While the crypto market continues to grow and evolve, several challenges persist. One significant issue is that traditional banks often block transactions connected to cryptocurrency trading platforms. This scenario has prompted the need for robust and reliable crypto trading solutions that can bypass these transaction blocks.

In this guide, we’ll explore how payment solutions for trading, such as those offered by NOWPayments, can offer a secure and efficient alternative for trading businesses, facilitating seamless transactions and fostering the wider adoption of cryptocurrencies.

Understanding the Crypto Trading Landscape

Crypto trading has seen a significant uptick in recent years, and for a good reason. Cryptocurrencies offer a host of advantages, including decentralization, transparency, and the potential for high returns. As such, more individuals and businesses are exploring the opportunities within this digital asset space.

However, the crypto trading landscape isn’t devoid of challenges. One notable issue is the often complicated relationship between traditional banking institutions and crypto trading platforms. Banks have been known to block transactions connected to cryptocurrencies due to regulatory uncertainties and concerns over their use in illicit activities. This situation has created a need for alternative crypto trading solutions.

The Challenge: Bank Transaction Blocks

The blocking of bank transactions connected to crypto trading platforms is a widespread challenge in the industry. This problem, often driven by regulatory uncertainties and the perceived risks associated with cryptocurrencies, can hinder the smooth operation of trading businesses.

For instance, in India, major banks have distanced themselves from crypto businesses, creating a significant roadblock for local investors. Similarly, in other parts of the world, banks have issued warnings to customers about dealing with cryptocurrencies and have even threatened account suspension or closure.

- Compliance and Regulatory Issues: Banks often block transactions in the trading industry due to regulatory concerns. Trading activities are subject to various financial regulations, and banks must ensure that their clients are in compliance with these rules. Non-compliance can lead to legal repercussions, which banks seek to avoid.

- Risk Management: Trading involves a degree of risk, and banks may block transactions to mitigate their own risk exposure. They may be concerned about clients engaging in speculative or high-risk trading activities that could result in substantial losses.

- Money Laundering and Fraud Prevention: Banks are obligated to implement strict anti-money laundering (AML) and fraud prevention measures. They may block transactions that appear suspicious or involve large sums of money with unclear origins to prevent illegal financial activities.

- Volatility and Market Fluctuations: Financial markets can be highly volatile, and prices of assets can change rapidly. Banks may block transactions during times of extreme market volatility to protect their clients from making impulsive or uninformed trading decisions.

- Lack of Transparency: Banks may not have visibility into the nature of the trading transactions conducted by their clients. This lack of transparency can lead to cautious actions, including blocking transactions to ensure they are not facilitating illegal or unethical activities.

- Technical Issues: Sometimes, legitimate trading transactions may be mistaken for fraudulent ones due to technical glitches or errors in transaction monitoring systems. These false positives can result in legitimate transactions being blocked.

Introducing NOWPayments: A Bridge for Uninterrupted Transactions

One solution that has emerged to address this challenge is NOWPayments. As a crypto payment gateway, NOWPayments offers a secure and efficient platform for businesses to accept crypto payments, bypassing conventional banking systems.

Key Features of NOWPayments

NOWPayments provides several unique features that make it an ideal solution for trading businesses facing transaction blocks:

- No KYC/KYB Requirements for Crypto Transfers: NOWPayments doesn’t require Know Your Customer (KYC) or Know Your Business (KYB) procedures for crypto transfers. This feature allows businesses to facilitate transactions quickly and without unnecessary red tape.

- Competitive Fees: With a service fee of just 0.5%, NOWPayments is not only secure but also cost-effective.

- Wide Range of Supported Cryptocurrencies: NOWPayments supports a vast range of cryptocurrencies (over 300 as of August 2025). This extensive coverage enables businesses to offer their customers a variety of payment options, further enhancing the user experience.

- Secure and Reliable: Security is a top priority for NOWPayments. The platform employs robust security measures to ensure that all transactions are safe and secure.

NOWPayments: A Bridge for Seamless Crypto Trading

NOWPayments is a global payment gateway that facilitates the acceptance of multiple cryptocurrencies. It provides a secure, efficient, and low-cost platform for businesses to accept digital assets as payment or donation.

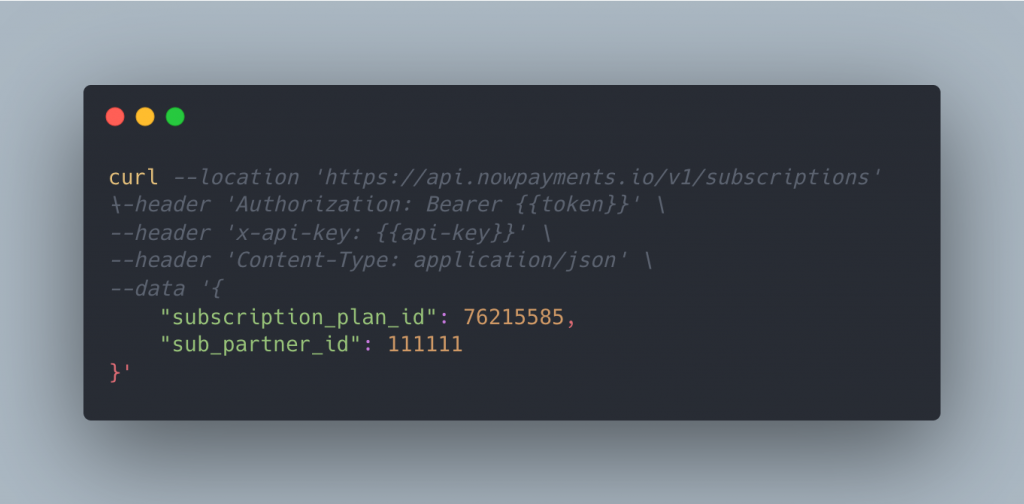

NOWPayments offers an API that allows businesses to integrate its crypto trading solutions seamlessly into their existing systems. This feature is an advantage for trading platforms that have been grappling with banking challenges.

- User Account Management: Trading businesses can use the “Create new user account” method to set up balances for their traders. This integration can be part of the registration process, ensuring that players have a dedicated balance upon registration.

- Balance Display: The “GET user balance” method allows businesses to display user balances on the frontend, providing transparency to traders.

- Top-ups: With the “POST deposit with payment” method, trading businesses can facilitate white-labeled payments directly into user balances, making it convenient for traders to fund their accounts.

- Transaction Management: The API provides methods like “POST deposit from master account” and “POST write-off” for managing debit and credit transactions between master and user balances. The “GET transfer” and “GET all transfers” endpoints enable businesses to track and list these operations.

- Payouts: NOWPayments offers a comprehensive payout administration system, allowing businesses to automate payouts-on-demand for traders. This includes address validation, withdrawal creation, and 2FA verification for added security.

- Security Measures: NOWPayments emphasizes security by allowing payouts only from whitelisted IP addresses and to whitelisted wallet addresses. This ensures that funds are handled securely.

Embracing the Future with Crypto Trading Solutions

The rise of crypto trading payment solutions like NOWPayments represents a significant step forward for the trading industry. By providing secure and efficient alternatives to traditional banking transactions, these solutions are helping businesses and individuals navigate the often complex world of crypto trading.

As the crypto market continues to grow, the demand for such solutions is likely to increase. Businesses that can adapt and embrace these changes will be well-positioned to capitalize on the opportunities presented by this burgeoning industry.

In conclusion, while banking challenges remain a significant hurdle in the crypto trading industry, solutions like NOWPayments provide a viable way forward. By offering secure, efficient, and cost-effective payment solutions, NOWPayments is helping pave the way for the wider adoption and acceptance of cryptocurrencies in the world of trading.

Related articles:

- How to sell crypto without losses?

- How to manage crypto volatility with payment covering and payment markup?

- Simplifying International Trading: NOWPayments’ Answer to Cross-Border Payment Woes.

- How to Build a Trading Platform with Custody API: A Comprehensive Guide.

- Cryptocurrency Exchanges And Trading Explained