In 2023, integrating a crypto payment gateway into your online business is not just a trendy choice, but a strategic move. It paves the way for smoother transactions, broader market access, and a future-proof commerce model. But how do you choose the best crypto payment gateway for your business? Here’s a comprehensive 10-point checklist to guide you through the process.

Understanding Crypto Payment Gateways

Before diving into the selection process, it’s crucial to understand what a crypto payment gateway is and how it works. A crypto payment gateway is a digital platform that enables businesses to accept payments in various cryptocurrencies securely and efficiently.

It essentially acts as an intermediary, facilitating the transfer of digital currencies from the payer’s wallet to the merchant’s software. The transactions are transparent and irreversible, thanks to blockchain technology, which eliminates intermediaries and increases process efficiency.

1. Evaluating Gateway Features and Functionalities

Crypto payment gateways come with a wide array of features and functionalities. Here are some key features to consider:

Checkout Page

The checkout page is where customers make their payments. Hence, it should be user-friendly, mobile-responsive, secure, and efficient. Some gateways offer a white-label version or a demo version, which allows you to customize the checkout page to align with your brand identity.

Payment Options

A good crypto payment gateway should support a variety of cryptocurrencies including, but not limited to, Bitcoin, Ethereum, Litecoin, and stablecoins. This provides a wide array of choices for your customers, enhancing their shopping experience.

Merchant Account

The merchant account interface should be intuitive and comprehensive. It should allow you to manage multiple currencies, request payments, and withdraw accrued funds to bank accounts and crypto wallets.

Financial Reporting

For tax compliance and financial transparency, the payment gateway should provide comprehensive financial reports and data exports. These features allow for seamless integration with your existing financial systems.

Technical Integration

The payment gateway should be easy to integrate with your existing systems. Look for a gateway that provides a REST API and plugins for your CMS or shopping cart system.

2. Considering Security and Compliance

Security should be a top priority when choosing a crypto payment gateway. Opt for gateways that offer two-factor authentication, encryption, and advanced fraud protection.

3. Analyzing Transaction Fees and Pricing Model

Different gateways have different pricing models. Some charge per transaction, while others have monthly or annual fees. Make sure to understand the pricing structure and transaction fees of the gateway to avoid unexpected costs down the line.

4. Checking for Cross-Border and Multi-Currency Support

If your business operates globally, you need a gateway that supports cross-border transactions and multiple currencies. This ensures your global customers can make payments easily without worrying about currency conversion rates.

5. Assessing Customer Service and Support

Choose a crypto payment gateway that offers reliable and prompt customer support. This is crucial for addressing any issues or queries that may arise during the integration process or during regular operations.

6. Reviewing Gateway Reputation and Customer Reviews

Check the reputation of the payment gateway in the market. Look for customer reviews and testimonials. A gateway with positive reviews and a good reputation is likely to offer reliable and quality services.

7. Inspecting Integration and Compatibility

The payment gateway should be compatible with your existing systems and easy to integrate. Check if the gateway offers plugins or APIs for integration with your CMS or shopping cart system.

8. Checking for KYC/AML Compliance

Ensure that the crypto payment gateway follows required Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures. This is crucial for maintaining regulatory compliance and preventing fraudulent activities.

9. Custodial vs Non-Custodial Flow

Lastly, decide whether you prefer a custodial or non-custodial flow. A custodial flow means that the gateway provider manages the cryptocurrencies on behalf of the merchant. On the other hand, a non-custodial flow (also known as self-custody) means that the merchant manages their own cryptocurrencies. Opt out for the one that aligns with your business needs and risk tolerance.

10. Comparing Different Gateways

Finally, don’t settle for the first gateway you come across. Compare different gateways based on the above factors. Look at their features, pricing, security measures, customer support, and reputation. This will help you make an informed decision and choose the best crypto payment gateway for your business.

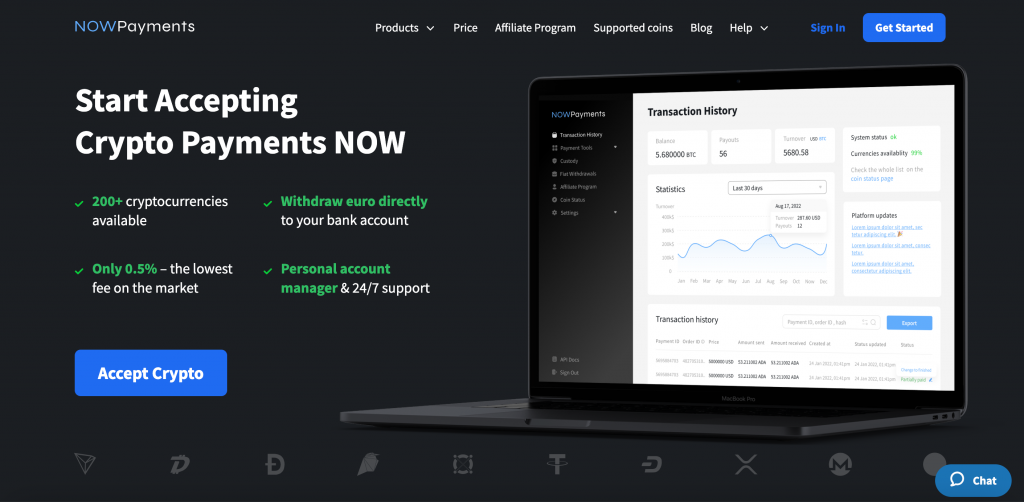

Trusting NOWPayments with Your Crypto Transactions

Once you’ve considered all the factors mentioned in the checklist, one crypto payment gateway that stands out in the crowd is NOWPayments. NOWPayments is a non-custodial crypto payment gateway that supports over 200 cryptocurrencies.

It offers an array of features like auto coin conversion, instant withdrawals, 24/7 customer support, and is known for its trustworthiness and security. With its easy integration process and user-friendly interface, NOWPayments is an excellent choice for businesses looking to embrace the future of commerce.

To sum up, selecting a crypto payment gateway is a crucial decision that can significantly impact your business operations and customer experience. Therefore, it’s essential to do thorough research and consider all the factors before choosing one. With this checklist in hand, you’re well-equipped to make the right choice.