There is nothing more annoying than have your transaction fail because of one tiny mistake. Sending TRX instead of USDTTRC20 or using the BEP-20 network instead of ERC20 is a common occurrence with crypto payments. With the updated Wrong-Asset Deposits Auto Processing feature, NOWPayments ensures such payments are automatically processed, simplifying the experience for merchants and customers alike.

The original process requires you to return those funds, hoping that next time the customer would get it right. However, there is a feature which could free you of this struggle forever. NOWPayments is here to save the day with our Extra Deposits Auto Processing feature.

What Is Auto Processing?

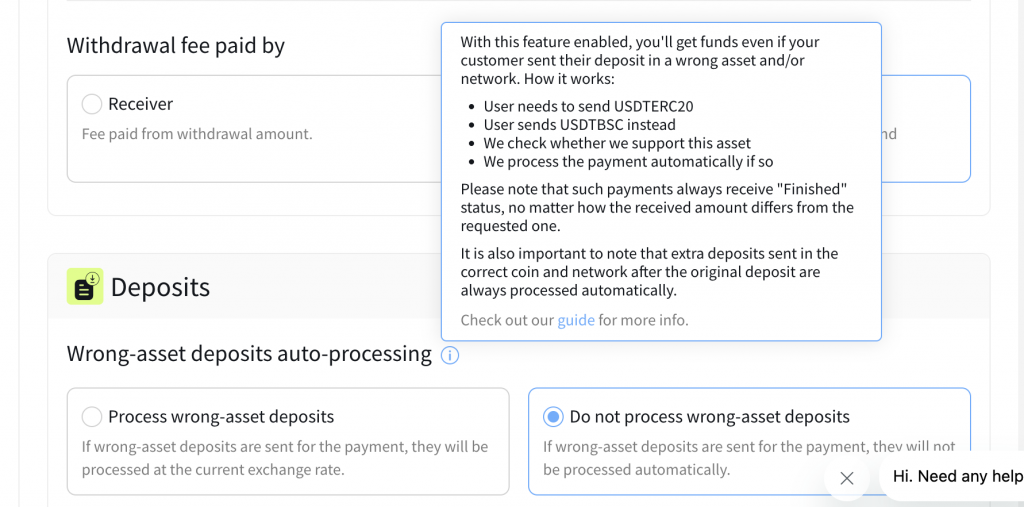

This feature now processes payments made in the wrong network or coin if the asset is supported by NOWPayments. Additionally, this functionality ensures that funds sent using a different supported coin or network are reviewed and processed efficiently without requiring merchant intervention.

We call these payments Wrong Asset Deposits. For instance, if you have auto processing enabled, and a buyer sends USDTBSC instead of USDTERC20, the payment will go through successfully, reaching your wallet without a hitch. Without this feature enables, the transaction will simply fail.

Additionally, auto processing can handle repeated deposits—meaning if a buyer sends more funds to an existing payment address, those funds will be processed too. Talk about efficiency!

Auto Processing Key Features

- Payment History Visibility: All processed payments appear in your Payment History, labeled as Re-deposit or Wrong Asset Deposit. You’ll have access to details like payment amount and currency, just like any standard transaction.

- Filtering Made Easy: You can filter payments by type to quickly locate Re-deposit or Wrong Asset Deposit transactions. Need to export data? No problem—just use the filter options to download the info in a format that suits you.

- Clear Payment Status: Auto-processed payments will always receive the ‘Finished’ status, even when the received amount or network differs from the original requested one. However, payments below the minimum threshold will still display a ‘Failed’ status. It is also important to note that extra deposits sent in the correct coin and network after the original deposit are automatically processed.

- Failed: The deposited amount is below the minimum required, preventing the system from processing the payment.

- Finished: The system successfully completed the payment, and the funds are in your wallet.

Configuring Auto Processing

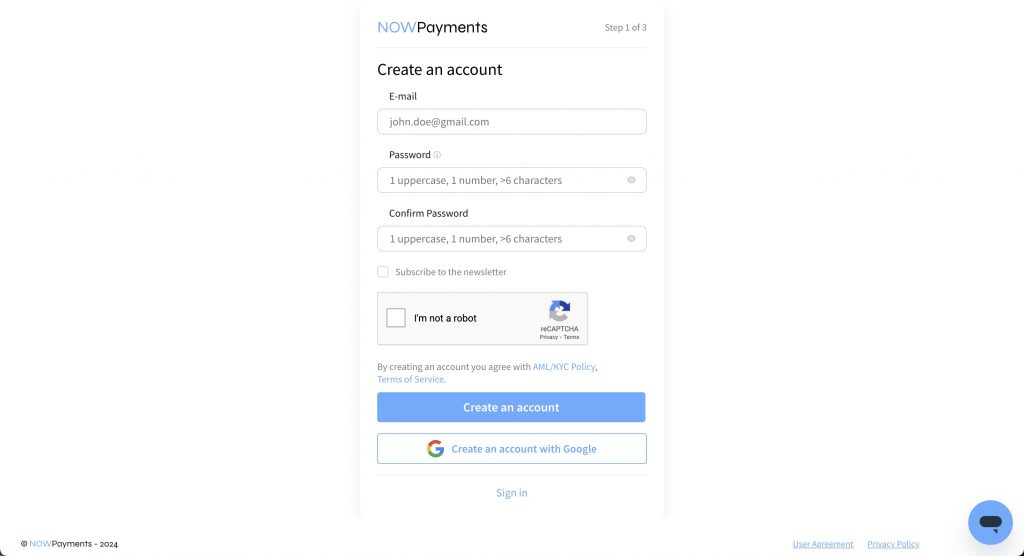

- Sign In or Create an Account

First things first, you must have a NOWPayments account to access any of the features. The registration process should take no more than 5 minutes, and then you will be ready to proceed to the next steps.

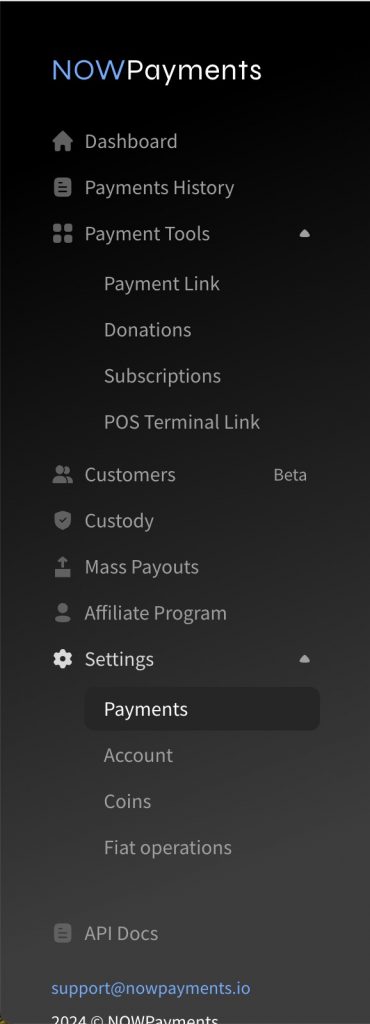

- Go to Settings on Your Dashboard

The Dashboard is the main tool you have to customize the payment flow to your liking. The Auto Processing option is no exception, as it can be found in the Settings category on the left panel.

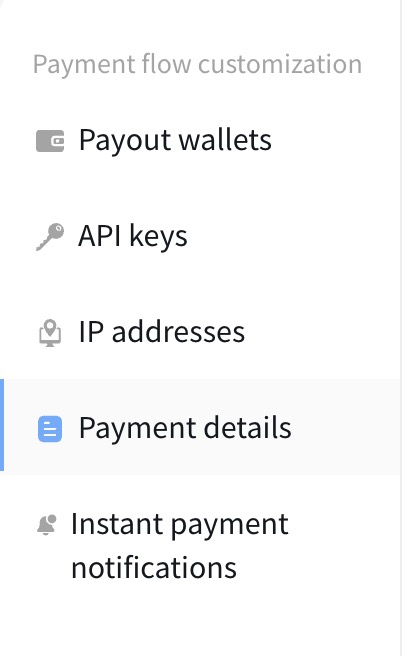

- Choose Payments, and then Payment Details

There are many things you can customize in the Settings section of the dashboard, but for now you need to go to Payments and then select Payment Details from the navigation panel on the left. You can always come back to Payout wallets, API keys, IP addresses, or Instant payment notifications later.

- Scroll Down

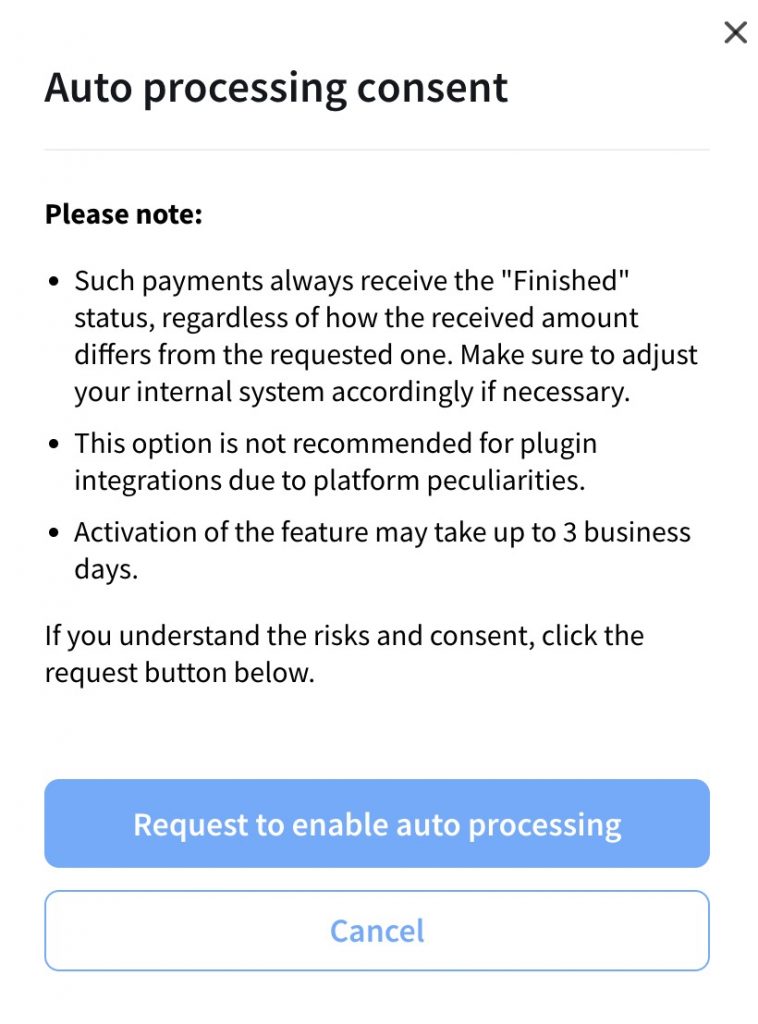

Scroll down to the Deposits section, where you’ll find the ‘Wrong-asset deposits auto-processing’ feature. You can select between enabling or disabling the auto-processing of wrong-asset deposits. To proceed, click the ‘Request to enable auto-processing’ button, ensuring to carefully read the details in the pop-up window.

Note: that enabling this feature might take up to 3 business days to activate.

Disclaimer:

It’s crucial to ensure that the coin and network being sent are supported by NOWPayments. Unsupported assets will not be processed, and merchants may need to manually resolve such payments.

Extra Tips

One of the most important steps is to check that you take the actual paid amount and currency into account before providing any services to your user. It’s especially important for payments made in a wrong asset or network, since all extra deposit payments above the minimum amount currently receive the ‘Finished’ status in our system.

Payments sent in the wrong network or coin will now always receive a ‘Finished’ status, provided the asset is supported.

Here are 3 extra steps you want to take to make the most out of your experience with the auto processing feature:

- Setting your system in a way that it pays attention not only to the payment status but also to the amount and currency of the actually sent deposit when processing a wrong-asset payment.

- Merchants should still verify the actual received amount and currency before providing goods/services.

- Converting the received amount to USD or any other fiat currency using the Get estimated price method from our API documentation.

- Comparing the USD amount of the received deposit with the USD amount of your original payment if needed before providing the buyer with goods/services.

Conclusion

This innovative feature not only eliminates the need for merchants to manually resolve wrong-asset issues but also enhances trust and efficiency for customers making payments in cryptocurrencies.

With NOWPayments’ enhanced Wrong-Asset Deposits Auto Processing feature, you can effortlessly manage payments sent in the wrong network or coin. This update ensures seamless processing, enabling businesses to focus on growth while providing customers with a hassle-free payment experience.