Ethereum, one of the leading players in the blockchain sphere, has sparked significant shifts in the financial landscape with its innovative zkSync technology. Combined with NOWPayments’ robust payment solutions, businesses can redefine their payment strategies and unlock new growth opportunities. In this comprehensive guide, we’ll explore the details of zkSync, the benefits it brings, and how businesses can leverage NOWPayments’ eMail Subscriptions API to accept Ethereum payments effortlessly and efficiently.

An Overview of zkSync

zkSync is a cutting-edge Layer-2 protocol developed to tackle the scalability issues plaguing Ethereum. Its mission transcends merely enhancing Ethereum’s throughput; it is designed with the goal of maintaining Ethereum’s fundamental tenets of freedom, self-sovereignty, and decentralization, even on a large scale.

Thanks to zkSync’s breakthrough ZK technology, the protocol can process countless transactions without compromising security or incurring exorbitant costs. These attributes, collectively referred to as hyperscalability, form the crux of zkSync’s aspirations.

zkSync: The Gateway to Hyperscalability

To cater to the burgeoning demand of the web3 epoch, blockchains must emulate the scalability of the internet, smoothly processing transactions without undermining their security or incurring high costs. zkSync’s ZK-rollups enable this by inheriting the full security of Ethereum, making it the sole scaling solution capable of offering utmost security while achieving hyperscalability. The zkSync team is devoted to making zkSync the most secure Layer-2 protocol in practice, exceeding theoretical expectations.

A Year of Extensive Testing and Investment in Security

Before its official debut, zkSync underwent a full year of live testnet, ensuring that the protocol is sturdy and ready for commercial use. Additionally, the zkSync team invested a staggering $3.8 million in audits and bounties to augment the protocol’s security. This exhaustive testing and investment in security instill confidence in businesses looking to accept Ethereum (zkSync) payments through NOWPayments.

zkSync: The Dawn of Superior User Experience and Security

Apart from its scalability and security features, zkSync also prioritizes an outstanding user experience (UX). The protocol combines self-custody with intuitive, delightful, and security-driven UX, making it simpler than ever for businesses to onboard the first billion users to web3. The design of zkSync started with the end-user in mind, ensuring that interacting with the protocol is smooth and user-friendly.

Growing Adoption of zkSync

The increasing popularity of zkSync is evidenced by the growing number of projects expressing interest in deploying on the protocol. Over 200 projects, including prominent names like Chainlink, SushiSwap, Uniswap, Aave, Argent, 1inch, Gnosis, and Curve, have registered their interest to deploy on zkSync. This widespread adoption underscores the trust and recognition that zkSync has garnered within the crypto community.

Accept Ethereum (zkSync) Payments with NOWPayments

If your business is considering accepting crypto payments via zkSync, NOWPayments is here to assist. NOWPayments, a leading crypto payment gateway, has announced its support for zkSync, making it more convenient than ever for businesses to integrate zkSync and start accepting crypto payments. The integration process is simple and straightforward, allowing businesses to rapidly tap into the benefits of zkSync.

Step-by-Step Guide to Accept Ethereum (zkSync) Payments with NOWPayments

- Register for NOWPayments: Sign up for a NOWPayments account to get started.

- Connect your Wallet: Link your ZkSync-compatible wallet to the NOWPayments platform.

- Create an API Key: Generate an API key to securely manage your ZkSync payment integration.

- Choose an Integration Method: Select the integration method that suits your business needs, whether it’s a plugin, payment link, or custom API integration.

- Personalize the Payment Experience: Customize the payment experience to align with your branding and user preferences.

- Start Accepting Payments: Once the integration is complete, you can start accepting payments on zkSync seamlessly.

The Perks of Accepting Payments on zkSync

Accepting payments on zkSync offers a host of benefits for businesses, making it a revolutionary solution in the digital payment landscape.

Scalability and Speed

ZkSync’s Layer-2 protocol built on ZK technology provides unparalleled scalability and speed for businesses. With the capacity to process an unlimited number of transactions, businesses can cater to the surging demand for seamless payment experiences without compromising security or incurring high costs.

Enhanced Security and Trust

By inheriting the full security of Ethereum, zkSync ensures that businesses can accept payments with confidence. The rigorous testing and investment in security that zkSync has undergone instill trust and dependability, providing businesses and their customers with the peace of mind they require when transacting on the protocol.

Exceptional User Experience

ZkSync’s user-centric design ensures that businesses can onboard users to web3 effortlessly. The protocol combines self-custody with intuitive and delightful user experiences, making it easier than ever for businesses to attract and retain customers.

Access to a Flourishing Ecosystem

By accepting payments on zkSync, businesses can join a flourishing ecosystem of projects and developers. The widespread adoption of zkSync within the crypto community opens up new opportunities for collaboration and growth, allowing businesses to tap into a broader customer base.

NOWPayments’ Recurring Payments API: Simplifying Subscriptions

Subscription-based businesses can benefit significantly from NOWPayments’ Recurring Payments API. This feature allows businesses to assign payments to customers regularly, automating the billing process and providing a seamless payment experience for customers.

How the Recurring Payments API Works

The Recurring Payments API works by allowing businesses to create payment plans and individual recurring payments for each user. This simplifies the management of subscriptions and ensures customers have a seamless payment experience. Here is a detailed breakdown of how it works:

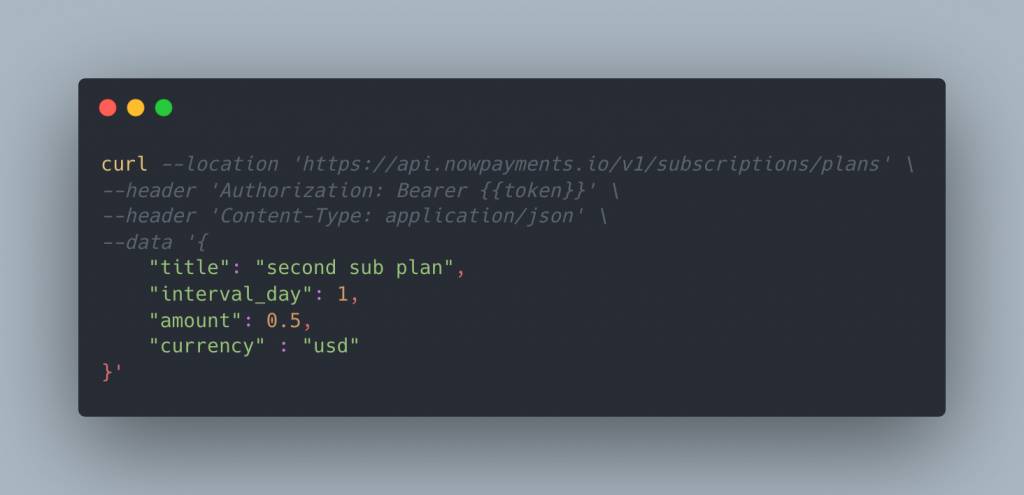

Step 1: Creating or Updating a Payment Plan

To create a recurring payment plan, businesses can use the “Create Plan” API method provided by NOWPayments. This method generates a unique ID for each plan, allowing businesses to manage and track their payment plans efficiently. Furthermore, businesses can update existing plans and obtain information about their payment plans using the “Update Plan” and “Get Plan” API methods.

POST

Create plan

https://api.nowpayments.io/v1/subscriptions/plans

Available parameters:

- “title”: the name of your recurring payments plan

- “interval_day”: recurring payments duration in days

- “amount”: amount of funds paid in fiat/crypto

- “currency”: crypto or fiat currency we support

- “ipn_callback_url”: your IPN_callback url

- “success_url”: url user got redirected in case payment was successful

- “cancel_url”: url user got redirected in case payment was cancelled

- “partially_paid_url”: url user got redirected in case payment was paid not in full amount

PATCH

Update plan

https://api.nowpayments.io/v1/subscriptions/plans/:plan-id

This method allows you to add necessary changes to a created plan. They won’t affect users who have already paid; however, the changes will take effect when a new payment is to be made.

GET

Get one plan

https://api.nowpayments.io/v1/subscriptions/plans/:plan-id

This method allows you to obtain information about your payment plan (you need to specify your payment plan id in the request).

GET

Get all plans

https://api.nowpayments.io/v1/subscriptions/plans?limit=10&offset=3

This method allows you to obtain information about all the payment plans you’ve created.

Step 2: Creating an Email Subscription

Once the payment plan is in place, businesses can create an email subscription to send payment links to their customers. The “Create Email Subscription” API method enables businesses to generate email subscriptions and schedule recurring payment reminders. This proactive approach ensures that customers are informed about upcoming payments, reducing the risk of missed payments and ensuring a seamless customer experience.

POST

Create an email subscription

https://api.nowpayments.io/v1/subscriptions

This method allows you to send payment links to your customers via email. A day before the paid period ends, the customer receives a new letter with a new payment link.

Available parameters:

- subscription_plan_id – the ID of the payment plan your customer chooses; such params as the duration and amount will be defined by this ID.

- email – your customer’s email to which the payment links will be sent.

Step 3: Managing Recurring Payments

With NOWPayments’ Recurring Payments API, businesses have full control over managing recurring payments. The “Get Many Recurring Payments” API method allows businesses to view the entire list of recurring payments, filter them based on payment status or plan ID, and obtain relevant information about each payment. Additionally, businesses can delete recurring payments using the “Delete Recurring Payment” API method if necessary.

GET

Get many recurring payments

https://api.nowpayments.io/v1/subscriptions?status=PAID&subscription_plan_id=111394288&is_active=false&limit=10&offset=0

The method allows you to view the entire list of recurring payments filtered by payment status and/or payment plan id.

Available parameters:

- limit – the amount of shown items

- offset – setting the offset

- is_active – status of the recurring payment

- status – filter by status of recurring payment

- subscription_plan_id – filter results by subscription plan id.

Here is the list of available statuses:

- WAITING_PAY – the payment is waiting for user’s deposit

- PAID – the payment is completed

- PARTIALLY_PAID – the payment is completed, but the final amount is less than required for payment to be fully paid

- EXPIRED – is being assigned to unpaid payment after 7 days of waiting

GET

Get one recurring payment

https://api.nowpayments.io/v1/subscriptions/:sub_id

Get information about a particular recurring payment via its ID.

Here is the list of available statuses:

- WAITING_PAY – the payment is waiting for user’s deposit

- PAID – the payment is completed

- PARTIALLY_PAID – the payment is completed, but the final amount is less than required for payment to be fully paid

- EXPIRED – is being assigned to unpaid payment after 7 days of waiting

DELETE

Delete recurring payment

https://api.nowpayments.io/v1/subscriptions/:sub_id

Completely removes a particular payment from the recurring payment plan. You need to specify the payment plan id in the request.

Conclusion: Harness the Future of Digital Payments with zkSync

Accepting payments on zkSync is a game-changing solution for businesses seeking to leverage the scalability, security, and user experience offered by this cutting-edge Layer-2 protocol. With NOWPayments’ support for zkSync, businesses can seamlessly integrate zkSync into their payment processes and unlock the benefits of hyperscalability while preserving the core values of freedom, self-sovereignty, and decentralization.

As the world of cryptocurrencies continues to evolve, businesses that embrace innovative solutions like zkSync are well-positioned to thrive in the digital payment landscape. By accepting payments on zkSync, businesses can provide their customers with faster transactions, lower fees, enhanced security, and an exceptional user experience. NOWPayments’ commitment to simplifying the integration process ensures that businesses of all sizes can tap into the potential of zkSync and be part of the future of digital commerce.