In the bustling world of cryptocurrency, BTT is the cool kid on the block, quietly changing the game. Born from BitTorrent’s brilliance, BTT dances on the TRON blockchain, offering more than just transactions – it’s a portal to the future. Today, we’re unraveling the charm of embracing BTT payments and spicing things up with NOWPayments‘ Subscription API, a dash of magic for smoother-than-silk financial interactions. So, fasten your seatbelts, because we’re about to explore the brave new world of payments!

Understanding BTT: A Gateway to Digital Transformation

BTT, derived from BitTorrent, is a decentralized cryptocurrency that operates on the TRON blockchain. It was designed to incentivize users on the BitTorrent network to provide their local computer resources for fast download speeds and secure decentralized storage. With its integration into the TRON ecosystem, BTT has become a powerful tool for facilitating digital transactions and revolutionizing the way businesses operate.

The Benefits of Accepting BTT Payments

Enhanced Security and Privacy

One of the primary advantages of accepting BTT payments is the enhanced security and privacy it provides. Traditional payment methods often involve the sharing of sensitive customer information, increasing the risk of data breaches and fraud. However, with BTT payments, transactions are conducted on the blockchain, ensuring that they are secure, transparent, and immutable. This eliminates the need for customers to share personal data, reducing the risk of identity theft and enhancing privacy.

Faster and More Efficient Transactions

BTT payments offer businesses the advantage of faster and more efficient transactions. Unlike traditional payment methods that involve intermediaries, BTT transactions are conducted directly between the sender and receiver. This eliminates the need for third-party verification and reduces transaction fees, resulting in faster and more cost-effective transactions. By accepting BTT payments, businesses can provide their customers with a seamless and frictionless payment experience, ultimately enhancing customer satisfaction and loyalty.

Global Accessibility and Reach

Another significant benefit of accepting BTT payments is the global accessibility and reach it provides. Cryptocurrencies have a borderless nature, allowing businesses to expand their customer base beyond geographical limitations. By accepting BTT payments, businesses can tap into the growing cryptocurrency market and attract customers from around the world. This opens up new opportunities and revenue streams, positioning businesses for long-term success in an increasingly interconnected global economy.

Improved Financial Management

Integrating BTT payments into a business’s financial ecosystem offers several advantages. Blockchain technology provides transparent and auditable transaction records, simplifying accounting processes and reducing the potential for errors. BTT payments can also facilitate seamless cross-border transactions without the need for traditional banking intermediaries, reducing foreign exchange fees and simplifying financial operations for businesses.

Streamlining Recurring Payments with NOWPayments’ Subscription API

To further optimize the payment process, NOWPayments offers businesses a powerful subscription API. This feature allows businesses to streamline their workflows by assigning payments to customers on a regular basis. By creating a recurring payment plan, businesses can automate payment collection, ensuring a seamless and convenient experience for both businesses and customers.

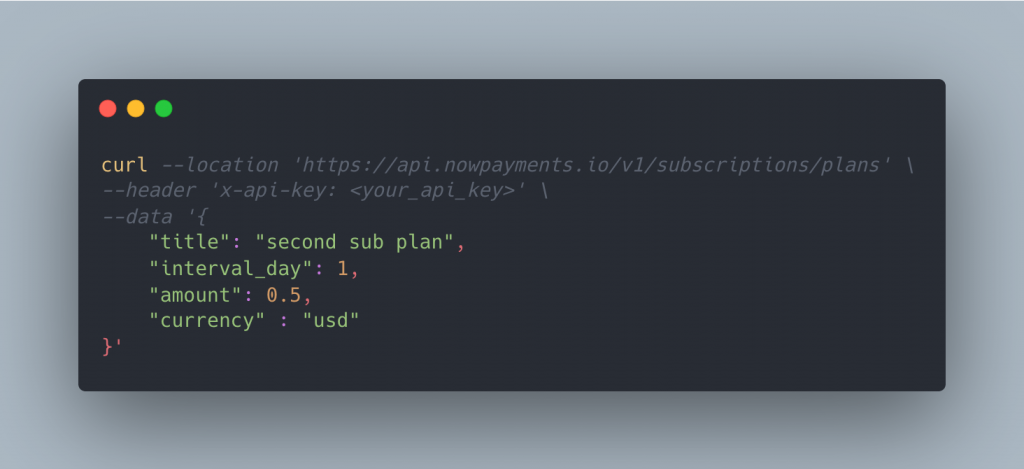

To get started, businesses can create a recurring payment plan using the POST method in the NOWPayments subscription API. Each plan is assigned a unique ID, which is required for generating separate payments. This allows businesses to tailor payment plans to their specific needs and the preferences of their customers.

Once a payment plan is created, businesses can make necessary changes using the PATCH method in the subscription API. These changes will take effect for future payments, ensuring that businesses can adapt their payment plans to meet evolving customer needs.

To obtain information about payment plans, businesses can use the GET methods provided by NOWPayments’ subscription API. These methods allow businesses to retrieve information about specific payment plans or view all payment plans associated with their account. This comprehensive view of payment plans enables businesses to make informed decisions and optimize their subscription offerings.

The subscription API also enables businesses to create email subscriptions for their customers. By using the POST method in the subscription API, businesses can send payment links to customers via email. A day before the paid period ends, the customer receives a new letter with a new payment link, ensuring a seamless and uninterrupted payment experience.

Use Cases: Industries Benefiting from BTT Payments and Subscription API

Accepting BTT payments and utilizing NOWPayments‘ subscription API can benefit businesses across various industries. Let’s explore some of the sectors that can leverage these solutions to their advantage:

E-commerce

E-commerce businesses can greatly benefit from accepting BTT payments and utilizing the subscription API. By accepting BTT payments, online retailers can tap into the growing cryptocurrency market and attract tech-savvy customers who prefer using digital currencies. The seamless integration provided by NOWPayments ensures that businesses can quickly start accepting BTT payments and provide their customers with a frictionless payment experience.

Travel and Hospitality

The travel and hospitality industry can also leverage BTT payments and the subscription API to enhance their payment options. By embracing cryptocurrencies, hotels, airlines, and travel agencies can streamline their payment processes, reduce transaction costs, and attract a new segment of tech-savvy travelers. The enhanced security and privacy offered by BTT payments can instill trust in customers, who are increasingly concerned about the safety of their personal information.

Gaming and Online Entertainment

The gaming and online entertainment industry is known for its forward-thinking approach, making it an ideal candidate for BTT payments and the subscription API. Gaming platforms, streaming services, and content creators can provide their users with a unique and secure payment option by accepting BTT payments. The transparency and efficiency of blockchain transactions align well with the gaming industry’s need for fast and secure microtransactions.

Digital Services and Subscriptions

Businesses offering digital services and subscriptions can leverage BTT payments and the subscription API to enhance their payment options. From software-as-a-service (SaaS) providers to online content platforms, accepting BTT payments enables businesses to tap into the cryptocurrency market and attract customers who prefer using digital currencies. NOWPayments’ seamless integration ensures a smooth user experience, encouraging customer loyalty and retention.

Conclusion

Accepting BTT payments and utilizing NOWPayments’ subscription API offers businesses a powerful solution to enhance their payment processes, streamline operations, and provide customers with a seamless and secure crypto payment experience. BTT payments provide enhanced security, faster transactions, global accessibility, and improved financial management. The subscription API further optimizes payment workflows, enabling businesses to automate recurring payments and provide customers with a convenient and frictionless payment experience. By embracing BTT payments and NOWPayments’ subscription API, businesses can unlock the potential of digital transactions and position themselves for long-term success in the evolving digital landscape.