As global awareness grows around climate change, biodiversity loss, and resource depletion, businesses are accelerating the adoption of sustainable practices throughout their operations and supply chains. In 2026, leading sustainability trends focus on minimizing environmental impact while supporting long-term economic growth, especially within high-emission industries. Forward-thinking companies are integrating comprehensive climate and sustainability strategies, prioritizing the reduction of Scope 3 emissions and widely adopting circular economy business models.

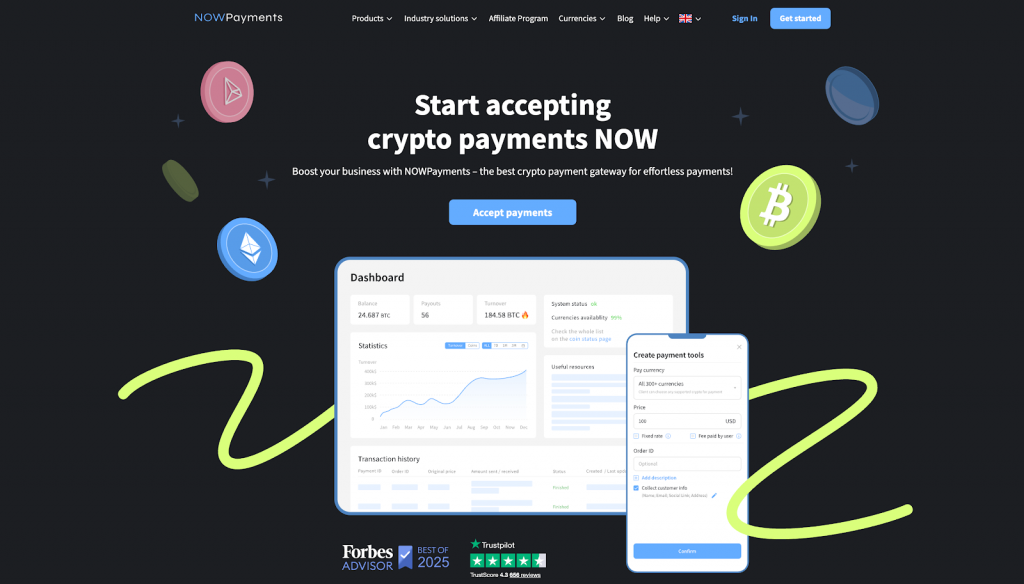

The shift toward digital solutions is crucial for reducing carbon footprints. Technologies like NOWPayments support this transition by enabling secure, fast, and eco-friendly cryptocurrency payment options without relying on paper transactions. This approach aligns perfectly with 2026’s emphasis on sustainable finance, lowering environmental impacts, and decreasing dependence on fossil fuels. NOWPayments empowers businesses to meet ESG (Environmental, Social, and Governance) regulations, reduce climate risks, and build a truly sustainable future through advanced payment technology.

As global challenges intensify, 2026 marks a pivotal year where sustainability intersects with geopolitics, technology, and social equity. This article explores the transformative trends redefining corporate and policy action:

- Climate Policy Resilience Amid Geopolitical Shifts

- Economic Inequality as a Climate Priority

- Climate Financing’s Next Chapter

- AI’s Double-Edged Sword for Sustainability

- Corporate Sustainability: From Compliance to Competitive Edge

- Circular Economy Breakthroughs

- Global Frameworks Turn into Action

- Greening of Crypto: Blockchain for Transparent Impact

Climate Policy Resilience Amid Geopolitical Uncertainties

As we move towards 2026, key sustainability trends are emerging that will significantly shape the industry. Companies are increasingly focused on leveraging technology to build resilience against the impacts of climate change, such as extreme weather events. By setting ambitious sustainability goals and integrating nature-based solutions, organizations can not only mitigate risks but also enhance their value chain. The importance of disclosure is growing as businesses align with ESG regulations and implement effective ESG strategies. Furthermore, the adoption of renewable energy sources is becoming critical in addressing environmental challenges and meeting the targets outlined in the Paris Agreement. Trends to watch include the carbon market and carbon sequestration initiatives, which are essential for achieving global sustainability and tackling climate change effectively. In this evolving landscape, the commitment to environmental sustainability will define how businesses navigate the complexities of 2026 and beyond, ensuring they remain resilient in the face of unprecedented global climate challenges.

Economic Inequality as a Climate Priority

The sustainability industry trends for 2026 are poised to significantly impact business operations, with a strong emphasis on climate action and sustainability efforts. Key trends shaping the landscape include a focus on climate adaptation strategies and the integration of the Inflation Reduction Act’s provisions to lower greenhouse gas emissions. As we approach 2030, organizations are recognizing the importance of addressing economic inequalities as part of their sustainability trends in 2026. This holistic approach is essential for achieving equitable climate outcomes and ensuring that all stakeholders are engaged in the journey toward a sustainable future.

Expanding Climate Financing and the Loss and Damage Fund

As we look towards 2026, several sustainability trends for 2026 are emerging, influenced by initiatives such as the Inflation Reduction Act. These trends are not only focused on environmental impacts but also emphasize social equity, highlighting the importance of environmental and social governance. The strategies developed in 2026 are paving the way for innovative financial tools that will support these sustainability trends, ensuring a holistic approach to addressing climate change and promoting resilience among vulnerable communities.

Artificial Intelligence in Sustainability: Opportunities and Challenges

As we look towards 2026, several sustainability trends are emerging that will shape the industry, including the rising popularity of green bonds and the growing market for carbon credits. These financial instruments are essential in funding sustainable projects and incentivizing emissions reductions. The integration of these trends with advancements in technology, such as artificial intelligence, will create new opportunities for transparency and efficiency in tracking sustainability metrics. By leveraging AI responsibly, we can enhance our approaches to sustainability while ensuring that the financial mechanisms supporting these initiatives, like green bonds and carbon credits, align with our environmental goals.

Corporate Sustainability: From Compliance to Competitive Advantage

As we approach 2026, sustainability trends are expected to evolve significantly, driven by increased demand for sustainability data. Companies will need to prioritize transparency and accountability in their operations, showcasing their commitment to sustainable practices. By openly sharing their sustainability data and demonstrating measurable progress, businesses can not only enhance their credibility but also align with emerging 2026 sustainability trends that emphasize the importance of ethical governance and environmental stewardship.

Driving Circular Economy Models and Resource Innovation

As the sustainability industry trends evolve in 2026, businesses will increasingly focus on transparency and accountability regarding their sustainability claims. This shift will be driven by the adoption of circular business models and the integration of innovative technologies like blockchain and AI, which enable precise tracking of sustainability metrics. Companies will not only prioritize recycling and sustainable food systems but will also leverage real-time data from the Internet of Things (IoT) to enhance their environmental impact. Ultimately, these advancements will foster a more responsible approach to achieving net-zero emissions and protecting vital ecosystems.

From Regulation to Implementation: The Role of Global Frameworks

As we approach 2026, the sustainability industry is witnessing transformative trends driven by advancements in clean energy and enhanced data collection methods. Companies are increasingly adopting renewable energy sources, reducing their carbon footprints while complying with evolving regulations such as the Corporate Sustainability Reporting Directive (CSRD). This shift not only aligns with global biodiversity goals but also emphasizes the importance of accurate data collection for measuring sustainability efforts, enabling businesses to make informed decisions that contribute to a more sustainable future.

Greening of Crypto: Blockchain for Transparent Impact

The narrative around cryptocurrency has fundamentally shifted from energy-intensive speculation to efficient utility, driven by Ethereum’s move to Proof-of-Stake and the rise of low-cost layer-2 solutions. In 2026, this mature infrastructure is being harnessed for real-world sustainability through “regenerative finance” (ReFi) protocols that create transparent carbon credit markets and allow for the tokenization of green bonds, enabling investors to track the impact of their contributions, such as real-time solar energy generation, with unprecedented verifiability.

Crypto payments, particularly via stablecoins, are now a direct mechanism for financial inclusion and a gateway to the green economy. By integrating with leading gateways like NOWPayments, businesses and nonprofits can seamlessly accept over 350 cryptocurrencies to fund reforestation or climate resilience projects, bypassing expensive traditional banking fees and providing donors with an immutable record of where their money goes. This bridges the gap between blockchain technology and tangible climate action, making low-footprint, transparent giving a core component of the modern sustainability toolkit.

NOWPayments and eForest+: Pioneering Sustainable Payment Solutions

The sustainability industry is poised for significant evolution by 2026, driven by emerging sustainability practices that align with stringent sustainability standards. Companies are increasingly focusing on ESG reporting to enhance transparency and accountability in their operations. As water scarcity becomes an urgent global issue, organizations are adopting innovative approaches to conserve water resources while adhering to the Kunming-Montreal Global Biodiversity Framework. This multifaceted commitment to sustainability not only supports ecological health but also strengthens the financial viability of businesses across various sectors.

Final thoughts

Businesses aiming to meet the demands of 2026’s sustainability landscape must embrace innovative, eco-friendly technologies like NOWPayments. Explore how digital payments and sustainable finance can reduce your carbon footprint, improve ESG compliance, and drive competitive advantage while contributing to a greener planet.