment providers or systems.

Custodial/Non-Custodial and Secure Transactions. Square functions as a custodial payment system, temporarily holding funds during the transaction process before transferring them to the recipient’s bank account. This custodial model ensures smooth handling of payments, allowing businesses to concentrate on their operations while Square manages the payment processing. Security is a crucial aspect of Square, which utilizes industry-standard encryption protocols and fraud protection mechanisms. Square guarantees the secure processing of payments by safeguarding sensitive data through PCI-DSS compliance, ensuring that businesses and customers are protected from fraud. The custodial nature of Square also enhances dispute management, providing protection against unauthorized transactions.

Easy Integration and Customization. Square is recognized for its straightforward integration and customization options, making it suitable for businesses of all sizes. It provides a variety of pre-built solutions for point-of-sale systems, online payments, invoicing, and mobile payments. Additionally, Square offers multiple plugins and integrations with popular e-commerce platforms like WooCommerce, BigCommerce, and Wix, simplifying the process for businesses to get started. For those needing more tailored payment solutions, Square also features a robust API that enables developers to create customized payment experiences. Whether integrating a credit card payment gateway into a website or developing an advanced POS system, Square’s tools facilitate a seamless and branded customer experience.

BlueSnap — best payment gateway for B2B & Subscriptions

BlueSnap is a comprehensive payment gateway that provides businesses with a versatile platform for accepting payments from around the world. In 2026, it stands out among the best payment systems, offering a robust solution for various online payment methods, including credit card payment gateways and debit card payment gateways. Designed for companies of all sizes, BlueSnap supports a wide range of payment methods including credit and debit cards, digital wallets, and ACH payments. It is recognized as one of the best e-commerce payment solutions, as it allows businesses to seamlessly integrate with their existing operations. BlueSnap is known for offering a unified solution that enables businesses to handle online, mobile, and in-person payments in a secure and efficient manner.

Currency Support. In 2026, businesses looking for the best payment gateways will find that BlueSnap stands out for its extensive currency support, allowing them to accept payments in over 100 currencies. This capability is essential for companies aiming to leverage the best ecommerce payment solutions, as it simplifies cross-border transactions and enhances the customer experience. By offering multi-currency merchant accounts, BlueSnap acts as one of the best online payment platforms, enabling businesses to manage funds effortlessly in various currencies. This feature not only reduces conversion fees but also streamlines financial management, making it an ideal choice for those seeking the best online payment processing options. Moreover, with its robust payment gateway API, BlueSnap provides a seamless integration experience, ensuring that businesses can build a payment gateway that meets their specific needs. As a result, it positions itself as one of the best payment providers in the market, particularly for ecommerce ventures looking for reliable credit card payment gateways and electronic payment processing solutions.

Custodial/Non-Custodial and Secure Transactions. BlueSnap functions as a custodial payment service, temporarily holding funds during transactions until they are transferred to the business’s account. This custodial method allows for smoother transaction management and a streamlined settlement process, particularly for businesses managing high volumes of payments. Security is a key focus for BlueSnap, utilizing end-to-end encryption and tokenization to safeguard sensitive payment information. Furthermore, BlueSnap adheres to PCI-DSS standards, enabling businesses to securely accept payments while protecting customer data privacy. The platform also features fraud detection and chargeback management, minimizing risks related to fraudulent transactions and providing enhanced protection for both businesses and customers.

Easy Integration and Customization. As we look toward the best payment gateways in 2026, businesses must consider various factors, including the ability to define payment gateway functionalities that suit their needs. BlueSnap stands out by providing exceptional credit card payment processing gateway options that integrate seamlessly with major e-commerce platforms, such as Shopify and WooCommerce. With its advanced API, BlueSnap acts as an electronic payment processor, enabling businesses to customize their credit card payment platforms to enhance user experience. Additionally, its comprehensive support for multiple gateway credit card processing solutions ensures a smooth transaction process, making it an ideal choice for those seeking a reliable e-commerce payment gateway. Businesses can also explore examples of payment gateways that offer competitive gateway fees and flexible options for online payment, thus ensuring they choose the best financial services payment gateway for their specific requirements.

Final Thoughts

While PayPal, Stripe, Square, and BlueSnap offer reliable payment solutions, NOWPayments stands out as the superior choice for businesses embracing the future of payments. Its support for over 300 cryptocurrencies, non-custodial and highly secure transactions, and flexible, developer-friendly integration make it unmatched in versatility and user control. As the best online payment gateway for ecommerce, NOWPayments not only facilitates digital transactions but also positions itself among the best payment platforms available. For businesses seeking the best ecommerce payment solutions, this platform offers an exceptional gateway for online payment processing, ensuring seamless operations. Moreover, its functionalities as a credit card payment gateway and its effectiveness as an electronic payment gateway enhance its appeal to merchants looking for the best online payment methods. When considering the best payment gateway API and the best payment integration options, NOWPayments is the clear leader, allowing businesses to thrive in the competitive landscape of ecommerce. For those aiming for the best payment provider for international transactions, NOWPayments delivers unmatched capabilities, making it an indispensable tool in any merchant’s toolkit.